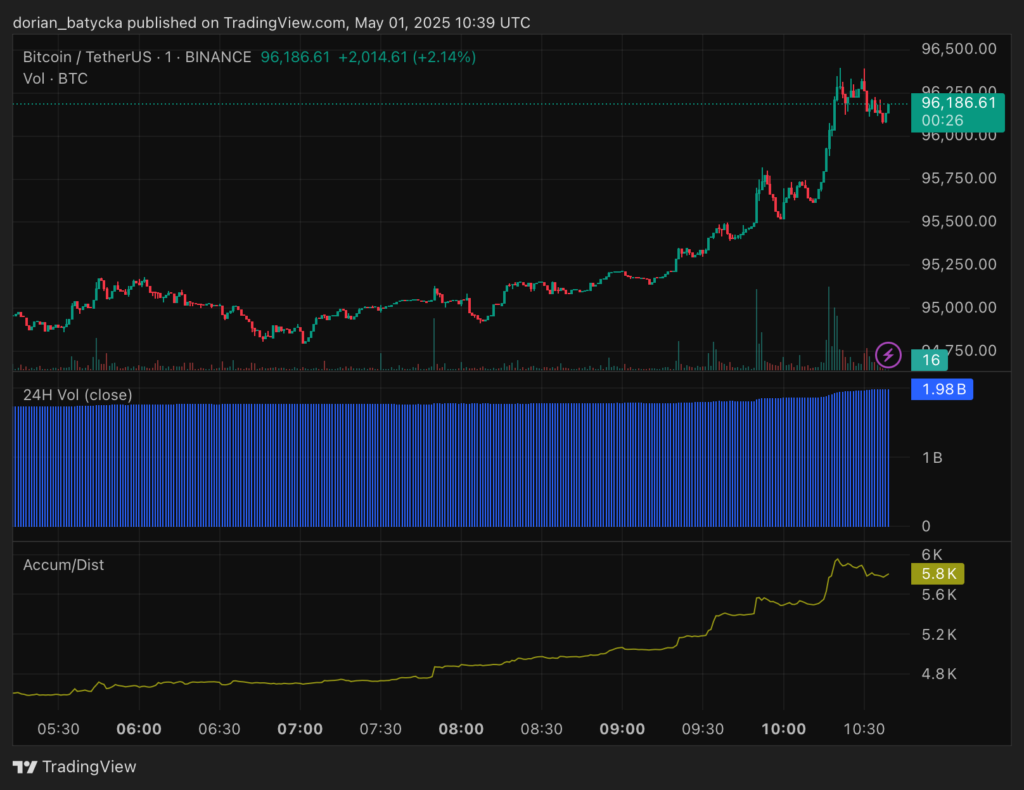

Bitcoin Price Surges Past $96,000 Mark

Bitcoin has reclaimed $96,000, a level not seen since late November 2024, driven by robust institutional demand and easing macroeconomic fears.

The leading cryptocurrency, Bitcoin (BTC), has seen a significant rally of nearly 20% from its April low of $79,000. This surge has been fueled by $381 million in ETF inflows and renewed optimism following U.S. President Donald Trump’s softened stance on China trade tensions.

Analysts Warn of Resistance Levels

Despite the impressive rally, analysts caution about potential resistance at the $94,000-$95,000 range due to heavy selling pressure in spot markets. Bitcoin is still 16% below its January peak of $109,000, and volatility remains a concern, especially with ongoing correlations to the stock market. Investors are closely monitoring whether Bitcoin can maintain its momentum amidst global economic uncertainties.

Institutional Interest and New Players

Renewed institutional interest, particularly from major players like Strategy, has been a driving force behind Bitcoin’s recent surge. Strategy has been steadily acquiring Bitcoin over the past few months. In addition, Twenty One Capital has emerged as a new player in the space, announcing plans to acquire billions of dollars worth of Bitcoin to compete with Strategy.