Bitcoin Metrics Signal Potential for Fresh All-Time Highs

Market intelligence firm Swissblock has provided new insights suggesting that Bitcoin (BTC) may soon reach new all-time highs, based on key metrics indicating further upside potential.

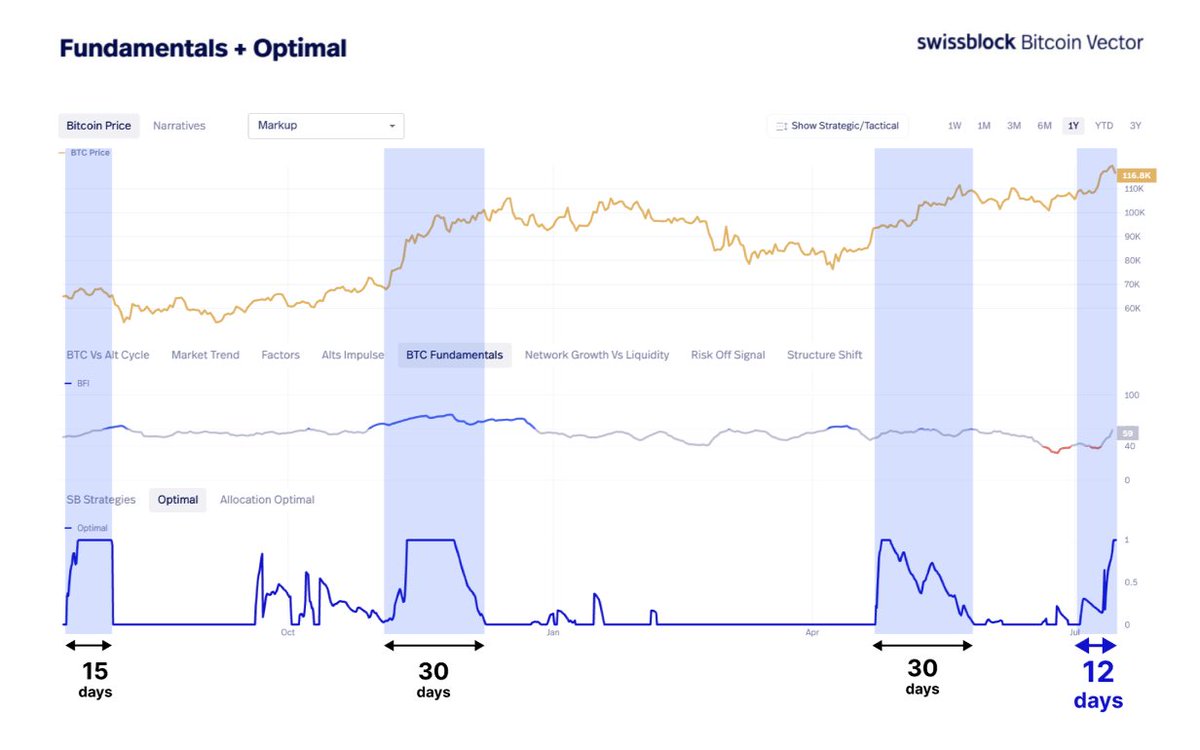

Optimal Signal Metric

Swissblock’s “Optimal Signal” metric, which analyzes the duration of previous significant Bitcoin price movements, indicates that the flagship cryptocurrency could continue its upward trend for at least another 10 days. According to Swissblock, historical data shows that major BTC expansions have typically lasted between 15 to 30 days, with the current cycle only at day 12.

Source: Swissblock/X

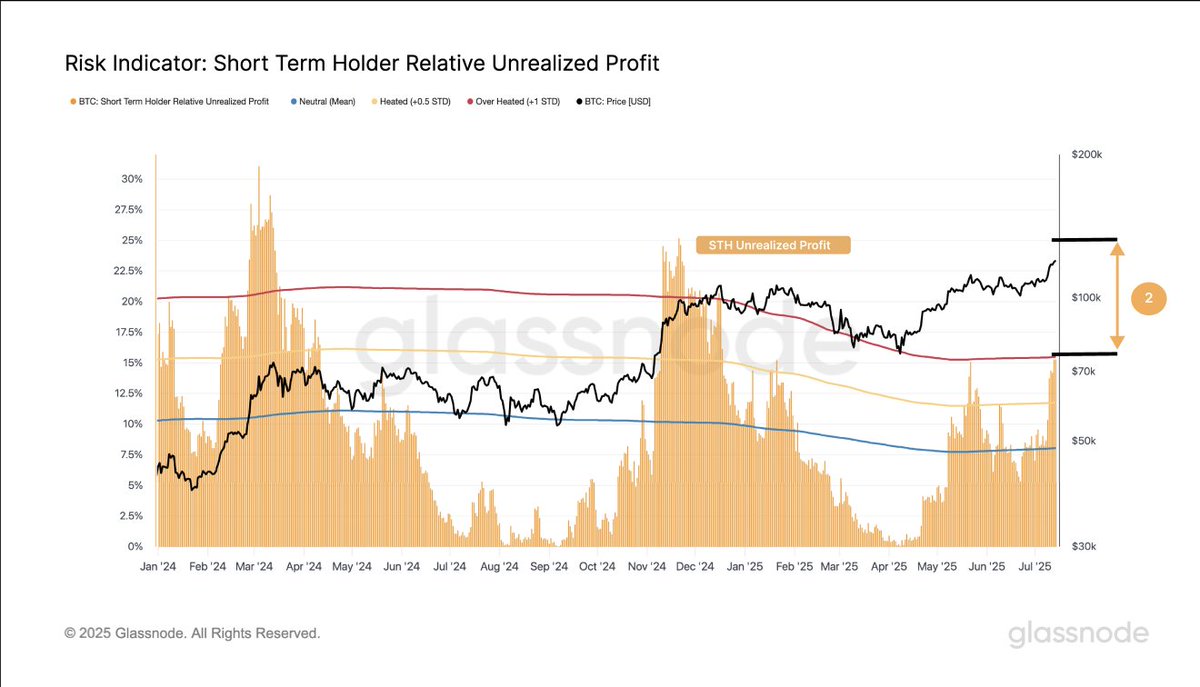

Short Term Holder Relative Unrealized Profit Metric

Swissblock also analyzed Glassnode’s Short Term Holder (STH) Relative Unrealized Profit metric, which measures the total profit of coins whose price at realization was lower than the current price, normalized by market cap. The data suggests that market participants are not displaying signs of excessive profit-taking or euphoria, as seen during previous cycle tops.

Source: Swissblock/X

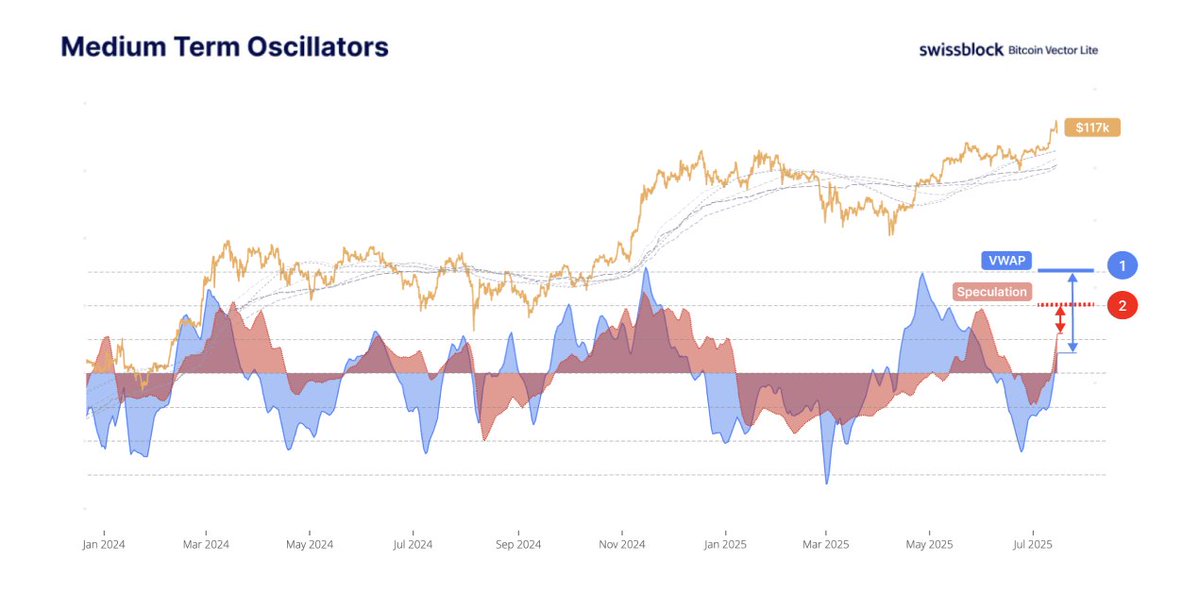

Volume-Weighted Average Price (VWAP) Indicator

Furthermore, Swissblock highlighted on-chain analyst Willy Woo’s volume-weighted average price (VWAP) indicator and Speculation Index, which indicate that Bitcoin has not yet reached its peak in the current cycle. Both indicators suggest ongoing support for higher prices, with no signs of market overheating.

Source: Swissblock/X

Current Price and Outlook

At the time of writing, Bitcoin is trading at $119,042. With key metrics indicating potential for further upside, market participants are closely watching for a potential surge to new all-time highs.

Stay Updated

For the latest updates on Bitcoin and cryptocurrency market trends, follow us on X, Facebook, and Telegram. Subscribe to receive email alerts directly to your inbox to stay informed about price action and market movements.

Generated Image: DALLE3