Bitcoin Hits New All-Time High of $113,900 as Adoption Accelerates

Today, Bitcoin officially reached a new all-time high (ATH) of $113,900, marking a significant milestone in its recent bullish run that started in late June. Just 18 days ago, BTC was trading around $98,000, showcasing the rapid pace at which the digital asset has been climbing. This latest ATH underscores the global trend toward recognizing Bitcoin as both a store of value and a strategic asset.

Short Squeeze Potential

Recent data from Coinglass reveals that $50 million worth of Bitcoin shorts were liquidated in the past hours, with over $1.5 billion worth of Bitcoin short positions set to be liquidated at $120,000. If Bitcoin continues on its upward trajectory, there is a possibility of a massive short squeeze being triggered. This scenario could force bearish traders to buy back in at higher prices, further propelling the price of Bitcoin.

Predictions and Market Sentiment

According to Polymarket, the likelihood of Bitcoin hitting $115,000 by the end of July stands at 80%, with a 44% chance of reaching $120,000. Additionally, Federal Reserve Board Member Christopher Waller’s consideration of cutting interest rates this month has the potential to fuel Bitcoin’s price even higher, as indicated in an interview with Bloomberg.

Political Influence

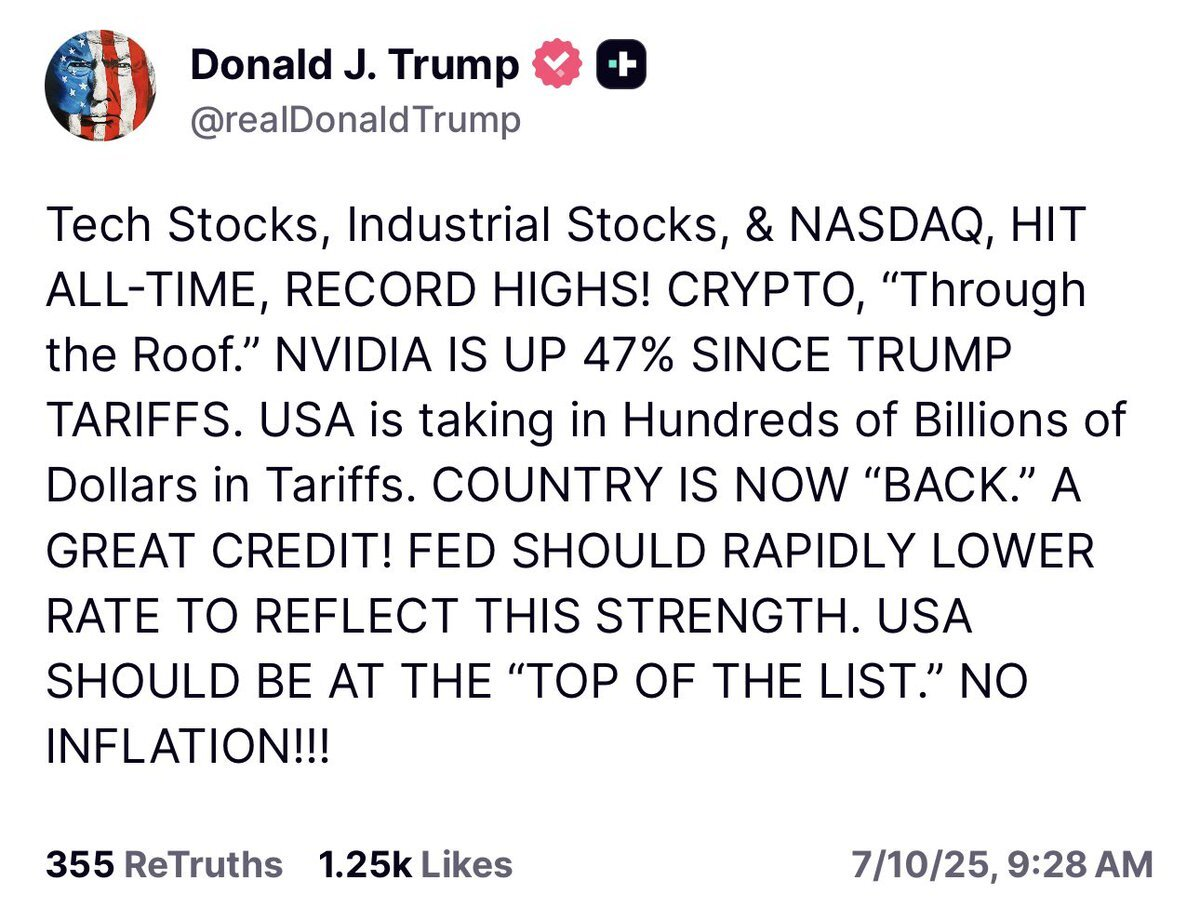

President Donald Trump, a vocal advocate for lower interest rates, recently commented on the rising price of Bitcoin on his Truth Social account. He emphasized the need for the Federal Reserve to rapidly lower rates in response to the strength of both cryptocurrencies and stocks, further highlighting the intersection of politics and financial markets.

El Salvador’s Bitcoin Reserves

Since November 16, 2022, El Salvador has been steadily acquiring Bitcoin for its treasury reserves. With over 6,233 BTC now in their possession, the country’s Bitcoin reserves have surpassed $700 million in value following today’s price surge. This strategic move further solidifies El Salvador’s commitment to embracing Bitcoin as a key asset in its financial portfolio.