The cryptocurrency market, particularly Bitcoin, has seen a slight pullback in its price as it struggles to reach the coveted $100,000 mark. Despite this, investors remain optimistic and undeterred by the recent price fluctuations.

Increasing Bitcoin Taker Buy/Sell Ratio and Its Impact

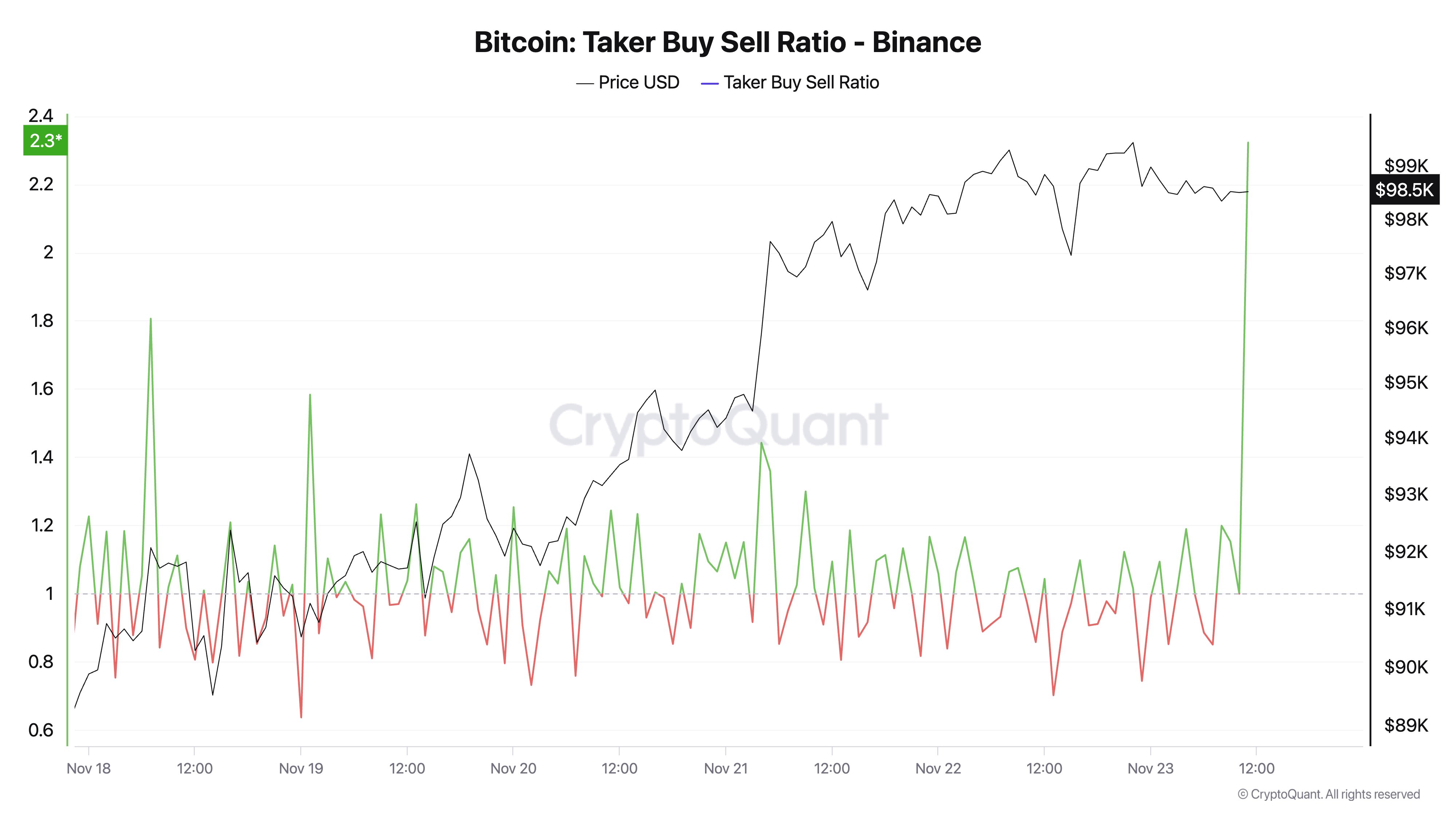

A recent analysis by renowned crypto analyst Ali Martinez on the X platform revealed a surge in traders’ interest in acquiring Bitcoin. This observation was based on the taker buy/sell ratio, a metric that monitors the buying and selling volumes of a specific cryptocurrency.

When the taker buy/sell ratio exceeds 1, it signifies a bullish sentiment, indicating higher buying pressure compared to selling pressure. Conversely, a ratio below 1 suggests bearish sentiment in the market, with more sellers than buyers.

Martinez’s analysis showed a significant increase in the Bitcoin taker buy/sell ratio across major exchanges like Binance, OKX, HTX, and Bybit. The ratio spiked to over 28 on Binance, signaling a strong buying trend in the market.

With the taker buy/sell ratio surpassing 1, the market is witnessing a surge in buying activity, potentially propelling Bitcoin towards the $100,000 milestone.

While Bitcoin’s current price hovers around $97,800 with a slight decline in the last 24 hours, its weekly performance remains strong, showing an 8% increase according to CoinGecko.

Whales’ Involvement in Bitcoin Market

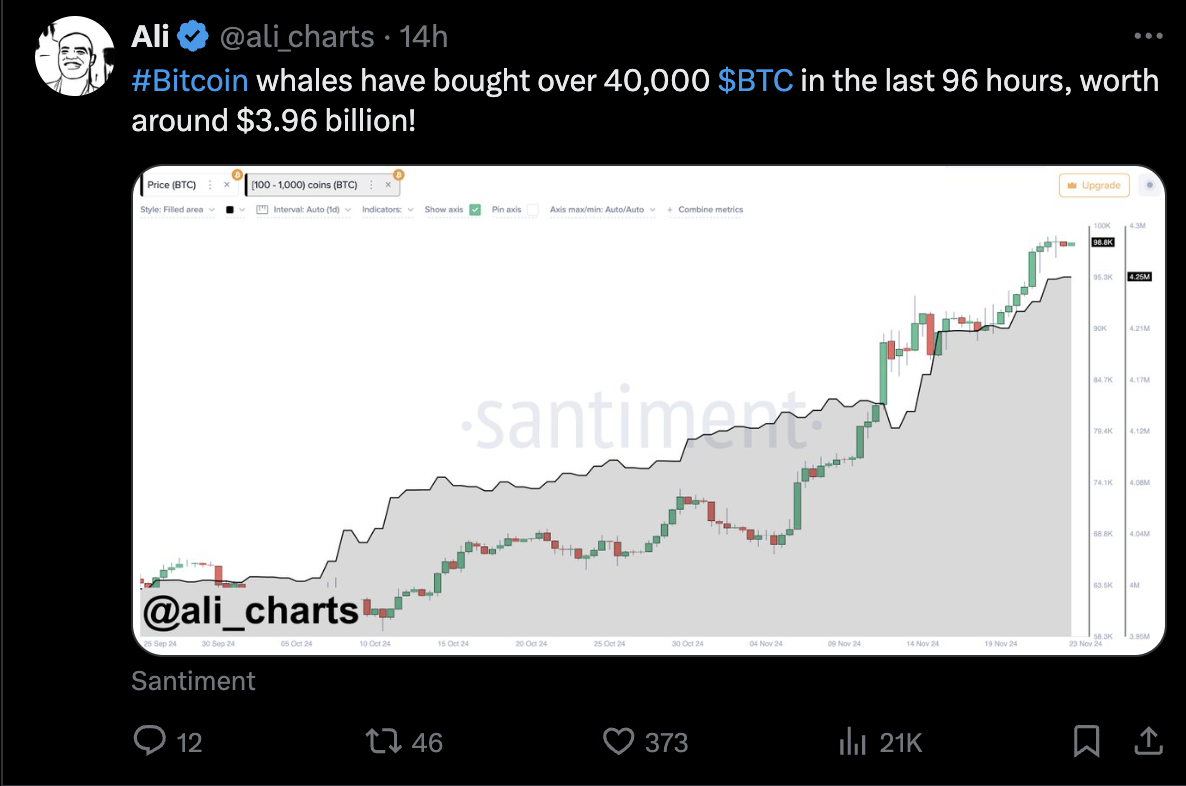

Another analysis by Martinez highlighted the active participation of large investors, known as whales, in the Bitcoin market. This particular group, holding between 100 and 1,000 coins, has been actively accumulating Bitcoin in recent days.

Data from Santiment revealed that whales have purchased over 40,000 BTC (approximately $3.96 billion) in the past four days. This significant buying activity by whales could have a bullish impact on Bitcoin’s price.

Featured image from iStock, chart from TradingView