The second quarter of 2025 saw the cryptocurrency market start to bounce back, driven primarily by a resurgence in interest in spot Bitcoin exchange-traded funds (ETFs) and a significant price increase in Bitcoin itself. TokenInsight’s latest Exchange Report revealed that the total crypto market capitalization reached $3.46 trillion by the end of the quarter, marking a 28.2% increase from the previous quarter.

Despite the overall market recovery, exchange activity did not see the same level of growth. Cautious sentiment, limited participation in altcoins, and macroeconomic challenges contributed to a decline in trading volumes across the top 10 crypto exchanges. The total trading volume for these exchanges reached $21.6 trillion in Q2, representing a 6.16% decrease compared to the previous quarter.

While Bitcoin experienced a rally from $83,000 to over $111,000, closing near $106,000, the performance of other cryptocurrencies was mixed. Liquidity remained concentrated in a few large-cap assets, with many altcoins facing low activity and decreased interest. The spot market, in particular, saw a significant pullback, with average daily spot trading volume dropping from $51 billion in Q1 to $40 billion in Q2. Total spot volume across major exchanges decreased by 21.7% quarter-on-quarter.

On the derivatives trading front, the market fared slightly better, reaching $20.2 trillion, a 3.6% decline from Q1. Traders sought to hedge volatility and manage risk amidst geopolitical tensions and sluggish global growth, leading to an average daily derivatives trading volume of $226 billion in Q2.

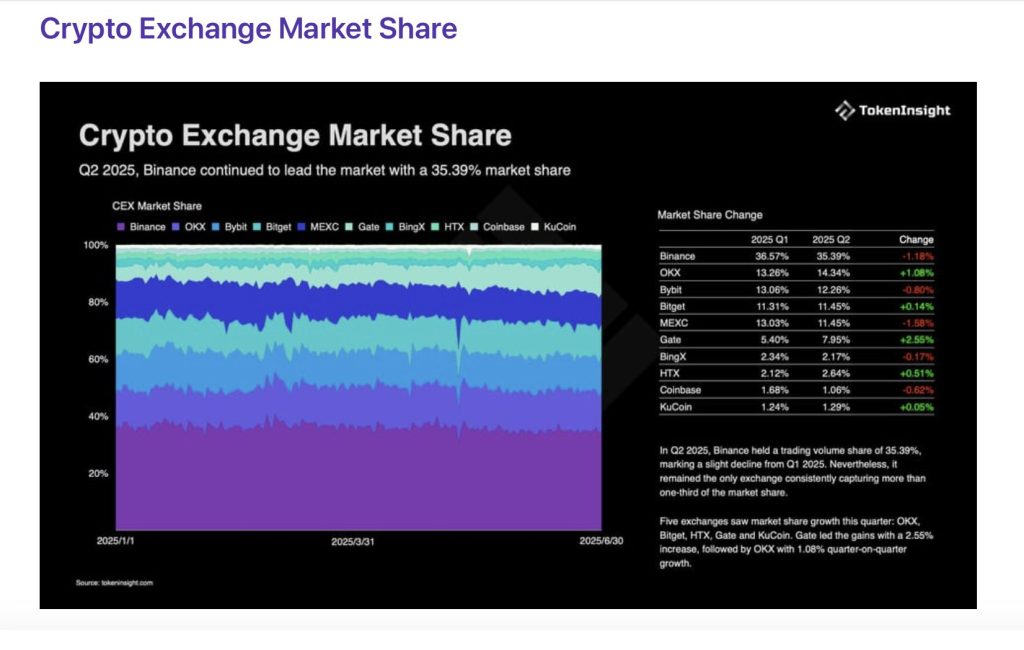

Binance maintained its position as the leading exchange in terms of total trading volume, with a 35.39% market share, although this share slightly decreased from Q1. Other exchanges like OKX, Bitget, HTX, Gate, and KuCoin managed to increase their market shares during the quarter. Gate saw the largest gain with a 2.55% increase, followed by OKX with 1.08%.

In the exchange token market, despite Bitcoin’s surge, exchange-related tokens struggled to keep pace. BNB showed the strongest performance with an 8.91% gain, while other tokens like OKB, BGB, and KCS saw modest increases. Most exchange tokens experienced declines, reflecting the overall decrease in altcoin market activity.

Looking ahead to Q3, TokenInsight predicts continued challenges for exchange token performance due to ongoing macroeconomic uncertainty and regulatory developments. Market participants are expected to remain focused on high-cap assets and be selective in their capital deployment across the exchange sector.