Bloomberg Analyst Warns of Potential Market Correction Amid US Tariff War

Bloomberg commodity strategist Mike McGlone has issued a stark warning about a possible massive correction looming in the US markets. This correction, according to McGlone, could have a significant impact on the prices of assets such as Bitcoin (BTC), oil, and stocks.

The Warning Signs

McGlone points to the escalating tariff war initiated by President Trump as a potential trigger for market chaos. He highlights the US’s “self-correcting mechanism” that could push back against these policies, leading to a correction in various asset classes.

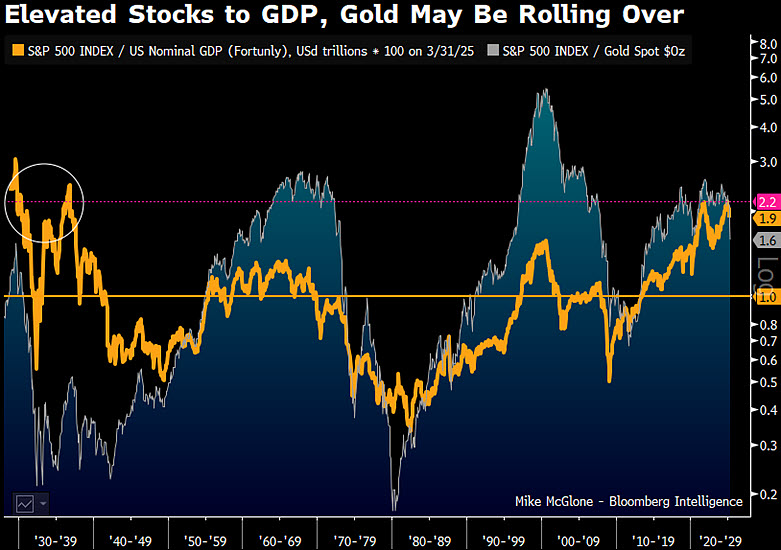

McGlone’s analysis includes a chart showing elevated levels in the S&P 500 vs. GDP ratio and the S&P 500 vs. gold ratio. Historically, such high levels have preceded major stock market crashes, reminiscent of the events in the 1930s, late 1990s, and 2008.

Predicted Drawdowns

The potential correction, or “reversion,” as described by McGlone, could result in significant drops across multiple assets. The analyst forecasts:

- 50% drawdown in the US stock market

- $40 a barrel crude oil

- $3 per pound copper

- 3% US 10-year yield

- $10,000 Bitcoin with 90% drawdowns in most cryptocurrencies

- $4,000 gold, an outlier due to its unique characteristics

Despite the severity of these predicted drawdowns, McGlone emphasizes that these potential downside moves are within normal historical parameters.

Current Market Status

As of the latest update, Bitcoin is trading at $87,529. The market continues to be on edge as investors monitor potential developments that could trigger the forecasted corrections.

Stay Informed

For the latest updates and insights, follow us on X, Facebook, and Telegram. Don’t miss out on important market movements by subscribing to our email alerts. Stay informed and navigate the market with confidence.

Generated Image: Midjourney