BlackRock’s iShares Bitcoin Trust ETF Hits $70 Billion Milestone at Record Speed

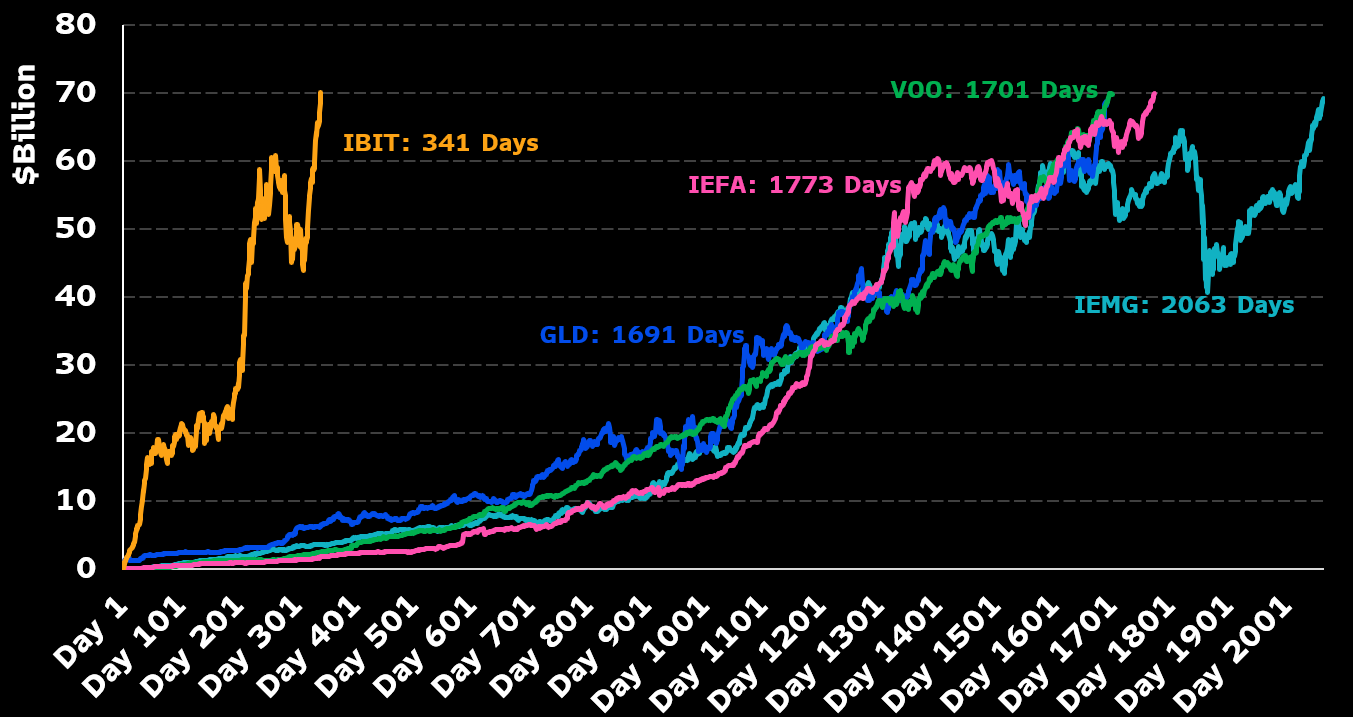

BlackRock’s iShares Bitcoin Trust exchange-traded fund has achieved a significant milestone, surpassing the $70 billion mark in just 341 days. This remarkable feat has set a new record in the world of ETFs, outpacing the previous record holder, the gold-based GLD product, by a staggering five times.

Renowned Bloomberg ETF specialist Eric Balchunas shared the news on X, highlighting the rapid ascent of IBIT in the market. He noted that the ETF’s value has skyrocketed from $30k to $110k since BlackRock filed for IBIT, making it a highly attractive investment option for big investors.

According to data from blockchain analytics platform Arkham, BlackRock currently holds a staggering $76.19 billion worth of digital assets in its crypto wallets, solidifying its position as a major player in the digital asset space.

BlackRock CEO Larry Fink’s Insights on Digital Assets and US Dollar Supremacy

In his annual letter to investors, BlackRock CEO Larry Fink addressed the evolving landscape of global finance, highlighting the challenges posed by the rising national debt and the emergence of digital assets and decentralized finance (DeFi).

Fink emphasized the changing dynamics of the US dollar’s status as the world’s reserve currency, pointing out the unsustainable growth of the national debt relative to GDP. He expressed concerns about the potential implications of uncontrolled debt expansion on the US economy and its global standing.

While acknowledging the transformative potential of decentralized finance and digital assets like Bitcoin, Fink cautioned that excessive debt accumulation could jeopardize America’s economic dominance. He warned that if deficits continue to balloon, investors may start viewing Bitcoin as a safer alternative to the dollar, posing a significant threat to the country’s financial stability.

Stay Updated with The Daily Hodl

For more insights and updates on the latest developments in the world of digital assets, follow The Daily Hodl on X, Facebook, and Telegram. Don’t miss out on important news – subscribe to receive email alerts directly to your inbox. Keep track of price action and explore a mix of content on The Daily Hodl platform.

Generated Image: Midjourney