Aave and Lido Surpass $70 Billion in Net Deposits, Setting New Records in DeFi Sector

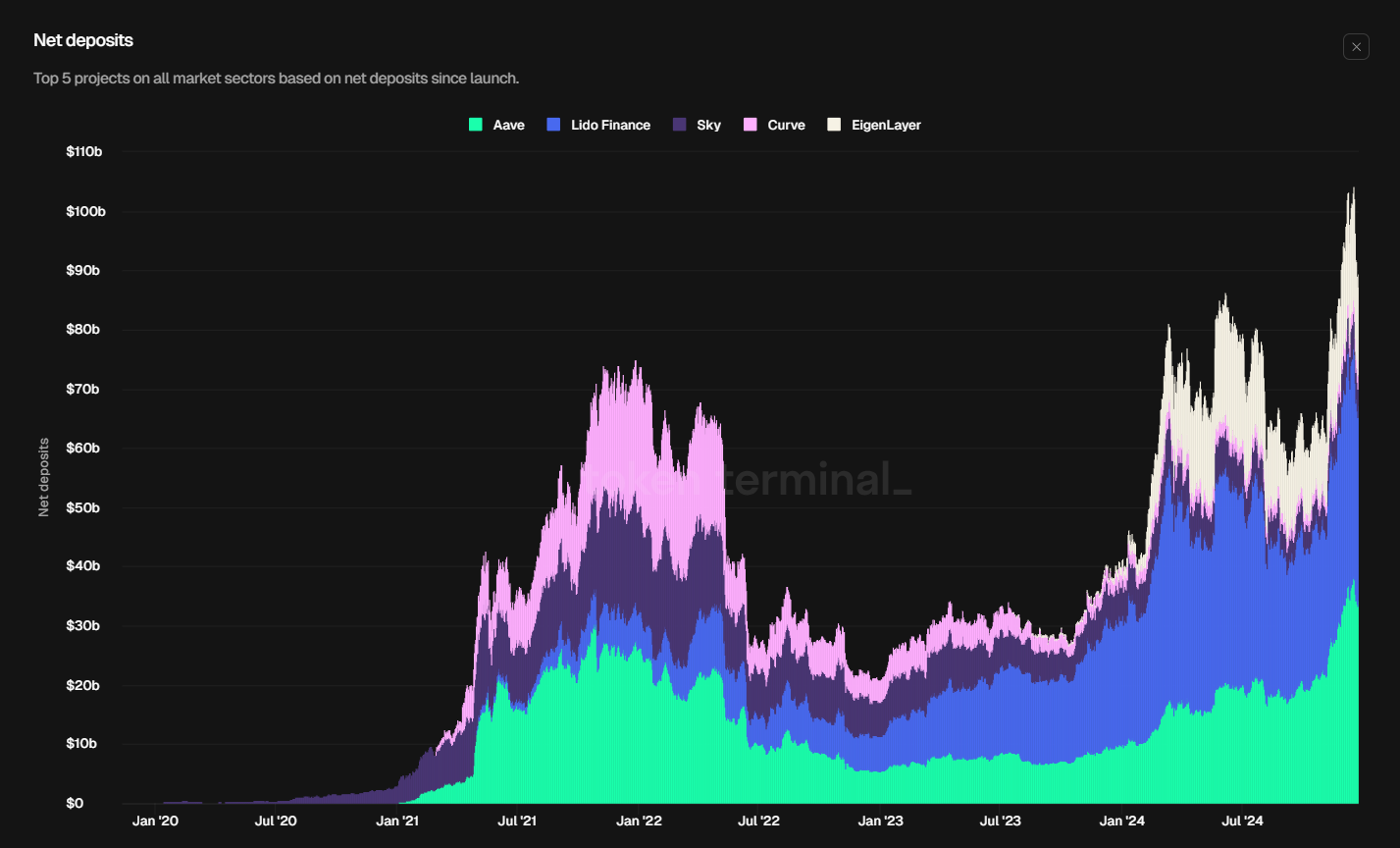

According to Token Terminal, Aave and Lido Finance have collectively reached a milestone by surpassing $70 billion in net deposits for the first time in history. Aave stands at the forefront with $34.3 billion, closely followed by Lido Finance with $33.4 billion. Together, these two protocols now account for 75.25% of the total $89.52 billion allocated to the top five Decentralized applications, marking a significant achievement in the DeFi space as of December 2024.

The dominance of Aave and Lido Finance extends to the top 20 DeFi applications, where they hold 45.5% of the total funds allocated, amounting to $67.42 billion out of the $148 billion total net deposits across the sector. Lido Finance leads in total value locked with $33.8 billion, while Aave follows closely behind with $20.6 billion.

Growth and Performance Metrics

The DeFi sector as a whole has witnessed substantial growth, with year-to-date Total Value Locked (TVL) increasing by 107%. On December 16, the TVL peaked at $212 billion, marking the first time it crossed the $200 billion threshold. This growth trajectory is further illustrated by the consistent rise in net deposits for Aave and Lido Finance, as shown in the graph below:

Furthermore, the revenue performance of Aave and Lido Finance highlights their strength in the DeFi space. AAVE generated $12.5 million in revenue over the last 30 days, reflecting a growth of 27.5%, while Lido Finance reached $9.6 million, driven by a platform growth of 24%.

Market Trends and Developments

Aside from net deposits and revenue, the DeFi ecosystem has also seen significant milestones in trading volumes on decentralized exchanges. In November, trading volumes on DEXes reached nearly $380 billion, indicating a growing preference for decentralized trading platforms. The share of trading volume on DEXes compared to centralized exchanges reached 13.86% in October, the second highest ever recorded.

The DeFi lending market has also experienced remarkable growth, with current loans totaling $21 billion in December, marking the largest monthly figure to date. Yield farming and staking play a crucial role in the DeFi ecosystem, with a $200 billion stablecoin market enabling users to earn rewards or borrow using stablecoins. The integration of DEXs and liquidity pools has minimized price slippage in high-activity markets, while the versatility of stablecoins across different blockchain networks enhances their usability.