Breaking Down the Barriers to BTCFi Adoption for Mainstream Bitcoin Holders

Despite the increasing investments and evident demand for yield, a large majority of Bitcoin holders have yet to explore BTCFi platforms. The complexity and lack of familiarity with these platforms have deterred everyday users from venturing into the BTCFi space, potentially hindering its path to mainstream adoption.

Summary

- Despite the growing investment and demand for yield, a significant number of Bitcoin holders have not yet engaged with BTCFi platforms.

- The complexity of existing platforms tailored to crypto insiders has left mainstream Bitcoin users feeling confused, cautious, or unaware of the opportunities in the BTCFi space.

- Without simplification and improved communication strategies, BTCFi may struggle to expand beyond its niche audience and achieve broader adoption among Bitcoin holders, as highlighted by insights from GoMining.

While reports of rising venture funding and enthusiasm surrounding Bitcoin DeFi suggest a flourishing landscape, the reality for Bitcoin users paints a different picture. A recent survey conducted by GoMining, shared exclusively with crypto.news, revealed that nearly 80% of Bitcoin holders have yet to dip their toes into BTCFi, underscoring a significant disparity between industry aspirations and actual user adoption.

Similar to the DeFi ecosystem on Ethereum, BTCFi was envisioned to provide a range of financial tools and platforms enabling users to leverage their BTC beyond mere acquisition and holding. These opportunities include lending, accessing synthetic Bitcoin assets, and utilizing cross-chain bridges for network interoperability.

The influx of institutional investments is also notable. Data from Maestro indicates a substantial uptick in BTCFi venture funding, amounting to $175 million across 32 funding rounds in the first half of 2025. Notably, a majority of these deals were centered around DeFi, custody solutions, and consumer applications within the BTCFi sphere.

Exclusive Realm of Crypto Natives

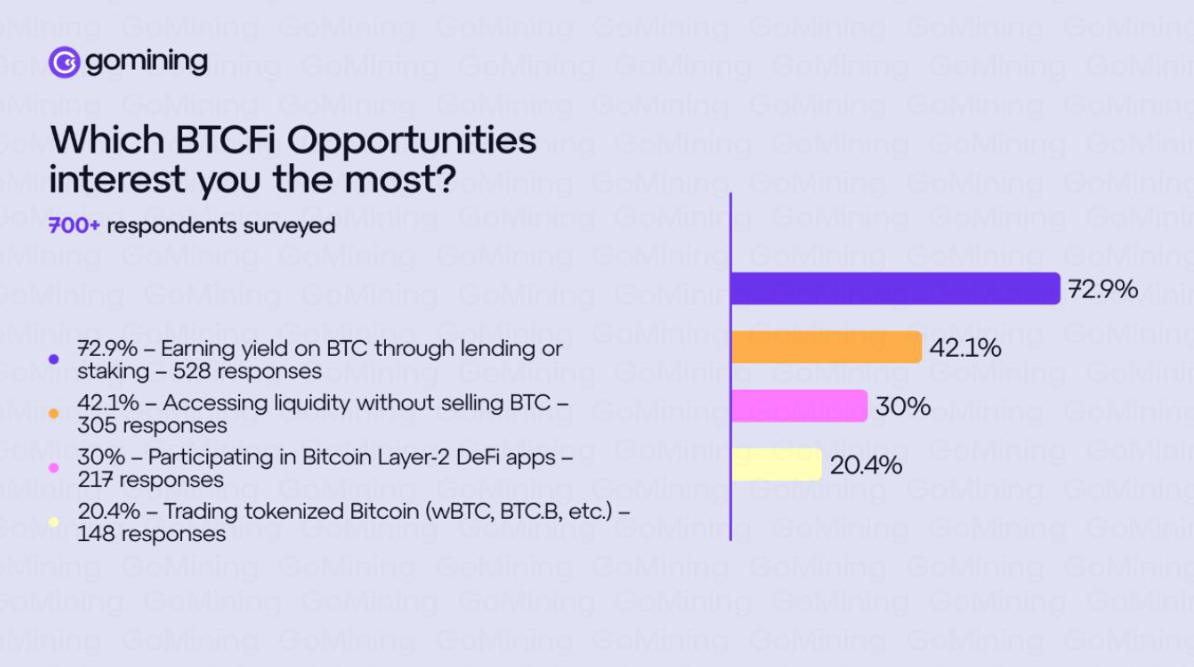

Despite the evident demand — with 73% of Bitcoin holders expressing interest in yield generation and 42% seeking liquidity channels without selling — the adoption of BTCFi remains sluggish. GoMining’s survey of over 700 individuals across North America and Europe unveiled that 77% of Bitcoin holders have yet to venture into BTCFi territory. This discrepancy is attributed to the existing platforms catering primarily to crypto insiders, leaving mainstream Bitcoin users perplexed, cautious, or oblivious to the available opportunities.

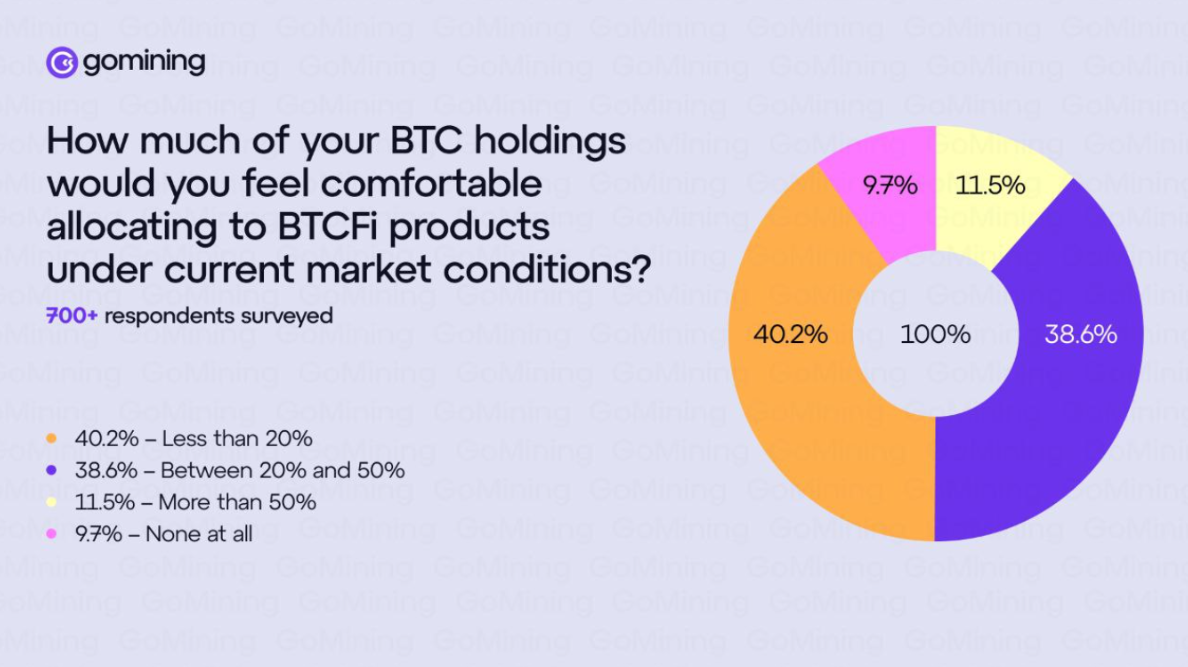

The impediments to adoption are rooted in trust issues and complexity, with over 40% of respondents indicating a reluctance to allocate more than 20% of their Bitcoin holdings to BTCFi products. This hesitance is correlated with uncertainties regarding platform security and apprehensions surrounding the intricate nature of the offerings.

Mark Zalan, CEO of GoMining, emphasized the mismatch between industry offerings and user preferences, stating that while there is a considerable appetite for such opportunities, the current products are tailored for crypto natives rather than everyday Bitcoin holders.

Navigating the Awareness Gap

A glaring obstacle for BTCFi is the lack of awareness among Bitcoin holders. A startling 65% of survey participants were unable to name a single BTCFi project, underscoring a critical communication deficiency within the industry.

“This isn’t a failure of Bitcoin holders to keep up. The BTCFi industry must communicate more effectively with its target market. When two-thirds of potential users can’t name a single project in your space, you’re facing an adoption challenge that education can solve.” – Mark Zalan

GoMining’s findings suggest that the current dialogue surrounding BTCFi primarily resonates with insiders rather than the broader base of Bitcoin owners.

Diverging Paths from DeFi

The divergence from Ethereum’s DeFi model may also contribute to the disconnect between BTCFi and mainstream Bitcoin users. Unlike Ethereum enthusiasts, Bitcoin holders exhibit a preference for custodial wallets and regulated exchange-traded funds over self-custody solutions and complex protocols.

Zalan highlighted this distinction, noting that platforms like Coinbase and Bitcoin ETFs have thrived due to their emphasis on accessibility. To appeal to the broader Bitcoin audience, BTCFi platforms must prioritize simplicity, security, and user-friendliness.

The survey delineates a landscape ripe with potential yet obstructed by trust barriers, complexity challenges, and low brand recognition. Addressing these hurdles presents both challenges and opportunities for BTCFi platforms. By enhancing communication strategies and streamlining user onboarding processes, these platforms can aspire to capture the interest of mainstream Bitcoin holders. Failure to do so risks relegating BTCFi to a niche enclave for crypto insiders, thwarting its ambition to cater to the vast community of Bitcoin enthusiasts.