Analysis Shows 93% of GameFi Projects Have Failed, Token Prices Plummet by 95%

GameFi, a sector that merges gaming with decentralized finance, has experienced a significant downturn following its initial surge during the 2022 crypto bull run. A recent report reveals that a staggering 93% of GameFi projects have failed, with their token prices plummeting by an average of 95%.

ChainPlay Survey Unveils Alarming Statistics

A comprehensive survey conducted by ChainPlay in collaboration with Storible delved into the performance of over 3,200 GameFi projects. The findings paint a grim picture, showing that the majority of these projects have a brief lifespan of just four months before fading away. Additionally, the tokens associated with these projects have seen a drastic decline, with prices dropping significantly from their all-time highs.

State of GameFi projects in 2024 | Source: ChainPlay

“Compared to other crypto projects, such as memecoins with an average lifespan of one year and typical crypto projects with an average lifespan of three years, GameFi projects have an even shorter lifespan, highlighting their heightened instability and inability to sustain momentum.” – ChainPlay

Venture Capital Involvement and Mixed Results

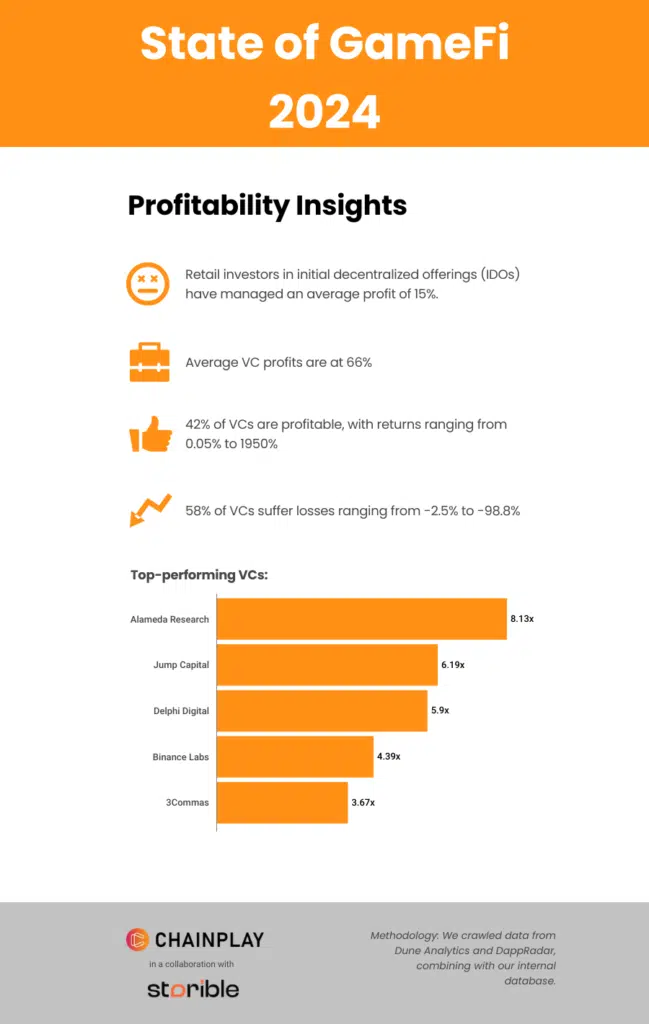

Interestingly, the report also sheds light on the involvement of venture capital in GameFi projects. While 42% of VCs have managed to secure profits, with returns ranging from 0.05% to 1,950%, a significant portion (58%) have faced losses, some as high as 99%. Notable firms like Alameda Research have continued to see positive returns, but many others have encountered substantial declines.

Future Prospects for GameFi

Despite the overall downturn, GameFi continues to attract investment, albeit with more caution. In 2024, VC funding for GameFi amounted to $859 million, marking a 13% decrease from the previous year and an 84.6% drop from the sector’s peak in 2022. ChainPlay suggests that the key to success in the coming years will lie in providing solid gameplay experiences and establishing sustainable, value-driven ecosystems.

You might also like: Nansen: GameFi market set for $301.5b surge amid ecosystem expansion

Read more: Truflation launches GameFi Index to track hottest gaming tokens