Since then, other countries like Paraguay, Panama, and Brazil have expressed interest in following suit. Sovereign adoption of bitcoin can provide countries with an alternative to traditional fiat currencies, offering benefits such as financial inclusion, lower transaction costs, and protection against currency devaluation.

Additionally, adopting bitcoin as a reserve asset can provide countries with a hedge against economic instability and geopolitical risks. Countries with large foreign exchange reserves, like China and Russia, may see bitcoin as a strategic asset to diversify their holdings and reduce dependence on the US dollar.

Overall, the increasing adoption of bitcoin across different segments of society reflects the growing recognition of its value as a superior store of wealth and medium of exchange. As more individuals, asset managers, corporations, and sovereigns embrace bitcoin, its value proposition is likely to strengthen, leading to further price appreciation and mainstream acceptance.

As bitcoin continues to gain traction as a legitimate asset class, it is important for investors and policymakers to understand its unique characteristics and the various factors that drive its valuation. By considering the different perspectives of individual users, institutional investors, corporations, and sovereign entities, a more comprehensive view of bitcoin’s value proposition can be obtained.

Ultimately, the increasing adoption of bitcoin across diverse sectors of society underscores its potential to reshape the global financial landscape and emerge as a key player in the digital economy of the future.

In the context of Bitcoin adoption, a quantitative model can be developed to predict the rate of adoption based on various factors. One such factor could be the price performance of Bitcoin, which has exhibited a power law distribution in the past. This means that there are many small price movements but fewer large ones, which can be indicative of adoption patterns.

Additionally, other factors such as regulatory environment, institutional interest, and technological advancements can also be included in the model to provide a more accurate prediction of Bitcoin adoption rates. By analyzing these factors and their impact on adoption, policymakers and researchers can better understand the trajectory of Bitcoin adoption in the future.

Overall, the case of El Salvador’s adoption of Bitcoin as legal tender and its subsequent economic benefits serve as a powerful example for other nations considering similar moves. The social dynamics of Bitcoin adoption, including network effects, the Lindy effect, and the Dunning-Kruger effect, can also play a significant role in accelerating adoption rates. By developing quantitative models and understanding these dynamics, countries can make informed decisions about adopting Bitcoin and potentially reap the economic benefits that come with it.

Power laws can be observed in various aspects of our world, providing insights into the distribution of sizes, impacts, and behaviors within different systems. Here are some common examples where power laws can be observed:

Cities

A power law can be used to characterize the distribution of city sizes when analyzing the link between populations and cities. For example, the number of small towns and villages is far higher than that of large cities (let alone megacities like Tokyo and New York). Nonetheless, a disproportionately large share of the population lives in these big cities. Here, the power law suggests that, according to a particular mathematical relationship, the frequency of cities declines as their size grows.

Large Corporations

A power law can also be used to describe how different business sizes are distributed inside organizations. There are far more small and medium-sized businesses (SMEs) than there are major, global organizations with revenues greater than the GDPs of some nations. A power law distribution is compatible with the size distribution of these firms, which tends to be composed of many smaller companies and fewer large ones based on factors like market capitalization, number of employees or revenue.

Viruses

Power rules can be used to explain how viruses mutate or how epidemics spread. The theory is that while the majority of changes may not have much of an effect, a small number might drastically change the behavior of the virus — making it more virulent or transmissible, for example. A power law can also be used to describe the distribution of outbreak sizes, with most outbreaks being tiny, localized episodes, but a small number having the potential to expand into broad pandemics that impact millions of people.

Bitcoin Adoption

There has been research indicating that the adoption of bitcoin as a monetary technology follows a power law distribution, much like the spread of a virus. The price evolution of bitcoin has shown a linear increase over time, indicating a power law relationship. Additionally, the number of active addresses/users and the hashrate of the Bitcoin network also adhere to this power law distribution. This suggests that bitcoin adoption could continue to follow a power law in the future, potentially leading to a significant increase in price over the next 10 years.

As adoption of bitcoin increases, the risk and volatility associated with the asset are likely to decline. This is supported by the Fractal Market Hypothesis, which suggests that increasing heterogeneity among investors leads to lower volatility in the market. With wider adoption, bitcoin is expected to transition from a risky asset with high volatility to a safe-haven asset with lower volatility over time.

Who Owns All the Bitcoin?

Identifying the holders of bitcoin is a complex task due to the semi-anonymous nature of the blockchain. However, there are companies specializing in “address tagging” and providing data on the distribution of bitcoin holdings among exchanges, miners, and other entities. Websites like bitcointreasuries.net compile information on bitcoin holdings of corporations, governments, and other entities based on community entries and publicly available information.

Overall, power laws offer valuable insights into the distribution and behavior of various systems, from cities and corporations to viruses and cryptocurrencies like bitcoin. By understanding and analyzing these power law distributions, we can gain a deeper understanding of how these systems evolve and grow over time.

It is designed to have a maximum supply of 21 million coins, making it inherently deflationary. This scarcity is in direct contrast to traditional fiat currencies, which can be printed endlessly by central banks, leading to inflation. As a result, many investors view Bitcoin as a potential hedge against inflation.

Historically, assets like gold and real estate have been popular choices for investors looking to protect their wealth against inflation. However, Bitcoin offers some unique advantages over these traditional assets. For one, Bitcoin is easily transferable and can be sent anywhere in the world within minutes. This makes it a highly liquid asset that can be quickly converted into cash if needed.

Additionally, Bitcoin is decentralized and operates on a secure and transparent blockchain network. This means that its value is not tied to any government or central authority, reducing the risk of government interference or manipulation. In times of economic uncertainty or high inflation, Bitcoin’s decentralized nature may make it an attractive option for investors seeking to diversify their portfolios.

Furthermore, Bitcoin’s fixed supply schedule, enforced by the Halving events, ensures that its scarcity will only increase over time. This increasing scarcity could potentially drive up the price of Bitcoin, making it a valuable asset for hedging against inflation.

While it is important to note that Bitcoin is a highly volatile asset and its price can fluctuate significantly in the short term, many investors see its long-term potential as a store of value and inflation hedge. As the global economy continues to face challenges such as rising inflation and economic uncertainty, Bitcoin’s unique characteristics may make it an appealing option for investors looking to protect and grow their wealth.

Bitcoin’s algorithm dictates a gradual reduction in price-inelastic supply growth, ultimately leading to a circulating supply that will converge towards 21 million coins in the long run. This absolute scarcity, along with its disinflationary supply growth schedule, positions bitcoin as a potential hedge against inflation. The performance of bitcoin has shown a close correlation to global money supply growth, indicating its sensitivity to market-based inflation expectations like U.S. CPI swap rates and TIPS breakeven rates.

While bitcoin’s price initially showed little correlation to inflation expectations during its early years, this has changed significantly since the Covid crisis and the 2020 Halving event. As the supply scarcity of bitcoin increases, its sensitivity to inflation expectations is likely to grow even further. Additionally, with countries experiencing higher inflation rates showing an increased adoption of bitcoin as a store of value, the potential for bitcoin’s value to rise in these environments is significant.

Bitcoin’s decentralized nature and censorship-resistant properties make it an attractive hedge against sovereign default risk. As major developed countries face high debt levels and increasing interest expenses, the likelihood of a sovereign default may rise. Central banks have acknowledged the diminishing safety of traditional safe-haven assets like U.S. Treasuries, further highlighting bitcoin’s appeal as a hedge against default.

Greg Foss proposed a model where bitcoin could act as a hedge against a basket of major sovereign debt, with its market cap reflecting the weighted probability of default. The model suggests that bitcoin’s market cap could align with the value of sovereign debt it aims to hedge against in case of a default. This approach indicates a “fair value” for bitcoin, suggesting a price of around $232,000 per coin based on current sovereign debt levels.

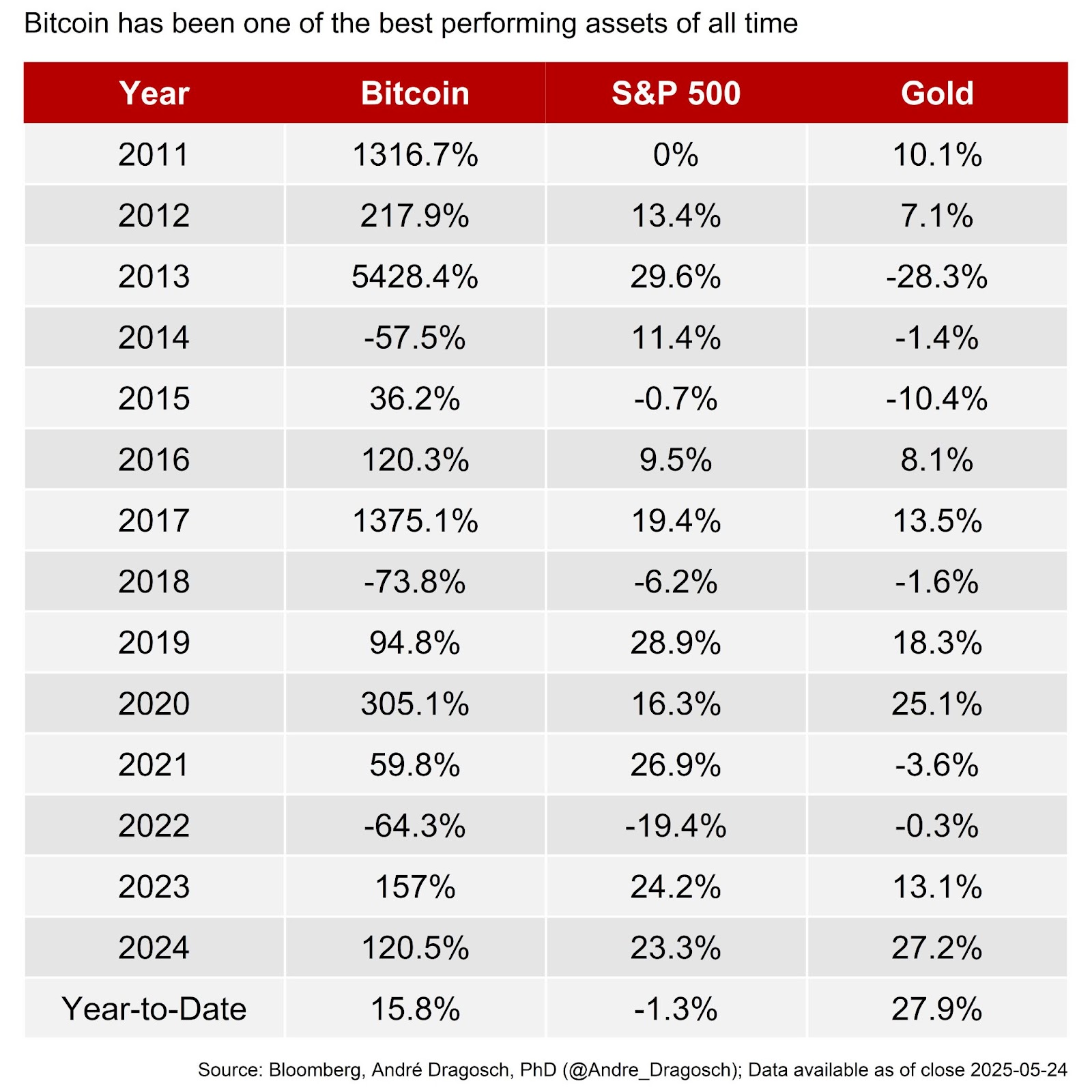

When considering bitcoin as an inflation hedge, historical data shows that bitcoin has outperformed U.S. CPI inflation in over 80% of the years since 2010. Compared to other asset classes like real estate, equities, government bonds, and commodities, bitcoin has exhibited higher average real returns and better purchasing power preservation.

Overall, the unique properties of bitcoin, its limited supply, and growing adoption as a store of value make it a compelling option for investors seeking protection against inflation, sovereign default risk, and the erosion of purchasing power.

Gold has long been considered a safe haven asset, with its value often remaining stable even during times of market volatility. However, when compared to other commodities, the returns on gold investments are not always phenomenal. While gold may appear to be an exception among commodities, its performance is not always extraordinary.

One of the key factors affecting the returns on gold investments is the supply and demand dynamics of the market. Historically, the price of gold has been influenced by factors such as geopolitical events, inflation, and currency fluctuations. As a result, the value of gold can fluctuate based on these external factors, making it a less predictable investment compared to other assets.

In recent years, there has been a growing interest in alternative assets such as Bitcoin. Some market observers have even questioned the traditional 4-year cycle of Bitcoin rallies following the Halving events. The diminishing returns of Bitcoin with each new cycle have led some to believe that the historical pattern may no longer hold true in the future.

However, the increasing adoption of Bitcoin by institutional investors and the growing demand for the cryptocurrency suggest that its price may continue to rise in the coming years. As more companies and governments embrace Bitcoin as a store of value, the demand for the cryptocurrency is expected to increase exponentially. This shift towards institutional adoption could potentially lead to higher returns on Bitcoin investments in the future.

In fact, some models estimate that Bitcoin could reach $1 million per coin by January 2027, driven by the significant increase in demand from institutional and nation-state sources. This outlook underscores the idea that Bitcoin sits at the intersection of supply scarcity and exponential demand growth, leading to potentially higher returns in each cycle.

As trust in traditional financial systems wanes, assets like gold and Bitcoin have become increasingly popular among investors looking to protect their wealth. Both assets have proven to be top performers in recent years, and are likely to continue to outperform other investments in the future.

Overall, while gold may not always deliver exceptional returns compared to other commodities, the growing demand for Bitcoin and its potential for exponential growth suggest that alternative assets like cryptocurrencies could offer investors a more lucrative investment opportunity in the years to come. The world of fashion is constantly evolving, with new trends and styles emerging each season. One trend that has been gaining popularity in recent years is sustainability. More and more fashion brands are making an effort to reduce their environmental impact and promote ethical practices in their production processes. From using organic materials to implementing fair labor practices, these brands are leading the way towards a more sustainable fashion industry.

One key aspect of sustainable fashion is the use of eco-friendly materials. This includes materials that are produced in a way that minimizes harm to the environment, such as organic cotton, hemp, and bamboo. These materials are grown without the use of harmful chemicals and pesticides, making them a more sustainable option compared to conventional fabrics. In addition, many sustainable fashion brands also use recycled materials, such as plastic bottles and old textiles, to create new garments. By repurposing these materials, brands are able to reduce waste and lessen their environmental impact.

Another important aspect of sustainable fashion is the promotion of fair labor practices. Many fashion brands have come under fire in recent years for using sweatshop labor in their production processes. Sustainable fashion brands, on the other hand, prioritize the well-being of their workers by ensuring fair wages, safe working conditions, and reasonable working hours. By treating their workers with respect and dignity, these brands are setting a positive example for the rest of the industry.

In addition to using eco-friendly materials and promoting fair labor practices, sustainable fashion brands also focus on creating timeless, high-quality pieces that are designed to last. This is in stark contrast to the fast fashion model, which churns out cheap, disposable clothing that quickly goes out of style. By investing in pieces that are made to last, consumers can reduce their overall consumption and minimize their impact on the environment.

Overall, sustainable fashion is about more than just the clothes we wear – it’s about making a positive impact on the world around us. By supporting brands that prioritize sustainability, we can help create a more ethical and environmentally-friendly fashion industry. Whether it’s choosing clothes made from eco-friendly materials, supporting brands that promote fair labor practices, or investing in timeless pieces that are built to last, there are many ways we can make a difference through our fashion choices. Let’s all do our part to support a more sustainable future for fashion. The Benefits of Regular Exercise on Mental Health

Regular exercise has long been touted for its physical health benefits, but its positive impact on mental health is equally important. Exercise has been shown to have a profound effect on mood, stress levels, anxiety, and overall mental well-being. In this article, we will explore the various ways in which regular exercise can benefit mental health.

One of the most well-known benefits of exercise on mental health is its ability to improve mood. Physical activity releases endorphins, which are known as the “feel-good” hormones. These endorphins act as natural mood lifters, helping to reduce feelings of stress, anxiety, and depression. In fact, studies have shown that exercise can be just as effective as medication in treating mild to moderate depression.

Exercise also helps to reduce levels of cortisol, the body’s primary stress hormone. When cortisol levels are elevated for prolonged periods of time, it can lead to a number of negative effects on mental health, including increased anxiety, depression, and even cognitive impairment. Regular exercise has been shown to reduce cortisol levels, leading to a more balanced and stable mood.

Furthermore, exercise has been shown to improve cognitive function and reduce the risk of cognitive decline. Physical activity increases blood flow to the brain, which can help to improve memory, concentration, and overall cognitive function. In addition, exercise has been shown to stimulate the production of new brain cells, a process known as neurogenesis, which can help to protect against age-related cognitive decline.

Regular exercise can also help to improve sleep quality, which is essential for maintaining good mental health. Sleep plays a crucial role in regulating mood, stress levels, and cognitive function. Exercise has been shown to promote deeper, more restful sleep, leading to improved mental clarity and overall well-being.

In addition to these cognitive benefits, exercise can also help to improve self-esteem and body image. Regular physical activity can help to strengthen muscles, improve flexibility, and increase overall fitness levels. This can lead to a more positive self-image and a greater sense of self-confidence. In turn, this can help to reduce feelings of anxiety and depression, leading to an overall improvement in mental health.

In conclusion, the benefits of regular exercise on mental health are vast and far-reaching. From improving mood and reducing stress to enhancing cognitive function and promoting better sleep, exercise has a powerful impact on mental well-being. Incorporating regular physical activity into your routine can help to improve your overall mental health and quality of life. So lace up those sneakers and get moving – your mind will thank you for it.