Cardano Price Slips as Whales Capitulate

The recent weeks have not been kind to Cardano as its price continues to slip, dropping below key support levels and causing whales to start capitulating.

The price of Cardano (ADA) has seen a significant decline over the past few days, hitting a low of $0.65, its lowest point since May 8. This marks a 21% drop from its peak in May and a 50% drop from its high in November 2024.

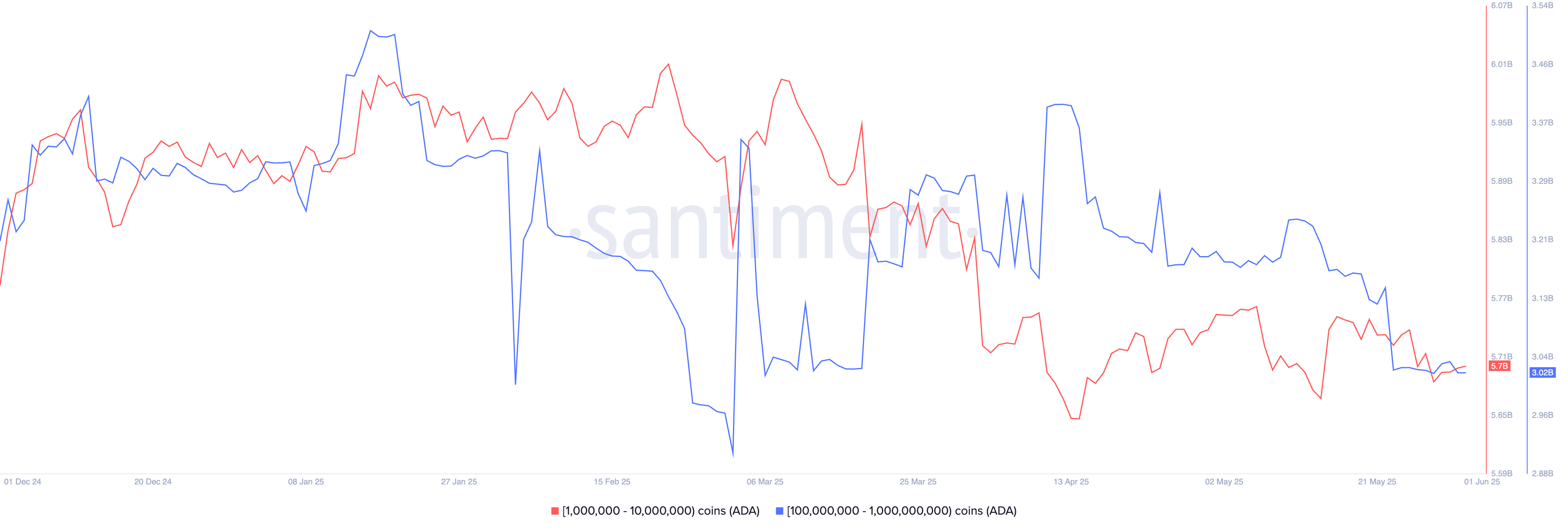

On-chain data from Santiment reveals that the number of ADA holders has decreased to 4.49 million from 4.55 million in May, indicating investor capitulation. Additionally, whales holding between 100 million and 1 billion coins have reduced their holdings from 3.4 billion to 3.02 billion, suggesting a bearish sentiment.

Furthermore, whales holding between 1 million and 10 million coins have also decreased their holdings to 5.7 billion from a high of 6 billion earlier this year. This sell-off coincided with a drop in the number of ADA tokens in profit from 27 billion to 22.69 billion in April.

Despite being hailed as a potential rival to Ethereum, Cardano has been underperforming in various aspects. Its total value locked in decentralized finance has dwindled to $391 million, with cumulative DEX transactions amounting to $4 billion.

Comparatively, Unichain boasts a TVL of over $702 million and a DEX volume exceeding $14 billion shortly after its launch.

Technical Analysis and Allegations

The daily chart indicates a sharp decline in ADA price following a double-top pattern at $0.839. The coin has breached the neckline at $0.710 and fallen below the 50-day and 200-day moving averages, potentially forming a death cross.

As a result, Cardano is likely to continue its descent, with sellers eyeing the $0.50 mark, representing a 25% drop from the current level.

Furthermore, Cardano has recently come under fire with allegations made by non-fungible token artist Masato Alexander, accusing founder Charles Hoskinson of misappropriating $619 million in ADA tokens. Hoskinson has refuted these claims, and an audit is underway to address the accusations.

If the audit clears Cardano of any wrongdoing, investor confidence could be restored, leading to a resurgence in the coin’s value. However, if the findings raise concerns, ADA may face further downward pressure.

The allegations pertain to a 318 million ADA transfer during the 2021 Allegra hard fork. Hoskinson, a co-founder of Ethereum, launched Cardano through IOHK in 2015, with the blockchain going live in 2017.

Named after mathematician Gerolamo Cardano and its native cryptocurrency after Ada Lovelace, Cardano’s future hinges on its integration with Bitcoin to attract staking from BTC holders. However, competition from established Bitcoin staking platforms raises questions about Cardano’s growth potential.