Binance continues to solidify its position as the premier exchange for altcoin trading, maintaining its lead in altcoin deposit activity, as highlighted in a recent report from CryptoQuant.

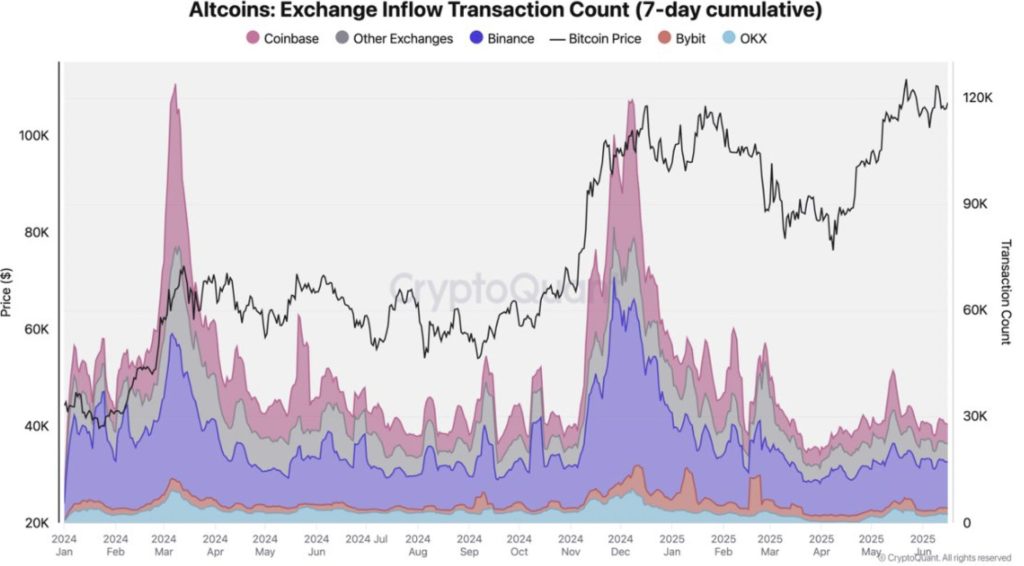

During the peak of last year’s November-to-December altcoin rally, Binance processed a staggering 59,000 deposits in a single day, surpassing Coinbase’s 26,000 and overshadowing the combined total of 24,000 on other exchanges. Even in more stable market conditions, Binance consistently handles around 13,000 altcoin inflow transactions daily, compared to Coinbase’s 6,000 and an average of 10,000 on other platforms.

Altcoin inflows tend to surge following market rallies, indicating that traders are transferring assets to exchanges to secure profits. These spikes often coincide with price peaks and increased speculative activity, as noted by CryptoQuant. Binance’s dominance in altcoin inflows can be attributed to its extensive range of altcoin offerings and deep liquidity, making it the preferred choice for both retail and institutional traders during periods of heightened market activity.

In addition to altcoin inflows, Binance also leads in stablecoin transactions on the Ethereum network, particularly with USDT and USDC. Recent data shows that Binance received approximately 53,000 Ethereum-based stablecoin transactions, surpassing Coinbase, Bybit, and OKX. This trend underscores Binance’s position as the primary gateway for dollar-denominated capital entering the crypto market via Ethereum.

Stablecoin inflows are often seen as a precursor to increased trading activity, indicating capital being held on exchanges for potential deployment. Binance’s dominance in this segment reflects strong trader and investor confidence, further solidifying its reputation as a platform for liquidity and execution.

The trend extends to the TRON network, where Binance consistently records the highest volume of USDT deposits. In the past week alone, Binance processed approximately 384,000 USDT inflow transactions, outpacing Bybit and HTX. TRON’s low fees and fast transaction speeds have made it a popular choice for moving stablecoins, with a significant portion of that traffic flowing to Binance.

Exchanges with dominant stablecoin inflows are poised to benefit from increased trading volume and user trust, as highlighted by CryptoQuant. Binance’s continued lead across both Ethereum and TRON networks underscores its pivotal role in global crypto liquidity and capital allocation.

Overall, Binance’s dominance in altcoin and stablecoin deposits reaffirms its position as a market leader, catering to the diverse needs of traders and investors in the ever-evolving cryptocurrency landscape.