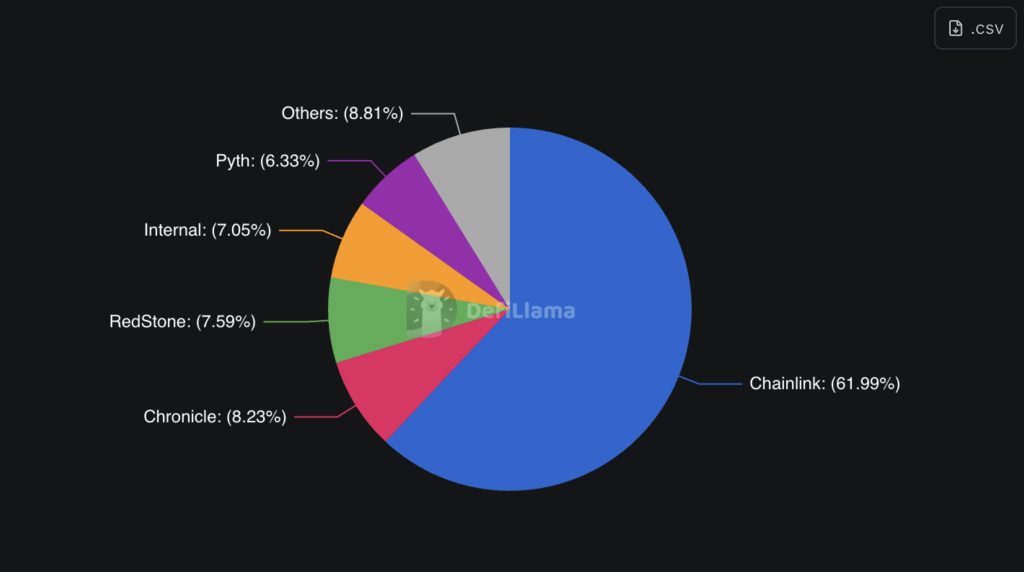

Chainlink, a leading player in the oracle market, has solidified its position with a significant partnership announcement with Polymarket, the world’s largest on-chain prediction market. This collaboration aims to enhance market resolution accuracy and speed, further establishing Chainlink’s dominance in the sector, which currently stands at 62% according to DeFiLlama.

The partnership involves the integration of Chainlink’s Data Streams and Automation services into Polymarket’s resolution process, which is now operational on the Polygon mainnet. This integration enables near-instant settlement of prediction markets, starting with asset-pricing markets related to popular assets like Bitcoin and Ether.

Chainlink’s decentralized networks offer low-latency, timestamped data delivery while eliminating single points of failure, ensuring secure and verifiable resolutions. Polymarket, known for its rapid growth since its launch in 2020, has positioned itself as a global hub for real-time information.

In recent developments, Polymarket acquired QCEX, a CFTC-licensed exchange and clearinghouse, in a $112 million deal to re-enter the U.S. market. Additionally, the platform has partnered with X to incorporate personalized market recommendations into the social platform.

The collaboration with Chainlink strengthens Polymarket’s infrastructure, reducing reliance on subjective voting systems and minimizing resolution risks in more intricate market categories. Chainlink’s co-founder, Sergey Nazarov, described the partnership as a pivotal milestone, emphasizing the importance of resolving markets with tamper-proof computation and high-quality data to establish trustworthy prediction markets.

This integration marks the beginning of a broader partnership between the two companies, with plans to expand beyond asset-pricing into more subjective prediction categories. Chainlink has been expanding its reach into traditional finance and government-linked data services, with recent partnerships with Intercontinental Exchange (ICE) and SBI Group focusing on on-chain foreign exchange rates and tokenized bonds, respectively.

Furthermore, the U.S. Department of Commerce has started publishing official economic data on-chain via Chainlink, marking a significant milestone for government statistics verification on blockchain networks. With billions of dollars in total value locked in DeFi secured by Chainlink’s oracles, the company continues to establish itself as a crucial component of decentralized data infrastructure.

On the regulatory front, Polymarket recently received clearance from U.S. regulators, including the DOJ and CFTC, following investigations into its operations. The platform has secured a no-action letter from the CFTC, allowing it to offer compliant prediction contracts through its acquired entities, QCX LLC and QC Clearing LLC.

Polymarket has emerged as the largest prediction market globally, processing billions of dollars in wagers and attracting millions of traders. With a funding round nearing $200 million led by Founders Fund, the platform is on track to be valued at $1 billion. Institutional support, including investments from Donald Trump Jr.’s 1789 Capital, underscores the platform’s rapid growth and increasing political backing.

In conclusion, the partnership between Chainlink and Polymarket signifies a significant step towards enhancing prediction market accuracy and efficiency. As both companies continue to innovate and expand their offerings, the future looks promising for decentralized finance and data services.