Bitcoin (BTC) Faces Bearish Momentum After Market Crash

As March 2025 comes to a close, the financial markets have experienced a significant downturn, with Bitcoin (BTC) losing its support and facing the possibility of a massive price drop. Technical analysis experts have noted a bearish trend in BTC’s price movement, indicating a potential further decline in the near future.

Technical Analysis and Price Levels

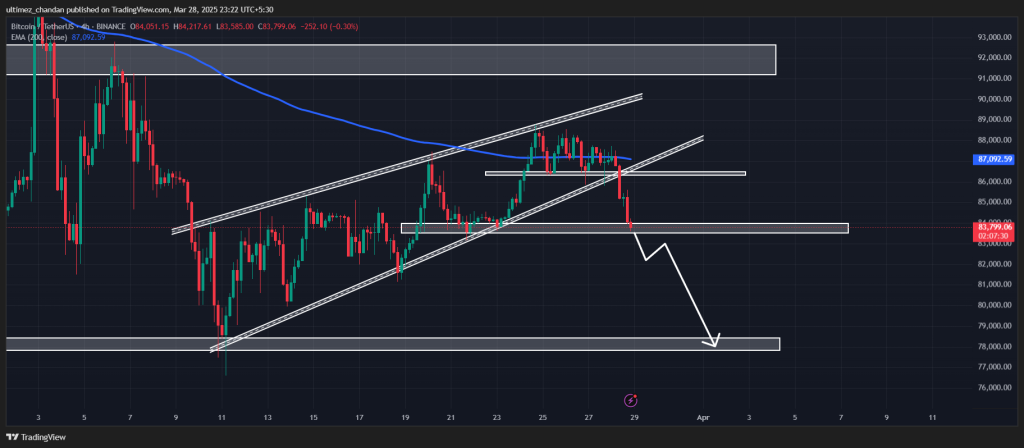

During late February and early March 2025, Bitcoin saw a surge in price, forming a bearish rising pattern on the daily charts. However, the recent breakout from this pattern has raised concerns among traders, with predictions of a 6% drop if BTC closes below the $83,500 mark and reaches $78,500. The breach of the 200 Exponential Moving Average (EMA) on the daily timeframe further supports a bearish outlook for the digital asset.

Current Price Movement

Bitcoin is currently trading around $83,850, with a 4% decrease in price over the past 24 hours. Despite the drop, trading volume has increased by 25%, indicating active participation from traders and investors in the market.

Traders’ Sentiment

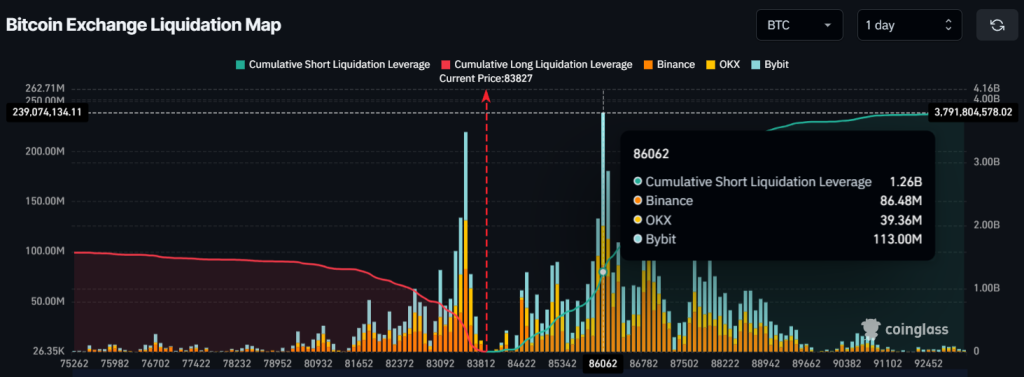

Traders are adopting a bearish outlook on Bitcoin’s price trajectory, with many taking short positions to capitalize on the downward trend. Data from on-chain analytics firm Coinglass reveals that traders have accumulated $1.26 billion in short positions at $86,000, anticipating a resistance level. Additionally, long positions worth $345 million at $83,500 are at risk of liquidation if BTC surpasses this mark, signaling a cautious stance among bullish traders.

The dominance of bearish sentiment in the market suggests a lack of confidence among bulls, as Bitcoin faces a challenging period ahead. Traders and investors will be closely monitoring price movements and key support levels to gauge the future direction of the world’s largest digital asset.