Prominent Crypto Analytics Firm Indicates Bitcoin May Be Carving Major Market Bottom

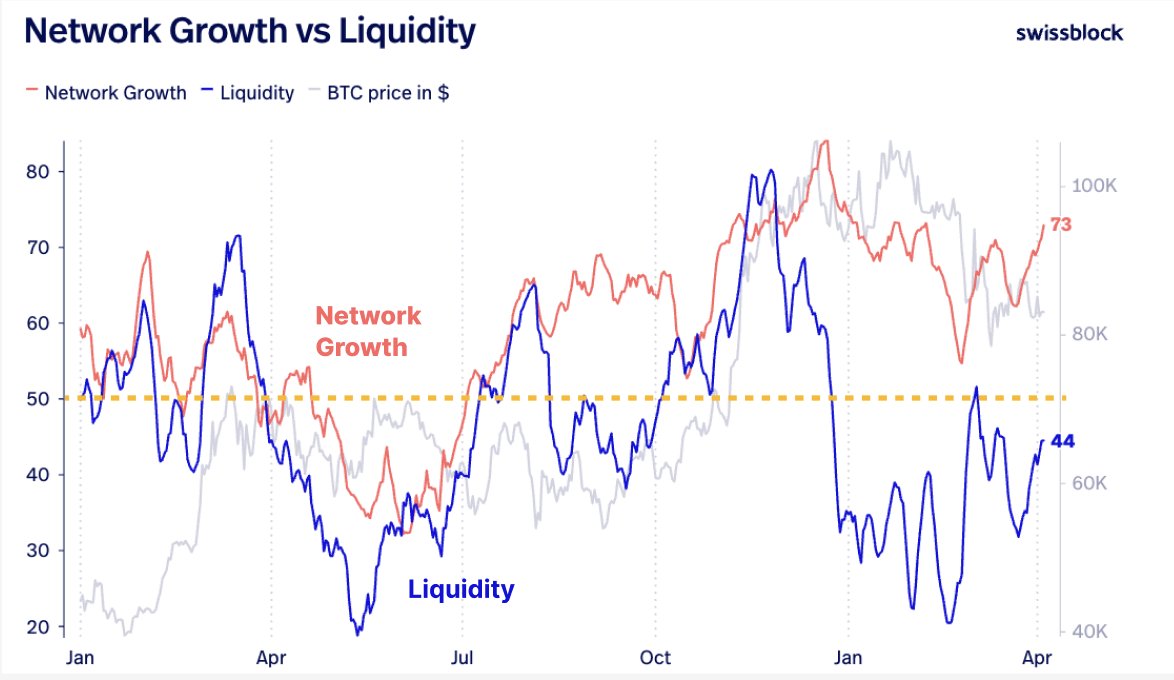

Swissblock, a well-known crypto analytics firm, has recently pointed out a key metric that suggests Bitcoin (BTC) is potentially forming a significant market bottom. The firm is closely monitoring the Bitcoin Fundamental Index (BFI), a metric that combines liquidity and network growth to gauge the health of the BTC market.

According to Swissblock, the BFI is showing signs of strengthening, indicating a consistent influx of new market participants who are bringing fresh liquidity into the Bitcoin network. The firm emphasizes that this uptrend in the BFI doesn’t signify the end of the bull market but rather signals a potential bottoming process that could lead to an explosive move in the near future.

Swissblock suggests that Bitcoin’s liquidity conditions need to surpass a certain threshold to confirm a massive bullish reversal. The firm indicates that once liquidity crosses the 50 threshold, the shift in market sentiment will be strongly bullish, leaving little room for bearish reactions.

As per Swissblock’s analysis, Bitcoin’s liquidity level is currently hovering around 44. The firm’s optimistic outlook on BTC is supported by the surging M2 money supply, which tracks the total amount of money in circulation within an economy. Swissblock notes that Bitcoin has been catching up gradually with the growth in M2 supply.

However, despite the bullish stance on Bitcoin, Swissblock acknowledges the possibility of another sell-off event in the short term. The firm suggests that while the bottoming process is nearing its final phase, there is still a chance for an explosive upward move followed by a potential breakdown, which could serve as an entry point for new participants and inject more liquidity into the system.

At the time of writing, Bitcoin is trading at $75,014, experiencing a slight decrease of over 7% for the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney