Cathie Wood’s ARK Invest has made significant investments in Bullish Holdings and Robinhood Markets, totaling $37.4 million during a period of market-wide selling pressure. This strategic accumulation reflects ARK’s confidence in these companies and their potential for growth.

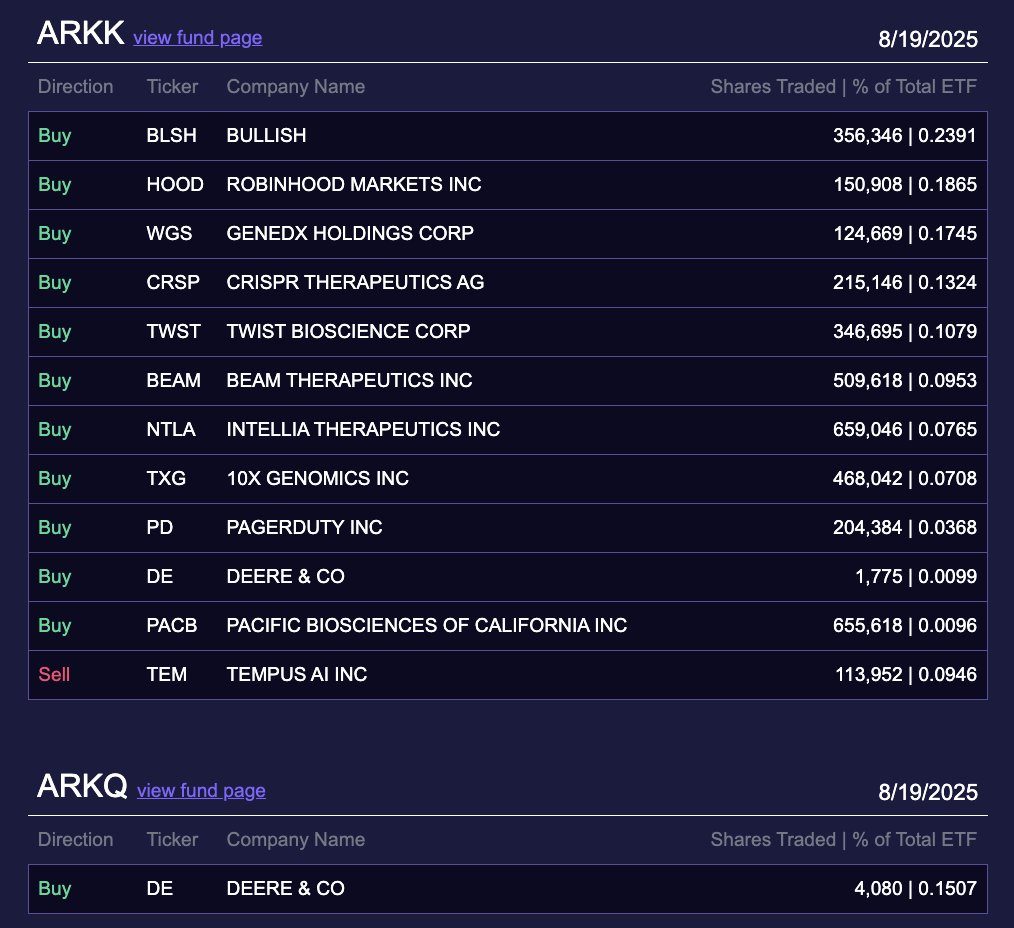

The purchases of 356,346 shares of Bullish Holdings and 150,908 shares of Robinhood Markets come at a time when ARK is actively reentering the market following regulatory compliance obligations. This marks a notable shift from previous forced selling to comply with Rule 12d3-1, which restricted ETF holdings in registered broker-dealer securities.

The recent acquisitions also align with ARK’s mid-year recovery narrative, where the firm outperformed the Nasdaq 100 with a 73.54% gain between April and June. This success was attributed to active portfolio rebalancing and strategic investment decisions.

ARK’s trading patterns in crypto equities have attracted attention, as the firm consistently maximizes returns by buying at opportune times and selling at apparent peaks. This strategic approach has raised questions about whether ARK possesses analytical superiority or informational advantages that retail investors lack.

The firm’s recent purchases of Bullish and Robinhood shares follow a similar pattern to its previous Circle strategy, where profit-taking was followed by renewed accumulation during market softness. This consistency in profit maximization across volatile assets has garnered interest and scrutiny within the investment community.

Moving forward, it remains to be seen whether ARK’s confidence in Bullish and Robinhood is a long-term investment or a short-term bet that may be offloaded in the future. The firm’s ability to navigate market fluctuations and capitalize on opportunities continues to be a point of focus for investors and analysts.

Overall, ARK Invest’s recent acquisitions demonstrate a strategic approach to investing in companies with strong growth potential. The firm’s success in maximizing returns and navigating market volatility highlights its expertise in the investment landscape.