The recent ruling by the Federal Court of Australia in favor of crypto lender Block Earner has sent shockwaves through the financial industry. The court overturned a decision that Block Earner needed an Australian financial services license (AFSL) to offer its crypto-linked ‘Earner’ product, dismissing the financial regulator ASIC’s suit to impose penalties on the digital asset platform.

According to the court’s judgment, the discontinued ‘Earner’ product was classified as a loan rather than a managed investment scheme. The product, which was available from March to November 2022, allowed customers to ‘loan’ specified crypto in exchange for interest paid at a fixed rate.

The Australian Securities and Investments Commission (ASIC) had initiated the case against Block Earner, alleging violations of corporation laws related to its ‘Access’ and ‘Earner’ products. The ASIC sought declarations, injunctions, and pecuniary penalties from the court in response to Block Earner’s activities.

In a previous ruling in February 2024, the Australian Federal Court imposed penalties on Block Earner over the ‘Earner’ product, stating that an AFSL license was required. However, a subsequent ruling in June 2024 relieved Block Earner from paying a penalty, as the court found that the company had acted honestly and not carelessly in offering the product.

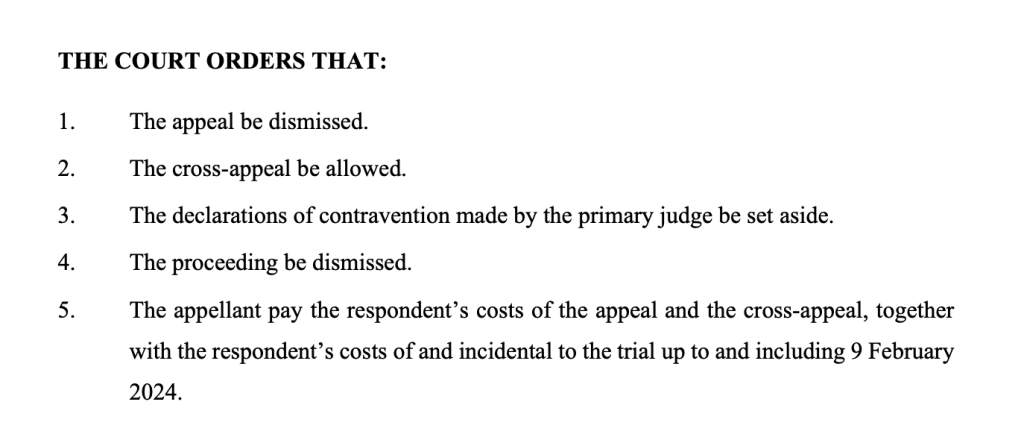

The recent judgment by the Federal Court, which dismissed ASIC’s appeal, has brought closure to a long and difficult legal process for Block Earner. Justices David O’Callaghan, Wendy Abraham, and Catherine Button ordered ASIC to cover all legal costs from the original trial and appeal.

Despite the legal victory, Block Earner has announced that it has no plans to re-launch its ‘Earner’ products for Australian customers. Co-founder James Coombes emphasized that the product was voluntarily closed in November 2022 and there is no intention to reintroduce it.

“This case highlights the importance of ensuring regulations evolve alongside technology,” Coombes said. “Without modernized guidance, Australia risks losing fintech innovation to offshore markets more supportive of responsible crypto entrepreneurship.”

Co-founder Charlie Karaboga added that the ruling brings closure to a challenging process for Block Earner. The company remains committed to compliance with regulations and responsible crypto entrepreneurship.

In conclusion, the Federal Court’s decision in favor of Block Earner marks a significant milestone in the evolving regulatory landscape of the cryptocurrency industry. The ruling underscores the importance of balancing innovation with regulatory compliance to foster a thriving ecosystem for crypto businesses in Australia and beyond.