Brian Quintenz Reveals Private Messages from Winklevoss Twins Regarding CFTC Support

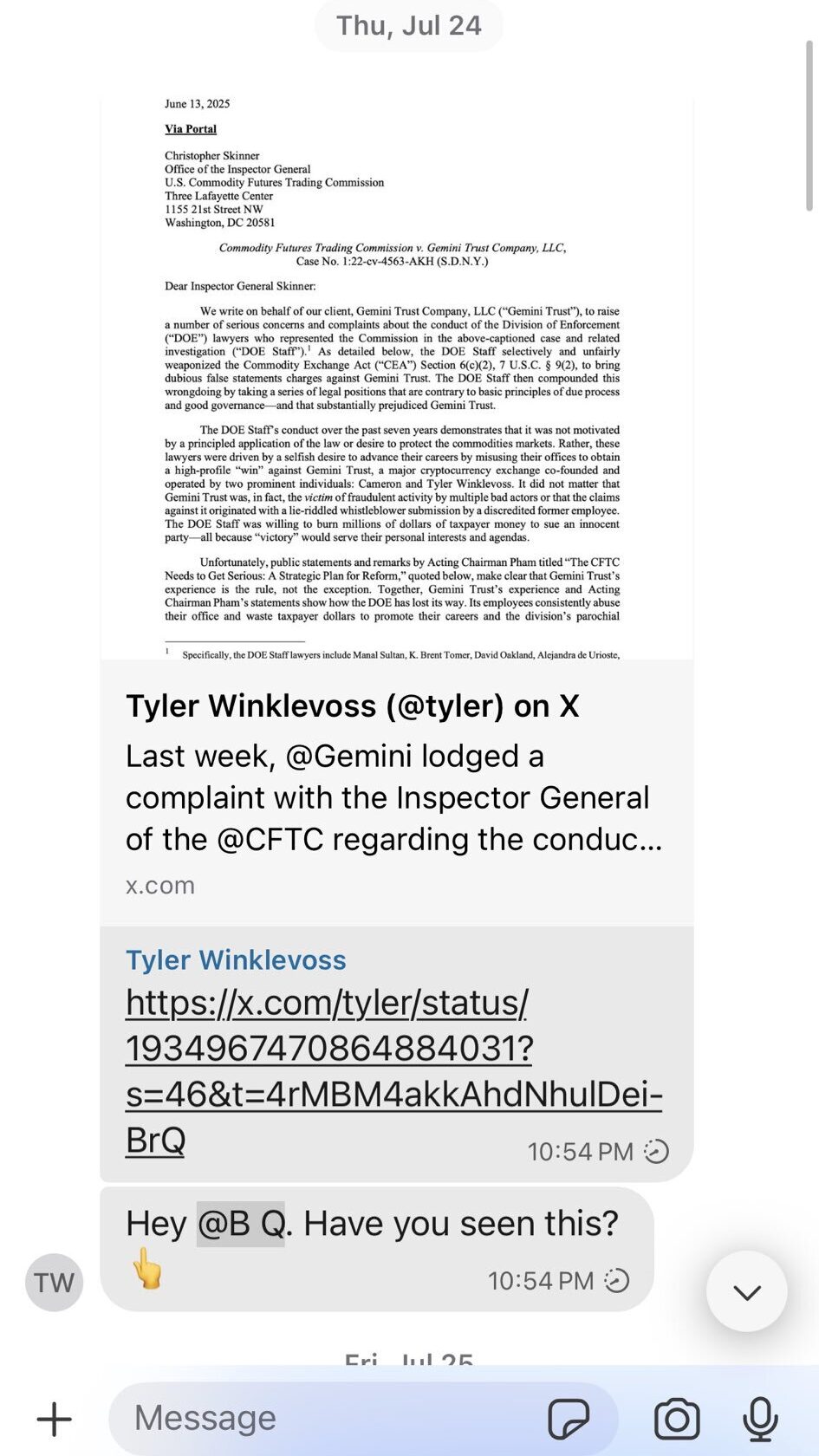

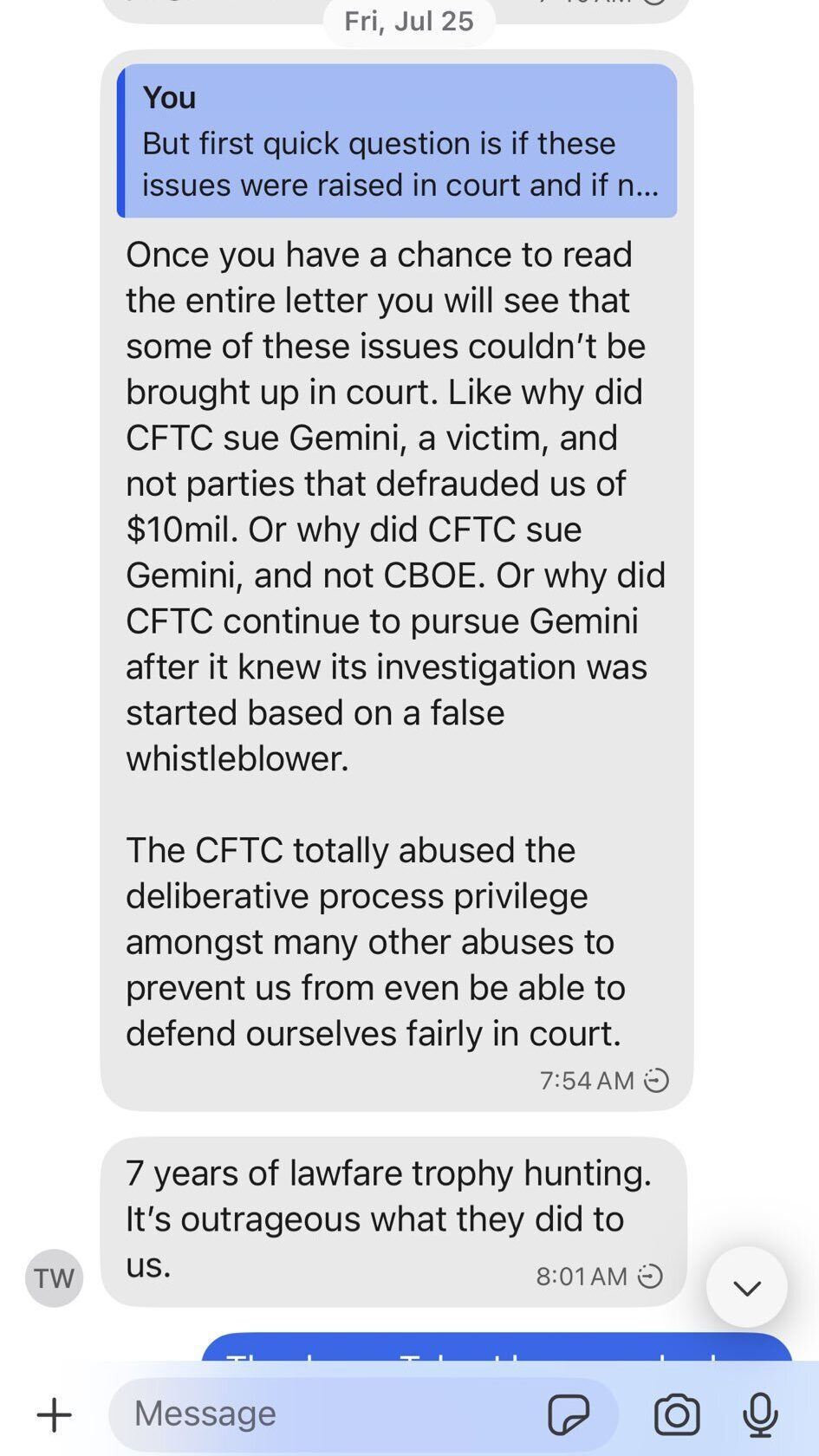

Amidst the chaos of recent tragedies, a significant financial development emerged as Brian Quintenz, the nominee for CFTC Chairman and Head of Policy for a16z crypto, shared personal messages from the Winklevoss twins. These messages, which were cryptic and focused on rectifying issues at Gemini and implementing cultural reform at the CFTC, raise questions about the relationship between regulators and industry billionaires.

Quintenz’s response to the Winklevii’s requests was non-confrontational, suggesting that he lacked a comprehensive understanding of internal matters at the CFTC. The screenshots of their conversations, shared on X, shed light on potential conflicts of interest and favoritism within regulatory bodies.

One of the pressing concerns raised by Quintenz’s disclosure is the propriety of engaging in private discussions about potential support from influential figures in the industry. The blurred lines between regulatory oversight and personal relationships with billionaires underscore the challenges of maintaining impartiality in financial governance.

The public exposure of these conversations has ignited speculation about the dynamics between a16z, the Winklevoss twins, and other stakeholders in the cryptocurrency space. Quintenz’s revelation has also raised questions about the integrity of regulatory processes and the extent of undue influence exerted by wealthy individuals.

As the fallout from Quintenz’s disclosure unfolds, it remains to be seen how this revelation will impact his nomination and the broader regulatory landscape. The intersection of personal interests, political affiliations, and regulatory responsibilities underscores the complexities of overseeing a rapidly evolving financial ecosystem.

Implications and Consequences

While the legality of Quintenz’s actions remains ambiguous, the optics of cozying up to industry titans raise concerns about regulatory independence and accountability. The Winklevoss twins’ attempt to sway Quintenz’s nomination underscores the power dynamics at play in shaping financial governance.

The clash between the Winklevoss twins and President Trump over Quintenz’s nomination further complicates the situation, highlighting the entanglement of personal relationships and political agendas in regulatory decision-making. The lack of clear boundaries between industry players, regulators, and political figures underscores the challenges of ensuring transparency and fairness in financial oversight.

As stakeholders grapple with the fallout from Quintenz’s revelations, the need for greater scrutiny and accountability in financial governance becomes increasingly apparent. The blurred lines between public duty and private interests highlight the imperative of upholding ethical standards and maintaining impartiality in regulatory decision-making.

Ultimately, Quintenz’s disclosure serves as a cautionary tale about the complexities of navigating the intersection of politics, finance, and personal relationships in the regulatory realm. As the implications of this revelation reverberate throughout the financial world, the imperative of upholding integrity and transparency in regulatory processes becomes more pressing than ever.

Read more: Winklevoss twins issue warning to Democrats on the impact of anti-crypto measures on young voters