AAVE Token Price Surges by Over 132% and Shows Potential for Another 50% Increase

AAVE token price has already jumped by over 132% from its lowest level in April, and a rare technical formation points to another 50% surge.

The decentralized finance giant, AAVE (AAVE), has been on a winning streak this week, with its total assets in the network reaching a record high.

On Ethereum alone, the total market size has skyrocketed to $33.5 billion, with $13 billion being borrowed and $20.45 billion available to borrow, as per data on the official AAVE website.

Aside from Ethereum, AAVE has been expanding its presence on other chains like Base, Sonic, and Arbitrum. The total market size on Sonic has surged to $383 million, while on Base it has hit $882 million this week.

AAVE’s GHO stablecoin has also seen a rise in market share, with its market cap reaching a record high of $255 million.

Furthermore, futures open interest for AAVE has climbed to $550 million, marking the highest point this year. The increase in open interest suggests strong demand for AAVE in the futures market.

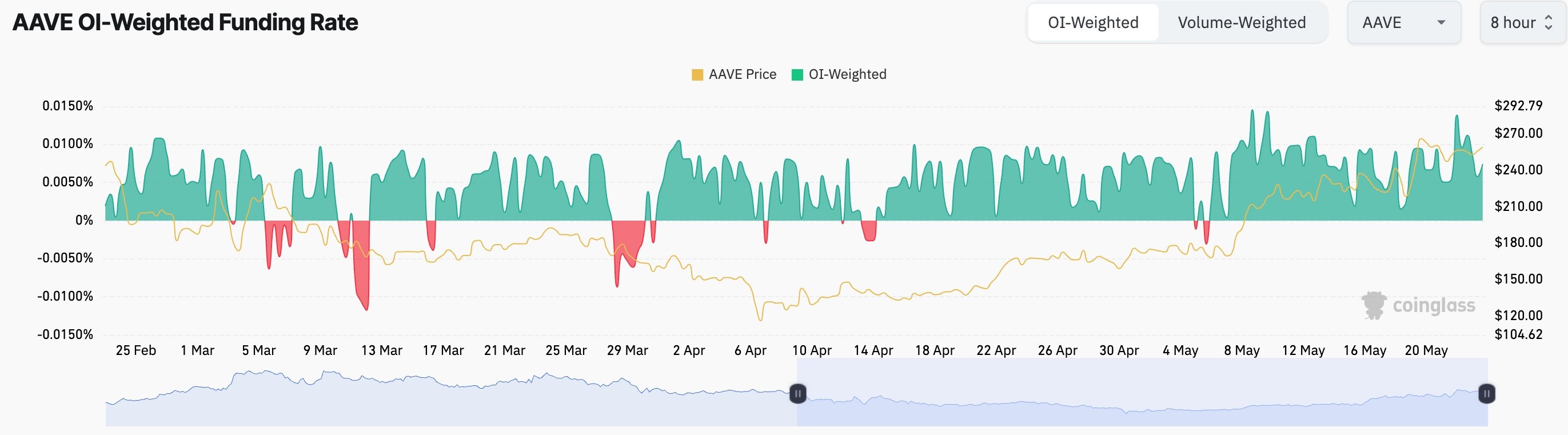

Looking at the funding rate chart, AAVE has maintained a positive funding rate since May 6, indicating that investors are optimistic about its future price performance.

The number of AAVE coins held on exchanges has been decreasing, with CoinGlass data showing a drop from 2.72 million to 2.16 million coins.

AAVE Price Technical Analysis

On the daily chart, AAVE’s price has seen a significant uptrend in recent weeks following the formation of a falling wedge pattern, a bullish reversal signal.

Currently, AAVE has surpassed the 50% Fibonacci Retracement level, and the Average Directional Index (ADX) has risen to 40, indicating a strengthening trend. Additionally, a golden cross has formed as the 50-day and 200-day moving averages intersect, signaling a bullish outlook for AAVE.

The next key resistance level to watch for AAVE is the previous high of $400 from November.