An analyst has recently shed light on the importance of a crossover between two key Bitcoin metrics – the Realized Price and the 200-week moving average (MA) – before the ‘fun’ can begin for the asset. The Realized Price, an on-chain indicator that tracks the cost basis of the average investor on the BTC network, plays a crucial role in determining the overall market sentiment. When the spot price of Bitcoin exceeds this metric, it indicates that holders are in a state of net unrealized profit. Conversely, if the price falls below the indicator, it suggests that the market as a whole is holding loss.

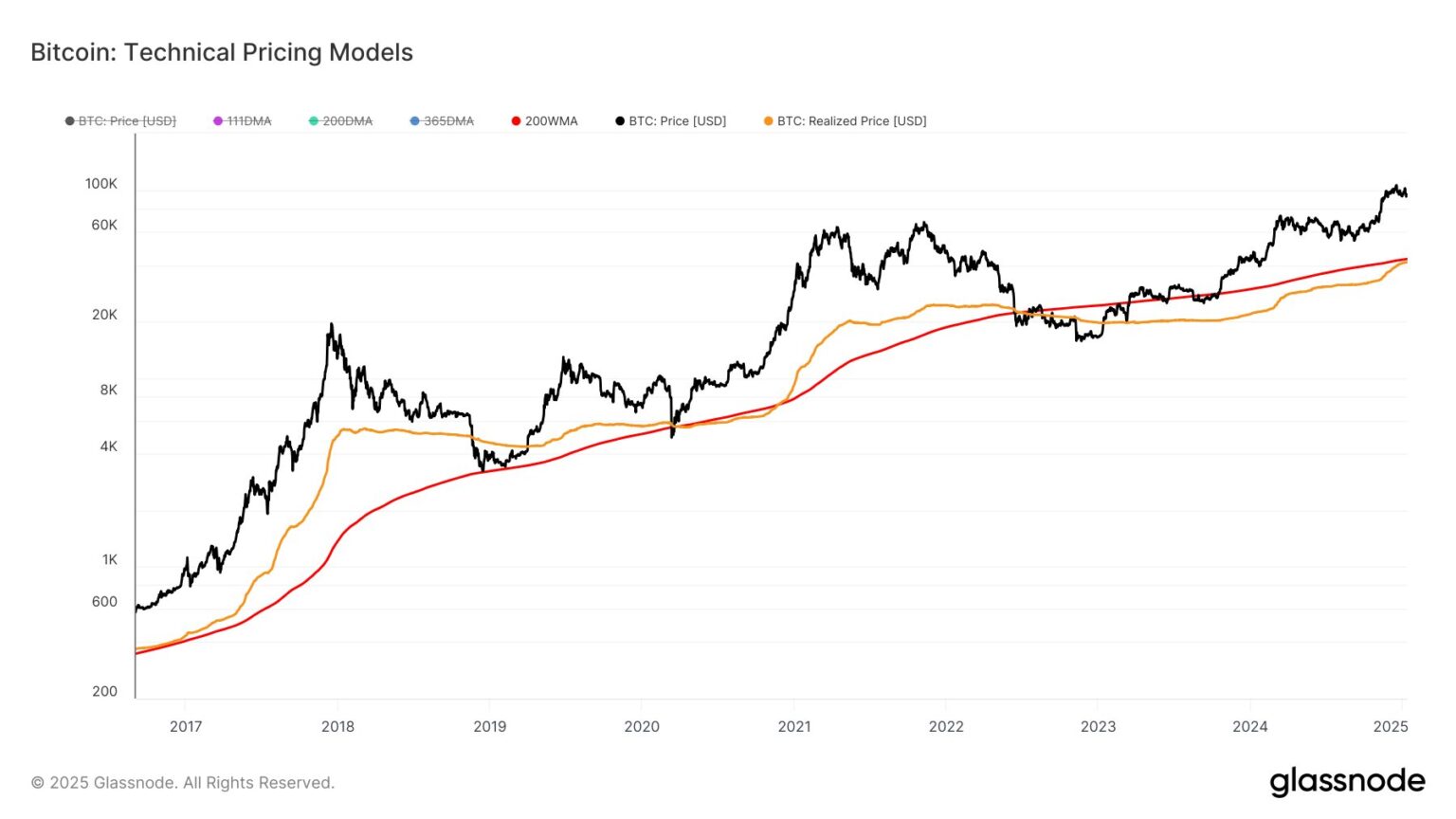

On the other hand, the 200-week MA is a technical analysis indicator that calculates the average value of Bitcoin over a specified time period and helps in studying long-term trends by smoothing out short-term fluctuations. Analyst James Van Straten has highlighted the significance of the crossover between the Realized Price and the 200-week MA in predicting major market movements. In a recent post, Van Straten shared a chart showcasing the trend in these two metrics over the past few years.

The chart reveals that the Bitcoin Realized Price dipped below the 200-week MA during the 2022 bear market and has since been approaching a retest. Previous instances of the Realized Price crossing above the MA have led to significant bull runs for the cryptocurrency. Van Straten emphasized that ‘the fun begins’ when this crossover occurs, hinting at a potential bullish cycle for Bitcoin in the near future.

Additionally, the Realized Price has historically served as a boundary for bear market lows, indicating a state of market loss and a lack of sellers looking to take profits. This often leads to a bottoming out of Bitcoin’s price during such periods. As Bitcoin continues to show resilience and bounce back from recent price drops, reaching the $96,600 mark after falling below $90,000, all eyes are on whether the Realized Price will surpass the 200-week MA and trigger a new bullish phase for the asset.

In conclusion, the crossover between the Bitcoin Realized Price and the 200-week MA holds immense significance for predicting market trends and potential price movements. As traders and investors keep a close watch on these metrics, the anticipation for the ‘fun’ to begin in the Bitcoin market continues to grow.