Bitcoin Standard Treasury Company, a leading Bitcoin-focused treasury vehicle, has recently announced a merger with Cantor Equity Partners I (CEPO) in a strategic SPAC transaction. This move will facilitate the company’s transition to becoming a publicly traded entity on Nasdaq, with the newly assigned ticker symbol BSTR once the merger is finalized.

The formal agreement was signed on July 16, with the official announcement being made public today. BSTR is set to launch with a substantial holding of 30,021 Bitcoin (BTC) along with a potential $1.5 billion in fiat PIPE financing. Additionally, CEPO trust will contribute up to approximately $200 million, subject to any redemptions.

The financing structure includes $400 million of common equity committed at a price of $10 per share, up to $750 million of convertible senior notes convertible at $13, and up to $350 million of convertible preferred stock also convertible at a common-stock equivalent of $13. In-kind PIPE funding of 5,021 BTC has also been secured, with long-time Bitcoin participants providing support at a $10 per share reference price.

Furthermore, founding shareholders under the guidance of Blockstream Capital Partners will contribute 25,000 BTC at the same $10 reference, solidifying BSTR’s position with the fourth-largest publicly reported corporate Bitcoin treasury as of July 17.

Notably, the announcement confirms recent speculations regarding Cantor Fitzgerald’s discussions to acquire approximately $3 billion in Bitcoin from Blockstream, further solidifying the company’s commitment to the digital asset space.

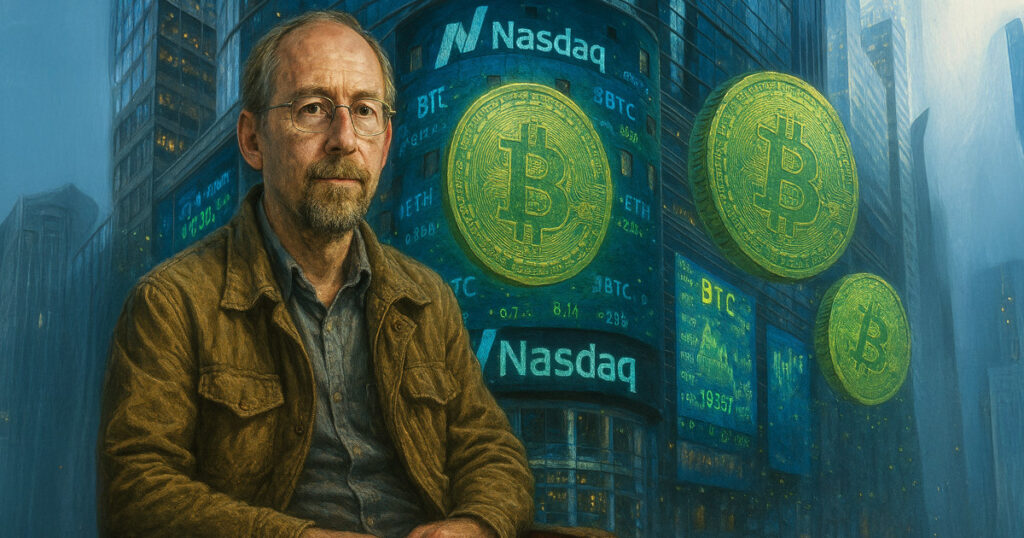

In terms of leadership, Adam Back has been appointed as the CEO of BSTR, with Sean Bill taking on the role of chief investment officer. Back is renowned for inventing Hashcash, the proof-of-work system referenced in the Bitcoin white paper, and co-founding Blockstream. Bill, on the other hand, has been instrumental in advancing Bitcoin allocations within US public pension plans and has a keen focus on integrating digital assets into institutional portfolios.

BSTR’s core focus revolves around accumulating Bitcoin, generating in-kind Bitcoin yield, and providing strategic advisory services to corporates and sovereigns on Bitcoin-denominated treasury strategies, measured in BTC per share. Back emphasized the company’s commitment to maximizing Bitcoin ownership per share and accelerating real-world Bitcoin adoption through innovative financial strategies.

Brandon Lutnick, chairman of Cantor Equity Partners I, hailed the merger as a significant milestone towards bridging the gap between the Bitcoin economy and traditional finance. The merger has been approved by the boards of both BSTR and CEPO, with the closing subject to approval from CEPO shareholders and the fulfillment of standard conditions.

CEPO will be filing additional documentation, including the Business Combination Agreement, PIPE details, and an investor presentation, in current reports on Form 8-K and a forthcoming Form S-4 registration statement containing prospectus materials.

Overall, the merger between Bitcoin Standard Treasury Company and Cantor Equity Partners I marks a pivotal moment in the evolution of the digital asset space, underscoring the growing integration of Bitcoin within mainstream financial markets.