Bitcoin enthusiasts are abuzz following President-elect Donald Trump’s recent criticism of the Federal Reserve’s current interest rate policy. Trump stated that interest rates are “far too high,” despite ongoing inflationary pressures. He expressed his concerns at his Mar-a-Lago club, highlighting the challenging economic situation that his incoming administration is facing.

These candid remarks, made just days before Trump’s inauguration, have sparked speculation about a potential shift in US monetary policy. Many experts believe that this could lead to a positive impact on Bitcoin and other high-risk assets in the new year.

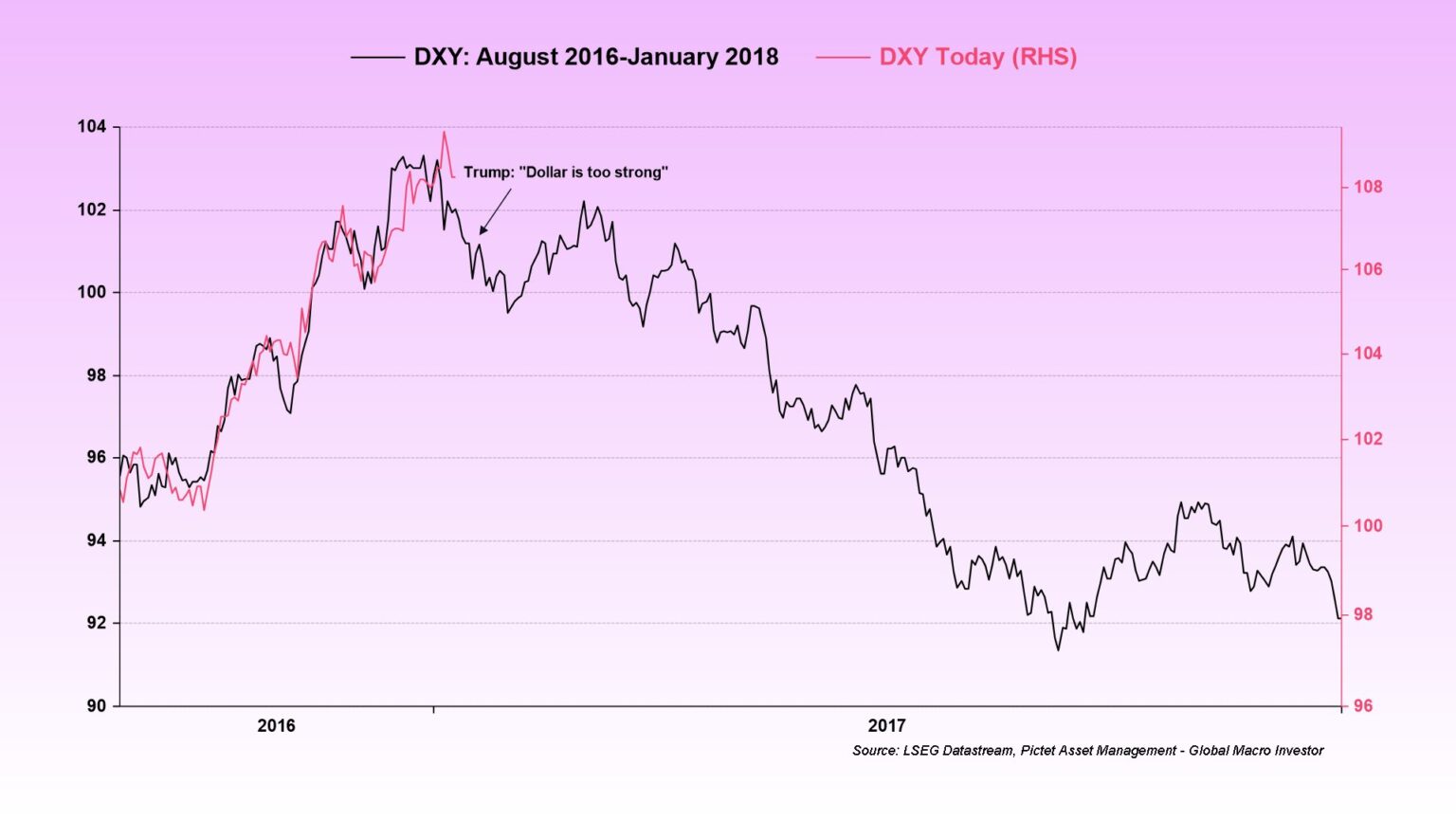

Drawing parallels to Trump’s rhetoric in 2017, where he criticized the strength of the US dollar, market analysts are predicting a similar scenario. Back then, Trump’s comments preceded a significant decline in the US Dollar Index (DXY), leading to a boost in equities and the cryptocurrency market.

Julien Bittel, Head of Macro Research at Global Macro Investor (GMI), drew a comparison between Trump’s past statements on the strong dollar and his recent remarks on high-interest rates. Bittel emphasized the negative effects of a strong dollar on US businesses and highlighted the potential benefits of a weaker dollar on exports and economic growth.

Speculation about the impact on Bitcoin and the broader crypto market is also mounting. Bittel suggested that a repeat of the 2017 dollar decline could trigger a surge in risk assets, benefiting Bitcoin in the process.

Other experts, such as Steve Donzé from Pictet Asset Management Japan, have pointed out similarities between the current DXY movements and the patterns observed in early 2017. This has led to predictions of a potential downturn in the dollar, which could create a favorable environment for risk assets like Bitcoin.

Financial analyst Silver Surfer highlighted the historical timing of the DXY’s peaks before Trump’s inaugurations in 2017 and 2025, suggesting a correlation that could impact the future trajectory of the dollar and Bitcoin.

Overall, the consensus among experts is that a weakening dollar could lead to increased liquidity and speculative interest in Bitcoin. As of now, Bitcoin is trading at $94,950, with the potential for further gains in the coming weeks.

In conclusion, the current economic landscape, coupled with Trump’s critical stance on US monetary policy, has created an atmosphere of uncertainty and anticipation in the Bitcoin market. Investors are closely monitoring developments to gauge the potential impact on Bitcoin and other risk assets in the near future.