Brazilian Lawmaker Eros Biondini is making waves in the crypto community with his latest draft bill that aims to abolish crypto tax for citizens who hold Bitcoin (BTC) as a long-term store of value. The bill, which has been filed in the Chamber of Deputies, calls for the removal of clauses in the tax code that specifically mention the taxation of cryptoassets.

In addition to scrapping existing tax laws related to cryptoassets, the bill also seeks to repeal a 2023 law that outlines how income tax should be collected on profits derived from cryptoassets. This move has sparked a debate within the Chamber of Deputies, with a committee set to assess the bill before deciding whether to pass it on to the lower house.

Biondini has been vocal about his opposition to new taxes on financial transactions, including foreign exchange and insurance transfers. He argues that imposing additional tax burdens on the population during a time of economic fragility could have detrimental effects. The lawmaker pointed out that Brazil’s tax burden reached 32.32% of the country’s GDP in FY2024, the highest rate in the last 15 years.

Criticism of the government’s crypto policy is also a central theme in Biondini’s bill, as he believes that Brazil should be leading the world in crypto adoption rather than hindering it. He argues that existing and future crypto tax laws penalize individuals seeking a legitimate and secure store of value.

This is not the first time Biondini has taken a stand for the crypto community. He previously authored a bill that aims to formally recognize Bitcoin as a strategic store of value in Brazil. The proposal includes tax exemptions for BTC buyers and holders and asserts citizens’ rights to self-custody their coins without relying on crypto wallet operators.

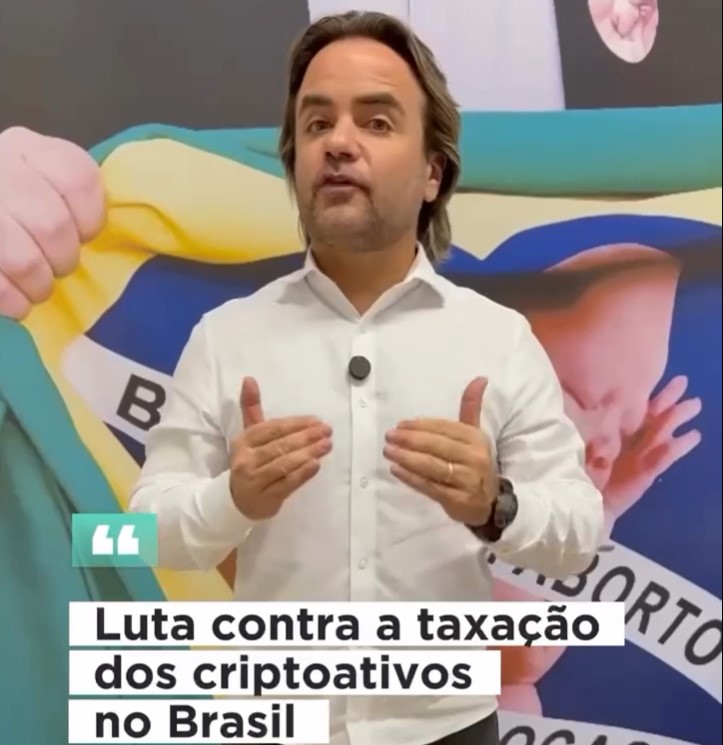

Taking his advocacy to social media, Biondini has called on the Brazilian crypto community to support his bill in order to pressure the lower house to reject efforts to increase crypto tax revenues. He has also urged fellow parliamentarians to stand behind the bill, emphasizing that it is designed to protect taxpayers, industry players, and Brazil’s economic sovereignty.

In a bold move last year, Biondini unveiled a bill proposing the creation of a national Bitcoin reserve. The plan suggested converting up to 5% of Brazil’s $372 billion international reserve fund into Bitcoin, showcasing his commitment to advancing the adoption of cryptocurrencies in the country.

Overall, Biondini’s efforts to push for the abolition of crypto tax for long-term investors highlight the growing importance of cryptocurrencies in Brazil and the need for a supportive regulatory environment. As the debate continues in the Chamber of Deputies, the outcome of this bill could have significant implications for the future of crypto taxation in the country.