Amp Crypto Price Plunges into Bear Market

The Amp crypto price has taken a significant hit this year, following the trend of many other altcoins in the market.

As of Tuesday, Amp (AMP) plummeted to $0.0033, marking a staggering 77% drop from its peak in November of last year. Its market capitalization has also seen a significant decline, falling from over $965 million to $283 million currently.

One possible reason for the sharp decline in Amp’s price is the substantial decrease in total value locked on the Flexa platform throughout the year. The value locked on Flexa has plummeted to $20.8 million from its year-to-date high of $295 million.

The activity on the Flexa Network is crucial for Amp, as the token serves as collateral for the platform. Flexa is a payment network that enables merchants to accept cryptocurrencies through their point-of-sale systems. Major companies like Chipotle, GameStop, and Ulta Beauty are just a few examples of businesses utilizing the Flexa Network.

Amp acts as collateral to ensure seamless and timely payments. In case a transaction fails or experiences delays, the staked AMP tokens can be liquidated to guarantee that merchants receive their funds promptly.

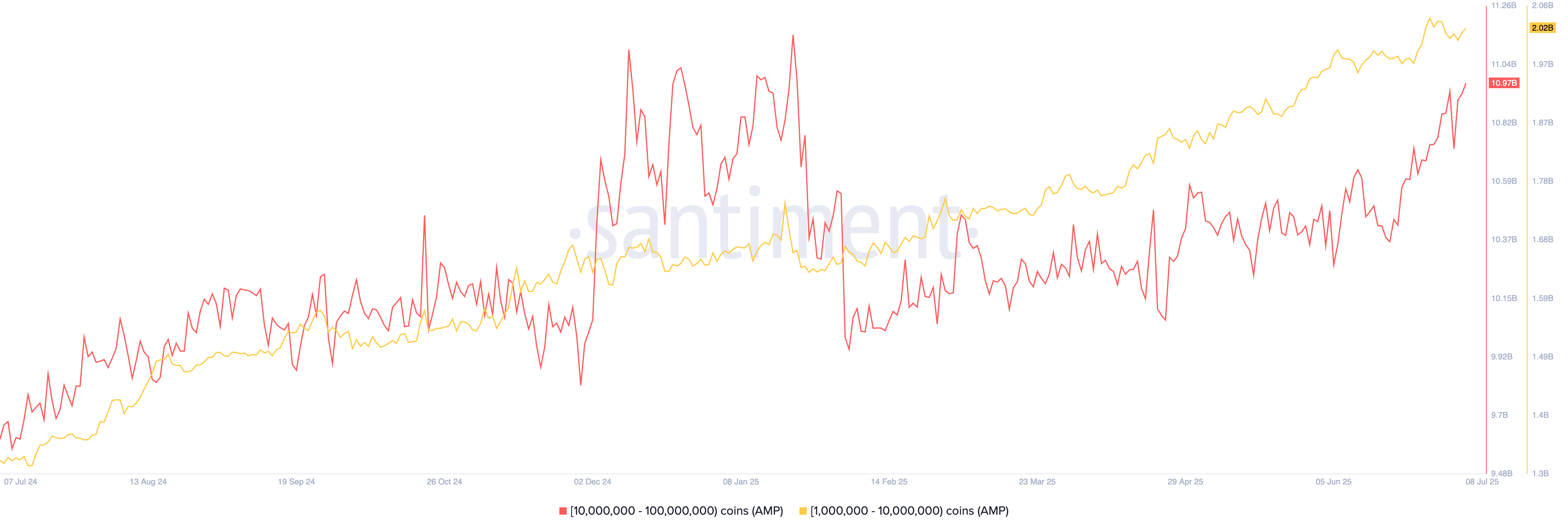

Despite the downward trend in price, on-chain data indicates that large investors, known as whales, are still accumulating Amp tokens, potentially anticipating a market rebound. Addresses holding between 10 million and 100 million AMP now control 10.97 billion tokens, showing an increase from 9.95 billion in February, according to Santiment.

Furthermore, data from Nansen reveals that the supply of AMP tokens on exchanges has decreased by over 43% in the past 90 days. This decrease is typically viewed as a positive sign, indicating that investors are moving tokens to private wallets rather than preparing to sell.

Amp Crypto Price Prediction

Looking at the daily chart, Amp appears to have formed a double-bottom pattern at $0.00306, a bullish signal in technical analysis.

Additionally, the Relative Strength Index has bounced back from an oversold level of 28 in June to the current 44. The Moving Average Convergence Divergence indicator has also shown a bullish crossover.

These indicators suggest a potential bullish reversal in the market. If the momentum continues, the next target for Amp could be $0.00573, the previous high from May 14, representing a potential gain of around 70% from the current levels. However, a drop below the support at $0.0030 would negate the bullish outlook.