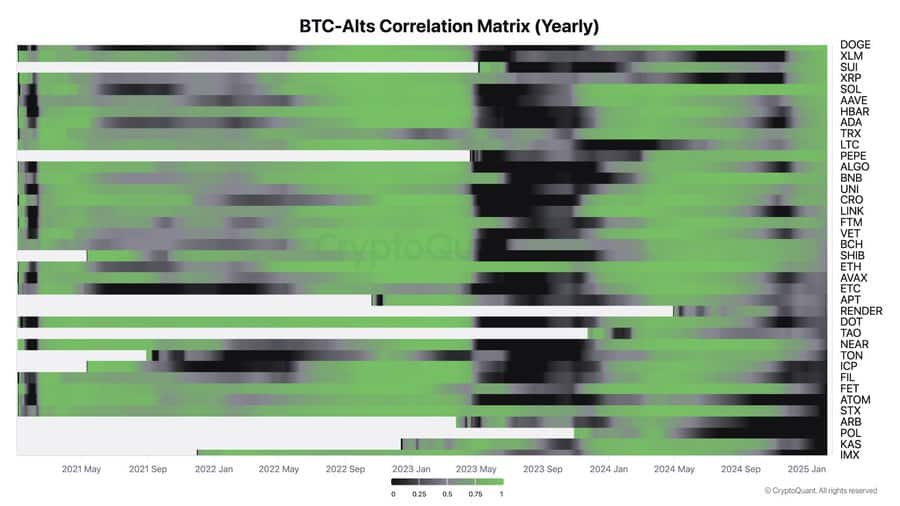

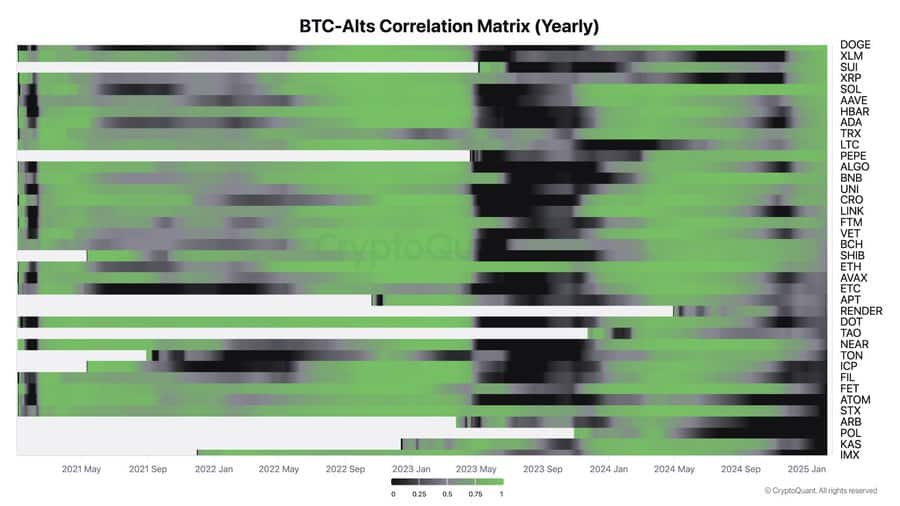

The Significance of the BTC-Alts Correlation Matrix

Understanding the relationship between Bitcoin and various altcoins is crucial for investors looking to navigate the volatile cryptocurrency market. The BTC-Alts Correlation Matrix provides valuable insights into how different coins move in relation to Bitcoin over time.

Upon analyzing the correlation chart, it is evident that certain altcoins such as Ethereum, Binance Coin [BNB], and Avalanche [AVAX] consistently exhibit a high correlation with Bitcoin. This indicates that these altcoins tend to follow Bitcoin’s price movements closely, making them potentially less volatile but also less independent in their price action.

Source: X

On the other hand, a noticeable trend of decoupling has emerged among altcoins like Dogecoin [DOGE], Shiba Inu [SHIB], Pepe [PEPE], and the Sui Network. These coins have shown lower correlations with Bitcoin, indicating that their price movements are influenced by factors other than Bitcoin’s performance. Whether it be unique use cases, social sentiment, or ecosystem-specific developments, these altcoins operate more independently in the market.

Resilient Altcoins and the Rise of Memecoins

In the year 2025, altcoins backed by institutional adoption displayed resilience in the face of market fluctuations. Projects like XRP stood out by decoupling from the broader altcoin trends, thanks to their increasing partnerships with financial institutions. This institutional support instilled confidence in investors, leading to significant price gains for these altcoins.

Simultaneously, the market witnessed a resurgence of memecoins. Despite lacking intrinsic value, these tokens surged in popularity, driven by community enthusiasm and speculative hype. The introduction of President Donald Trump’s memecoin sparked a wave of over 700 imitators, underscoring the impact of social sentiment in this niche.

Investing in memecoins often involves following the crowd, as investors flock to these tokens based on trends rather than fundamental analysis. This herd mentality can lead to rapid price spikes but also poses higher risks in volatile markets.

Implications for Investors

The shift towards decoupling from Bitcoin’s correlation necessitates a strategic adjustment for investors. With altcoins no longer solely reliant on Bitcoin’s movements, alternative market drivers gain significance. Institution-backed altcoins tied to finance and enterprise sectors offer stability amidst market shifts, while memecoins thrive on sentiment but come with heightened risks and rewards.

As traditional indicators lose relevance, a targeted investment approach becomes essential. Prioritizing projects with tangible use cases and growing adoption rates is crucial, while infrastructure tokens may lag behind in performance. Diversification and data-driven decision-making are key in navigating this evolving market landscape, requiring investors to adapt and refine their strategies for success.