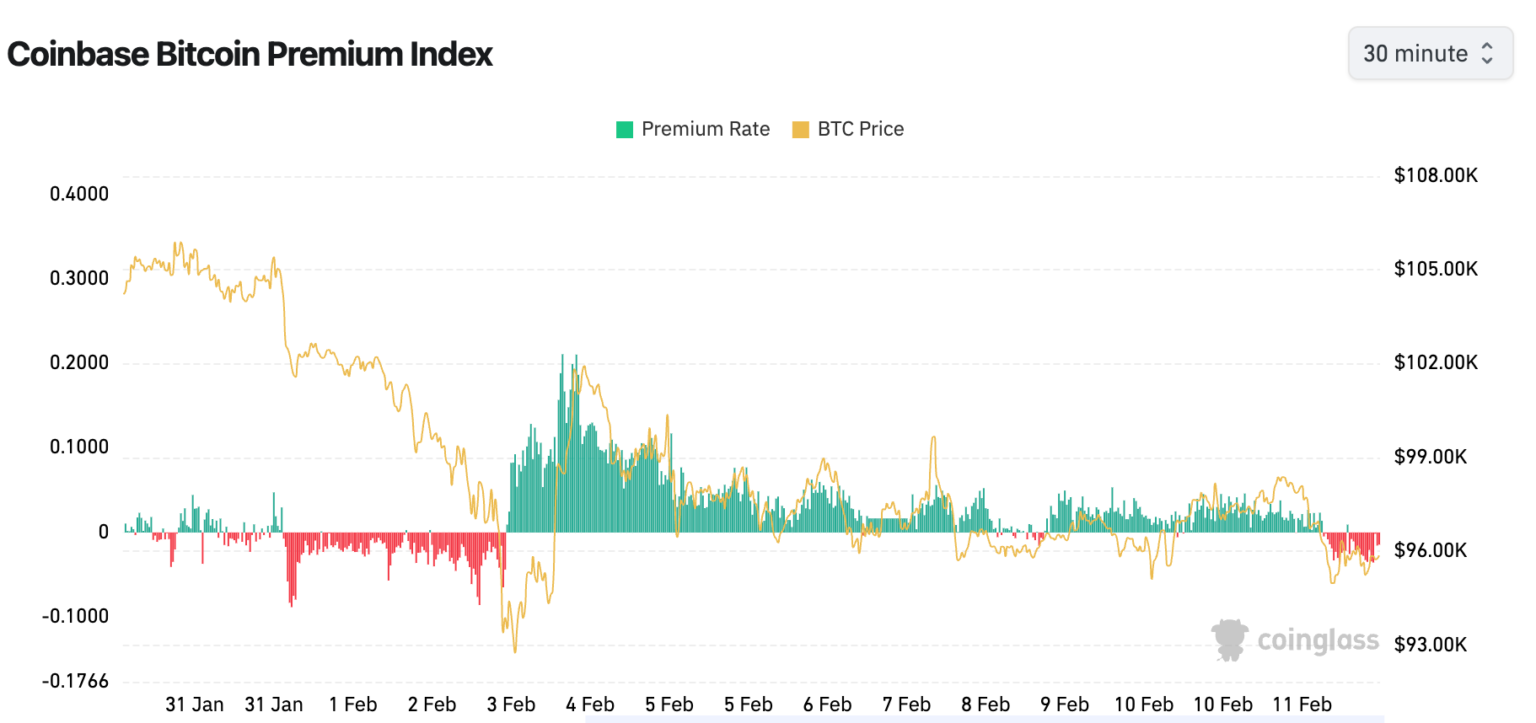

Bitcoin’s Coinbase premium indicator has recently flipped negative for the first time since the Feb. 3 crash, signaling caution among traders on the Nasdaq-listed exchange. The indicator measures the spread between Bitcoin’s dollar-denominated price on Coinbase and its tether-denominated price on Binance. This shift in sentiment comes ahead of Wednesday’s U.S. CPI release, with offshore traders leading the price recovery from overnight lows near $94,900 to $96,000.

Traditionally, bull runs have seen prices trading at a premium on Coinbase, indicating strong leadership from U.S. investors. The premium reached two-month highs in early November as Bitcoin surged to over $70,000. However, the current negative premium suggests a more cautious approach from traders on the exchange.

This change in the premium indicator reflects the uncertainty in the market as investors await key economic data. The U.S. CPI release is expected to provide insights into inflation levels, which could impact the broader financial markets. As a result, traders are adjusting their positions and strategies in response to potential market-moving events.

While the negative premium on Coinbase may indicate a shift in sentiment among U.S. investors, offshore traders have stepped in to support the price of Bitcoin. This dynamic demonstrates the global nature of the cryptocurrency market, with traders from different regions playing a role in price discovery and market trends.

Overall, the fluctuation in the Coinbase premium indicator highlights the complexity of the cryptocurrency market and the various factors that can influence price movements. As investors navigate changing market conditions and economic data releases, staying informed and adapting to new developments will be crucial for success in the dynamic world of Bitcoin trading.

This rewritten article provides a detailed analysis of the recent shift in the Coinbase premium indicator for Bitcoin and its implications for traders. It seamlessly integrates into a WordPress platform, offering valuable insights for readers interested in cryptocurrency market trends.