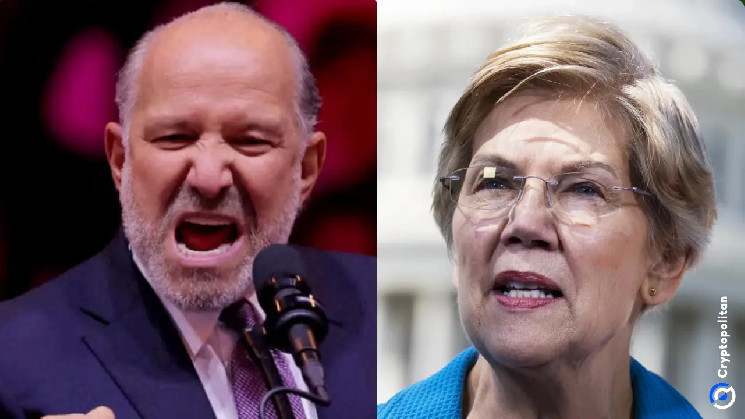

Democratic Senator Elizabeth Warren has recently made headlines for her direct attack on Howard Lutnick, President Donald Trump’s nominee for Commerce Secretary. In a letter sent to Howard, Elizabeth demanded answers about his ties to stablecoin issuer Tether, as reported by Bloomberg on Jan. 28.

Elizabeth, known for her strong stance against cryptocurrencies, questioned Howard about the amount he and his firm, Cantor Fitzgerald, have invested in Tether. She also requested information on the due diligence conducted by Cantor Fitzgerald before partnering with the stablecoin issuer, ensuring compliance with US anti-money laundering laws, international sanctions, and “know your customer” regulations under the Bank Secrecy Act.

The Senator raised concerns about national security implications, highlighting Tether’s alleged involvement in illicit transactions and emphasizing the potential risks associated with Howard’s connections to the company. Howard, a billionaire Wall Street executive, had previously submitted a financial disclosure form disclosing assets worth over $800 million but made no mention of Tether or other cryptocurrency holdings.

Elizabeth pressed Howard to explain why Tether was omitted from his financial documents and questioned whether his pledge to divest from Cantor Fitzgerald, if confirmed, would suffice to eliminate conflicts of interest. She expressed doubts about his ability to serve impartially given his deep involvement with Tether, citing the brokerage firm’s substantial earnings from managing Tether’s reserves and holding a minority stake in the company.

Tether, a controversial stablecoin issuer, has faced criticism for its lack of transparency and alleged facilitation of illicit activities such as money laundering and sanctions evasion. US officials have linked Tether to criminal enterprises worldwide, including Mexican drug cartels, human traffickers in Southeast Asia, and the North Korean government. Despite mounting scrutiny, Tether has continued to operate, recently relocating its headquarters and subsidiaries to El Salvador after obtaining a digital asset service provider license from the country.

Howard’s nomination as Commerce Secretary, viewed as a crypto-friendly pick within Trump’s administration, has drawn scrutiny from Elizabeth and other critics concerned about his ties to Tether. As a vocal opponent of cryptocurrencies, Elizabeth has targeted pro-crypto nominees like Howard and Treasury Secretary Scott Bessent in her efforts to crackdown on the industry. While Scott was ultimately confirmed despite her opposition, Howard’s confirmation remains uncertain amid ongoing Senate scrutiny.

Tether’s relocation to El Salvador signals a shift towards a more crypto-friendly jurisdiction, as the country embraces Bitcoin and positions itself as a global hub for digital assets. Tether’s CEO, Paolo Ardoino, described the move as a “natural progression” for the company, which has faced legal challenges in the US, including a $41 million settlement in 2021 for misrepresenting its reserves. The company’s future operations in El Salvador and the British Virgin Islands, where it was previously registered, remain uncertain.