New Data Reveals Awakening of Ancient Bitcoin, Sell-Side Pressure Looms

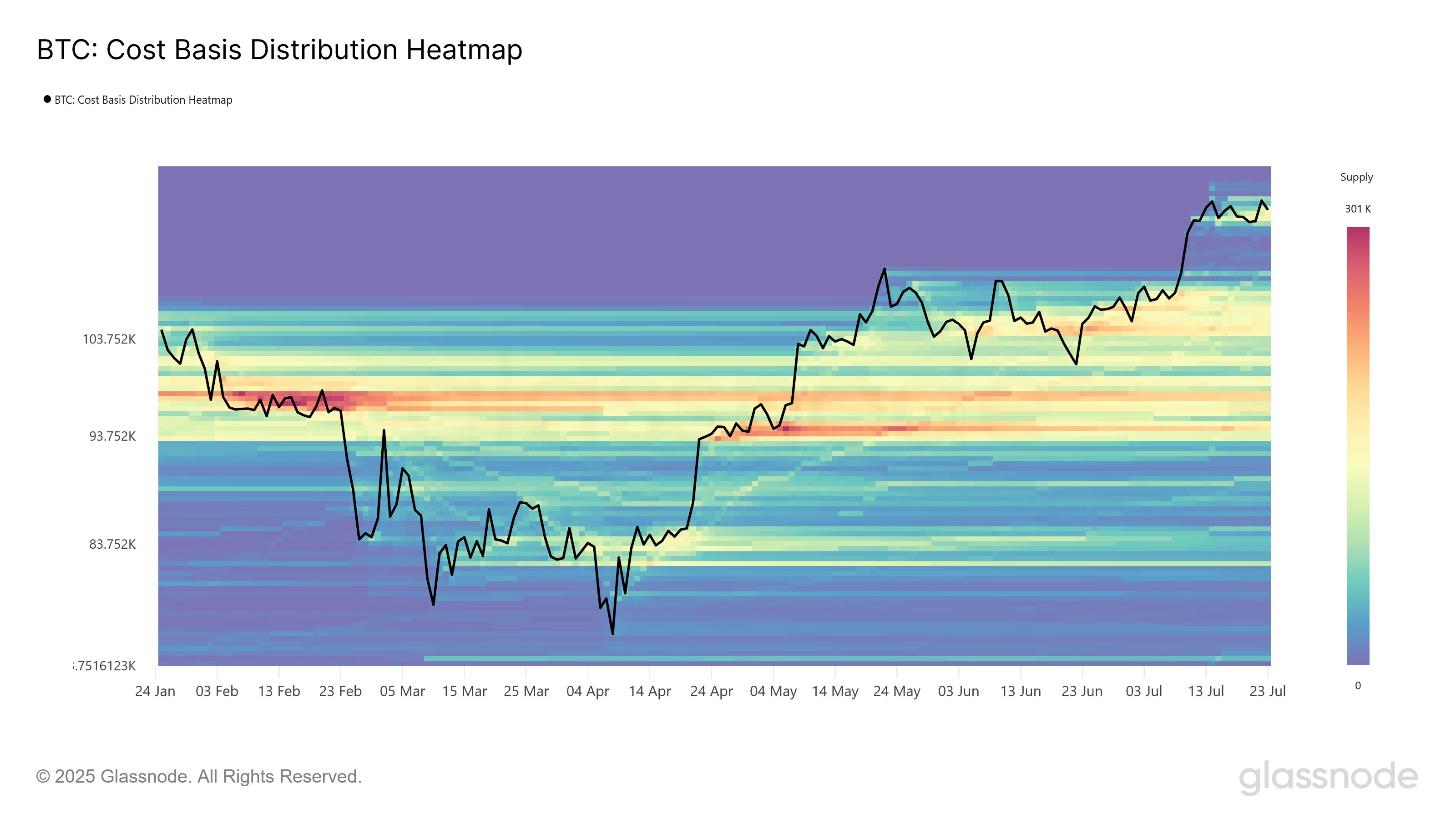

Recent data from market intelligence firm Glassnode suggests that ancient Bitcoin (BTC) is coming back to life, indicating potential sell-side pressure on the leading cryptocurrency.

In a recent update on their social media platform, Glassnode highlighted the resurgence of tens of thousands of dormant tokens in July, hinting that early investors might be looking to capitalize on their investments.

“Another wave of ancient coins moved on-chain on Thursday, with 3,900 BTC aged over 10 years becoming active. This follows the significant movement of 80,000 BTC on July 4, 2025. Such activity from long-dormant supply often signals internal reallocation, custodial shifts, or potential sell-side pressure.”

According to Glassnode, Bitcoin could potentially establish a “bottom formation zone” if it fails to hold its current support levels.

“The recent rally from $110,000 to $117,000 has created a low-density accumulation zone. If the price fails to hold above $122,000, historical data suggests that such gaps could evolve into bottom formation zones.”

In its weekly on-chain analytics report, Glassnode elaborated on how Bitcoin achieving a $1 trillion realized market cap signifies a significant milestone for the digital asset.

“The recent influx of capital has propelled Bitcoin’s realized cap above the $1 trillion mark for the first time. This milestone underscores Bitcoin’s deep liquidity profile and its growing importance on the global stage. As Bitcoin continues to grow, more capital can be stored within the network, allowing for larger transactions to be settled.”

Bitcoin is currently trading at $116,671, reflecting a 2.1% decline in the past 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney