CryptoQuant’s CEO: Bitcoin Now a Deflationary Asset Due to Michael Saylor’s Strategy Accumulation

CryptoQuant’s CEO, Ki Young Ju, recently made a significant observation regarding Bitcoin, stating that the cryptocurrency is now effectively a deflationary asset. This assertion comes as a result of the rapid accumulation of BTC by Michael Saylor’s Strategy (MSTR), which is outpacing the rate at which new coins are being mined.

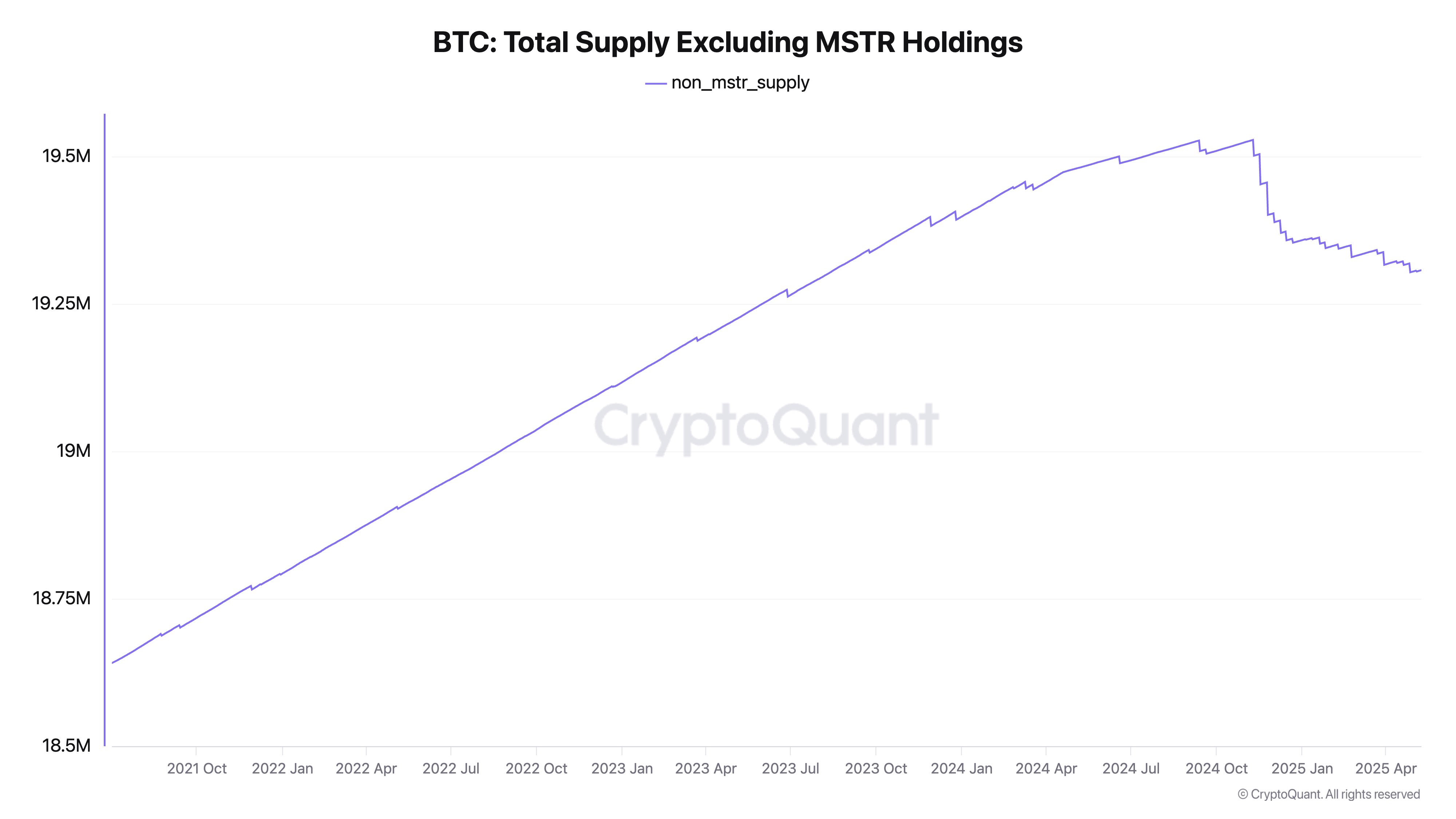

Bitcoin Supply Dynamics

According to data from CryptoQuant, excluding the coins held by MSTR, the overall supply of Bitcoin has been on a downward trend since late last year. This trend indicates a deflationary pressure on the asset.

As per BitcoinTreasuries.net, Strategy currently holds 555,450 BTC valued at approximately $58 billion, representing a significant portion of Bitcoin’s total supply.

Market Complexity and Forecasting Challenges

Ju also acknowledged the evolving market structure of Bitcoin, with various large players involved, making it more challenging to predict market movements. He recently retracted his earlier prediction that the Bitcoin bull market had ended, citing the increased complexity of the market.

He noted that selling pressure on Bitcoin has eased due to substantial inflows from spot exchange-traded funds (ETFs), which has altered the dynamics of the market.

Diverse Market Participants

Ju highlighted the diverse range of participants in the current Bitcoin market, including ETFs, institutional investors, and even government agencies. This diversity has transformed the market dynamics, reducing the predictability of price movements.

At the time of writing, Bitcoin is trading at $114,112.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney