Bitcoin Price Volatility Continues as Market Awaits Next Move

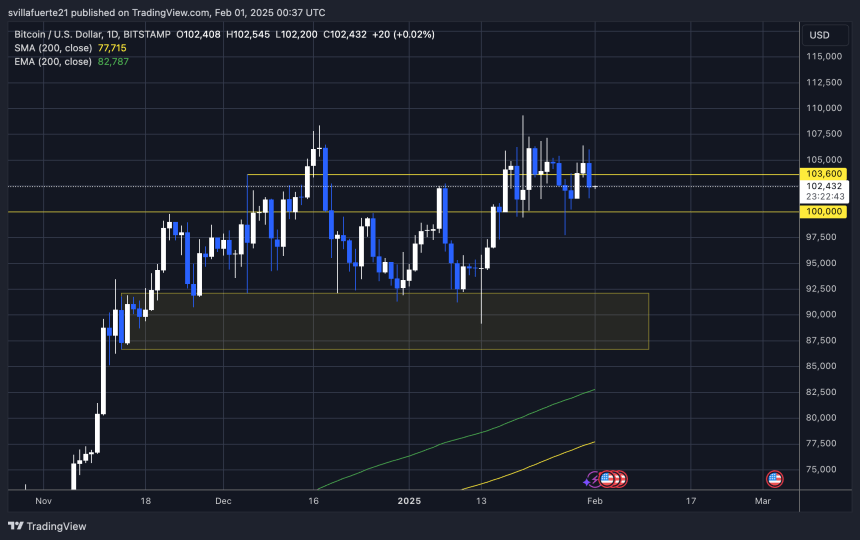

Bitcoin has been experiencing significant price swings in the past few days, with the market remaining on edge about its next move. After dropping to $97K on Monday, BTC surged to $106K before retracing back to around $102K where it currently consolidates. This volatility has kept investors guessing about the direction of the market.

Key Insights on Bitcoin Trading Trends

Recent data from Coinglass, shared by analyst Daan, indicates that Bitcoin has been trading at a discount on Coinbase compared to other spot exchanges over the past month. This suggests that selling pressure is coming primarily from US investors, leading to a flat Coinbase premium index. Typically, a Coinbase premium signals strong institutional demand, but the current market sentiment appears cautious.

Bitcoin’s Critical Levels and Market Sentiment

As Bitcoin hovers below its all-time highs, traders are closely monitoring key levels to gauge the market sentiment. Reclaiming $106K could signal a potential retest of the ATH, while dropping below $100K may lead to extended consolidation or a deeper correction. The next few days will be crucial in determining Bitcoin’s next trajectory.

Market Outlook and Potential Breakout Scenarios

Bitcoin’s current consolidation phase between $106K and $100K levels will likely determine its next trend. A breakout above $106K could pave the way for a retest of the ATH and a potential rally towards $110K. Conversely, a breakdown below $100K could lead to further consolidation or a downward correction, delaying any bullish momentum.

With market uncertainty prevailing, traders are eagerly awaiting a decisive price move to set the tone for Bitcoin’s short-term direction. The upcoming days will be critical in determining whether BTC can maintain its current levels or experience a shift in market sentiment.

Featured image from Dall-E, chart from TradingView