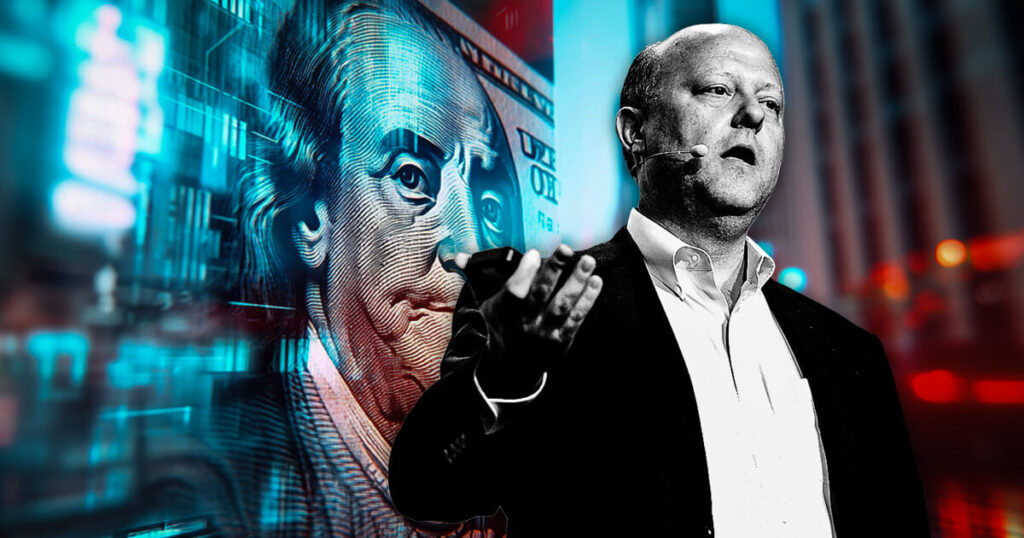

In a recent interview with Bloomberg, Circle co-founder Jeremy Allaire made a compelling argument for US dollar-pegged stablecoin issuers to be registered in the United States. Allaire emphasized the importance of regulatory clarity as lawmakers introduce new legislation on digital assets, highlighting the need for stablecoin issuers to operate within a clear legal framework.

The discussion around stablecoin oversight has been gaining momentum in Washington, with policymakers focusing on the regulation of these digital assets. Allaire’s call for formal registration aligns with efforts to bring stablecoin issuers under a transparent regulatory regime, particularly as the market for dollar-pegged digital assets continues to expand.

Stablecoins play a crucial role in digital asset markets, acting as a bridge between traditional finance and cryptocurrencies. Despite their significance, regulatory uncertainty has plagued the stablecoin industry, with concerns surrounding reserve backing, consumer protections, and financial stability risks.

Senator Bill Hagerty recently introduced a bill aimed at creating a federal framework for stablecoin regulation, signaling a shift towards clearer regulatory guidelines for the industry. With President Donald Trump showing support for positioning the US as a leader in the crypto industry, regulatory shifts could potentially impact stablecoin issuers like Circle.

Circle, known for its USDC stablecoin, has positioned itself as a transparent and regulatory-compliant issuer in the market. The company has long advocated for a clear legal framework that would allow stablecoins to operate within the US financial system, rather than existing in regulatory gray areas. However, there are concerns that stringent regulations could stifle innovation and competition in the global market.

Allaire’s call for US registration echoes the industry’s push for trust and stability in the market. While some lawmakers and regulators raise concerns about stablecoins’ potential impact on financial stability, others believe that well-regulated issuers could improve payment efficiency and drive innovation.

As stablecoins become increasingly central to the cryptocurrency ecosystem, the ongoing debate over their regulation will shape the future of digital finance in the US. Whether Hagerty’s bill gains traction or undergoes revisions, the quest for clarity in stablecoin oversight marks a pivotal moment for both the industry and policymakers.