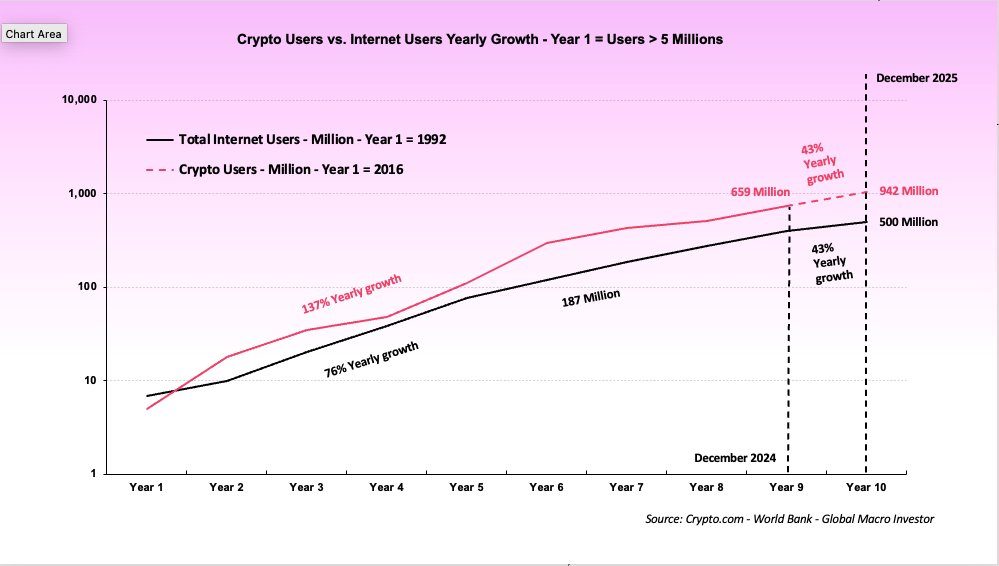

Raoul Pal, a former Goldman Sachs executive and co-founder of Real Vision, has made a bold prediction that crypto adoption could reach 4 billion users by 2030, potentially driving the market capitalization to $100 trillion. This forecast is based on the rapid expansion of crypto wallets, which are growing at twice the rate of internet IP addresses during the 1990s.

Pal’s analysis suggests that the surge in crypto prices is primarily driven by two factors: adoption and monetary debasement. He believes that debasement explains 90% of crypto price action, while adoption leads to outperformance against traditional inflation hedges like gold.

However, critics have raised concerns about the accuracy of the adoption metrics used by Pal. They argue that the proliferation of wallets may not accurately represent unique users, as some individuals can create multiple wallets to inflate community metrics. Research by venture capital firm a16z has suggested that the number of real monthly transacting users in the crypto space may be significantly lower than reported.

Despite these criticisms, Pal maintains that his comparison of crypto wallets to IP addresses is valid, as both metrics can multiply through various devices and locations. He believes that the current macroeconomic conditions, including rising U.S. M2 money supply and national debt, favor alternative stores of value like crypto.

Institutional adoption of crypto has also been on the rise, with the introduction of Bitcoin spot ETFs and the increasing use of stablecoins for cross-border payments. Major banks like JPMorgan, Goldman Sachs, and Deutsche Bank are exploring stablecoin offerings, signaling a growing acceptance of digital assets in traditional finance.

However, achieving Pal’s prediction of 4 billion crypto users and a $100 trillion market capitalization by 2030 would require significant growth and widespread adoption. Some experts have raised concerns about user experience and privacy issues that could hinder mainstream adoption, while regulatory developments like the EU’s MiCA and the U.S. GENIUS Act aim to provide oversight and guidance for the industry.

Despite the challenges and uncertainties surrounding crypto adoption, Pal remains optimistic about the long-term potential of digital assets. He advises his followers to focus on maintaining long-term positions and not to be overly concerned about short-term market volatility.

In conclusion, while Pal’s prediction may seem ambitious, the growing interest and investment in crypto suggest that the industry is poised for continued growth in the coming years. Only time will tell if his forecast of 4 billion users and a $100 trillion market cap by 2030 will become a reality.