Brown University Reveals Large Investment in BlackRock’s Bitcoin ETF

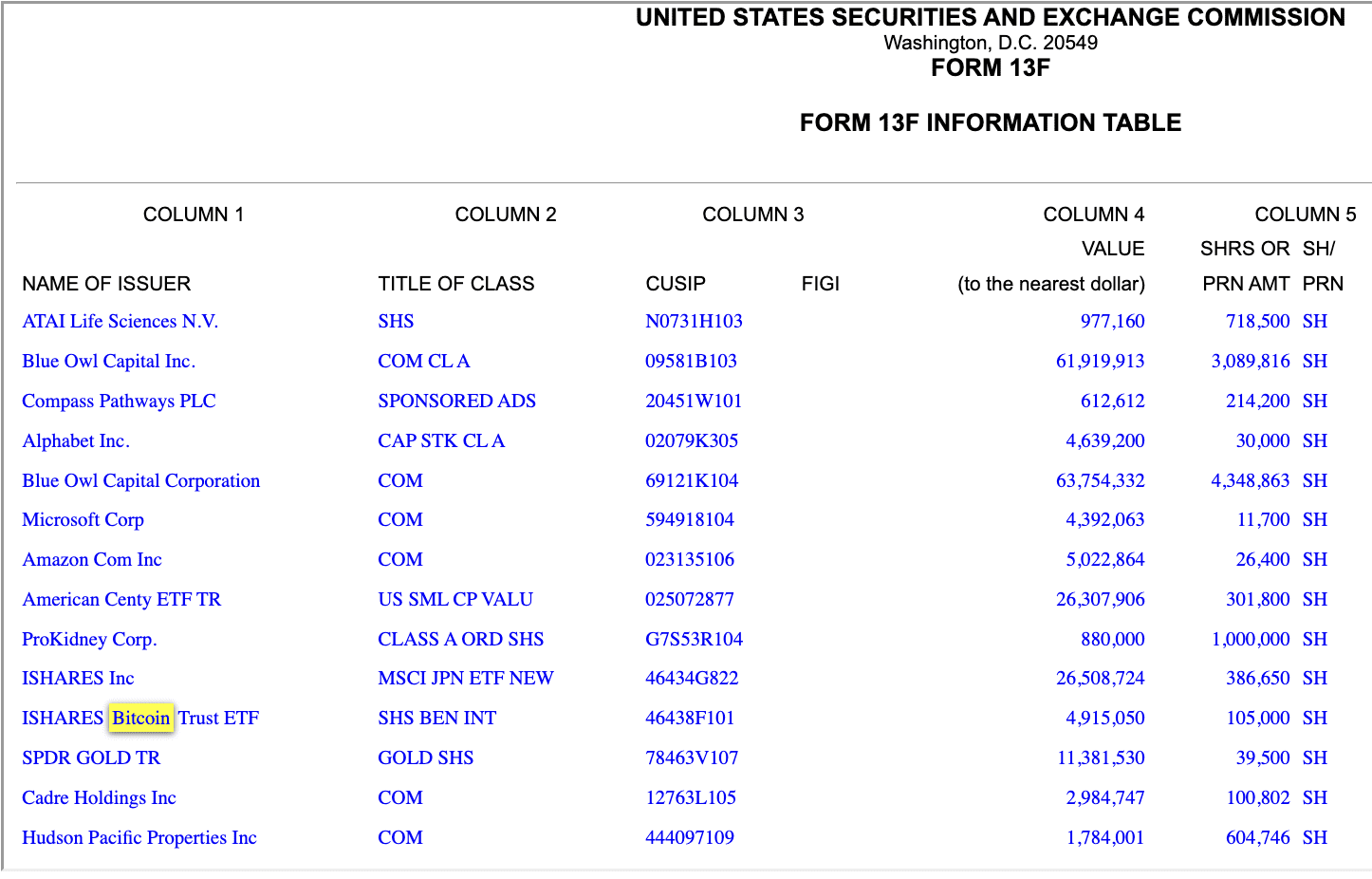

According to a recent SEC filing, Brown University, a prestigious private university based in Providence, Rhode Island, has disclosed a significant position in BlackRock’s spot Bitcoin ETF, IBIT. This revelation, first reported by market analyst MacroScope, shows that Brown University held $4,915,050 in IBIT as of March 31, 2025. This makes Brown University the third U.S. university to publicly announce a Bitcoin purchase, following in the footsteps of Emory University and the University of Austin (UATX).

MacroScope shared on X, “In a 13F filing this morning, Brown University reported owning 105,000 shares of the IBIT Bitcoin ETF as of March 31, valued at $4.9 million. This is a new position acquired in the first quarter of 2025. The total value of all 14 positions in the filing is $216 million, making this an important investment for the university.”

Increasing Institutional Interest in Bitcoin

Several U.S. universities are demonstrating their confidence in Bitcoin’s long-term potential by incorporating the digital asset into their endowment portfolios and academic programs. Emory University and the University of Austin have previously disclosed their Bitcoin holdings, underscoring the institutional appeal of cryptocurrency.

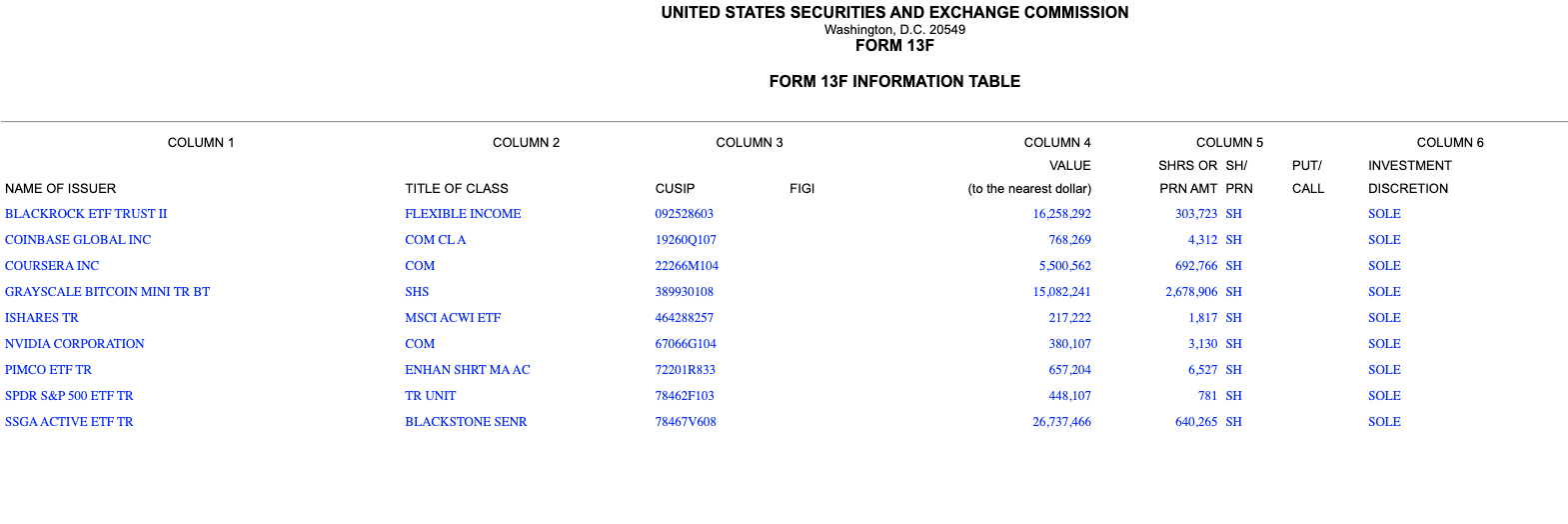

Emory University was among the first to reveal its Bitcoin holdings in an SEC filing on October 25, 2024. The university disclosed ownership of nearly 2.7 million shares of the Grayscale Bitcoin Mini Trust ETF, initially valued at $15.1 million.

With Bitcoin’s price surging since their initial investment, Emory University’s holdings may now exceed $21 million. Emory Investment Management (EIM) CIO Srinivas Pulavarti highlighted that the ETF conversion led to the public disclosure of their Bitcoin position.

Emory’s Associate Professor of Accounting Matthew Lyle commented on the advantages of investing in Bitcoin ETFs versus holding the digital asset directly, stating, “Using companies like Grayscale or BlackRock to manage the investments reduces the risk of potential losses compared to self-managing Bitcoin holdings.”

University of Austin’s Bitcoin Endeavors

In May 2024, the University of Austin made strides in the world of Bitcoin by partnering with Unchained, a Bitcoin financial services firm, to raise $5 million in Bitcoin for its endowment. Unchained CEO Joseph Kelly, who donated 2 BTC to the campaign, expressed enthusiasm about integrating Bitcoin into the university’s long-term strategy.

Thomas Hogan, incoming Associate Professor at UATX, emphasized the university’s commitment to nurturing future leaders and innovators through Bitcoin investments. He stated, “Bitcoin presents a unique opportunity for advancing UATX’s mission of fostering the next generation of visionary thinkers.”