Bitcoin Price Reaches New All Time High at $112,000

Bitcoin has recently hit a new all-time high (ATH) of $112,000, marking a significant milestone in its price trajectory. This surge began on June 22, when Bitcoin was trading near $98,000, and has continued steadily upwards since then.

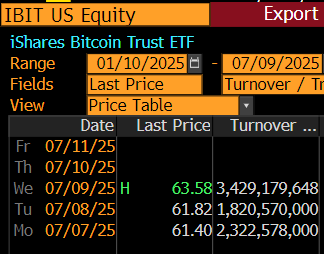

Accompanying this ATH for BTC is the BlackRock iShares Bitcoin Trust (IBIT), which also closed at a new high of $63.58. IBIT currently holds over 700,000 BTC, equating to more than 3.33% of the total Bitcoin supply. Bloomberg reports that IBIT generates higher annual fee revenue than BlackRock’s S&P 500 ETF (IVV), exceeding $187.2 million annually compared to IVV’s $187.1 million.

El Salvador, the first nation to adopt Bitcoin as legal tender, has amassed over 6,232 BTC in their treasury. With Bitcoin’s latest ATH, El Salvador’s Bitcoin reserves have seen unrealized gains of $400 million after years of consistent accumulation. President Nayib Bukele has announced plans for the country to purchase 1 BTC per day until Bitcoin becomes unaffordable with fiat currencies.

Corporate demand for Bitcoin is also on the rise, with companies like The Smarter Web Company increasing their BTC holdings to 1,000 BTC. Tech firms in the US have been following suit, with several Nasdaq-listed companies converting portions of their cash reserves into Bitcoin.

“I am looking forward to working with our advisors on evaluating the effectiveness and perhaps we can then inspire other UK companies to adapt a similar mechanism, as we have seen with our pioneering approach to treasury management using Bitcoin,” stated Andrew Webley, CEO of The Smarter Web Company.

Michael Saylor, Strategy Executive Chairman, recently expressed optimism about Bitcoin’s future, stating in a Bloomberg interview that the worst is behind us. He believes that if Bitcoin is not heading to zero, it will reach $1 million. With support from key figures in the US government and business sector, Bitcoin has navigated through its riskiest period and continues to show strong potential.