The Aave Decentralized Autonomous Organization (DAO) has recently given the green light to a six-month token buyback program valued at $24 million, set to kick off on April 9. This move aims to fortify the protocol’s long-term financial structure and provide enhanced incentives for its stakeholders. The proposal garnered an overwhelming 439,000 votes in favor, with merely 2,020 votes against it, showcasing strong community support.

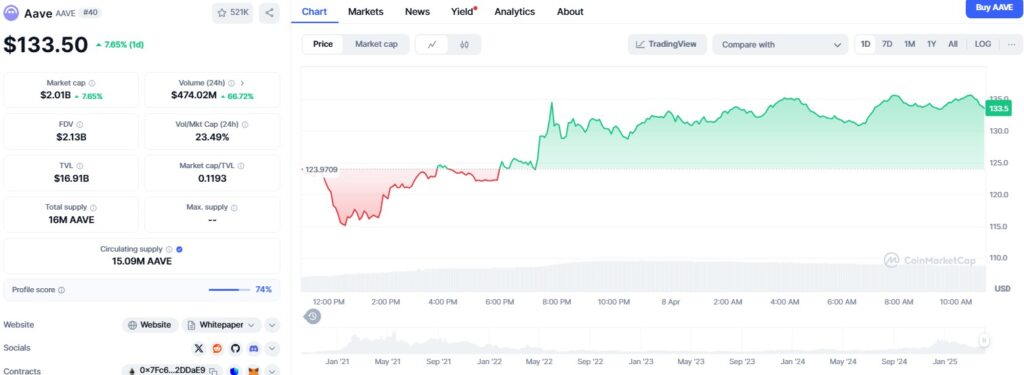

In parallel, the price of AAVE has surged to $133.50 in anticipation of the upcoming buyback initiative. The token’s value has seen a modest uptick from $131.55 earlier in the week, signaling a growing excitement surrounding the DAO’s financial strategy. This increase in price mirrors the broader market sentiment and reflects a positive outlook on the token’s future performance.

Moreover, institutional interest in decentralized finance (DeFi) is on the rise, with projections indicating a threefold increase in institutional DeFi utilization by 2026. According to research conducted by Coinbase and EY-Parthenon, 83% of institutional investors are gearing up to expand their digital asset exposure, with DeFi playing a pivotal role in this expansion. This trend underscores the growing acceptance of DeFi solutions among traditional financial institutions.

To oversee the execution of the buyback program, the Aave Finance Committee (AFC) has been established. The AFC will be responsible for managing the protocol’s treasury, ensuring transparent fund management, and aligning incentives across the platform. In its initial phase, the committee will leverage $4 million worth of aEthUSDT from the DAO’s treasury to fund the first month of buybacks. Subsequently, $1 million will be allocated weekly to purchase AAVE tokens, thereby reducing the token supply in circulation.

As Aave navigates through this strategic buyback initiative, it positions itself as a frontrunner in the DeFi space, particularly in decentralized lending. The protocol’s efforts to enhance its financial strategy and engage with institutional investors may set a precedent for other DAOs looking to implement similar treasury management programs. With a formal committee in place and a growing focus on DeFi platforms among institutional players, Aave is paving the way for deeper integration between decentralized protocols and traditional finance entities.

In conclusion, Aave’s approval of the $24 million AAVE buyback, coupled with the rising institutional interest in DeFi, signifies a significant milestone for the protocol. As it embarks on this strategic endeavor, Aave is poised to capitalize on the evolving landscape of decentralized finance and set new standards for governance and financial sustainability in the industry.