Citigroup’s venture capital arm, Citi Ventures, has made a significant investment in stablecoin infrastructure company BVNK, marking a notable shift in the bank’s stance on cryptocurrency. BVNK’s technology serves as a payments platform for global stablecoin transactions, enabling seamless movement of funds between fiat currency and cryptocurrencies.

While the exact amount of Citigroup’s investment remains undisclosed, BVNK’s co-founder Chris Harmse has confirmed that the company’s valuation now surpasses the $750 million mark from its previous funding round. With backing from industry giants like Coinbase and Tiger Global, BVNK competes in a crowded market alongside established players like Ripple and up-and-coming firms such as Alchemy Pay and TripleA.

The surge in BVNK’s growth can be attributed to the regulatory clarity provided by the GENIUS Act, which was passed earlier this year in the United States. This legislation has created a more favorable environment for stablecoin operations, prompting increased interest and investment in the sector. Citigroup’s CEO, Jane Fraser, has also expressed the bank’s intentions to explore issuing its own stablecoin and developing custodian services for digital assets to better serve its clients.

This move by Citigroup comes in contrast to previous warnings from the bank’s analysts about the potential risks of stablecoins causing deposit flight from traditional banks. However, industry groups like the American Bankers Association and Bank Policy Institute have raised concerns about the impact of yield-bearing stablecoins on the banking sector, citing potential deposit outflows that could disrupt loan funding.

Despite these concerns, the crypto industry has pushed back against calls for restrictions on stablecoin yields, arguing that such measures would stifle innovation and consumer choice. Recent research from Coinbase has shown no significant correlation between stablecoin adoption and deposit flight at community banks, further challenging the narrative of destabilization.

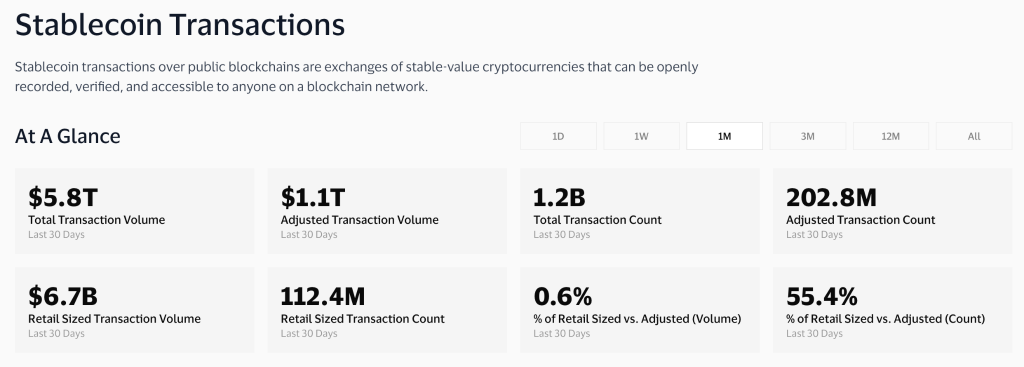

The convergence of traditional finance and blockchain technology is evident in the actions of major banks like JPMorgan Chase and Bank of New York Mellon, both of which have ventured into the stablecoin space. With stablecoins processing trillions of dollars in transactions and the market capitalization exceeding $300 billion, these assets have become integral to cross-border payments due to their speed, cost-effectiveness, and round-the-clock settlement capabilities.

Treasury Secretary Scott Bessent has voiced support for stablecoin adoption, emphasizing the potential benefits for global dollar access and the demand for U.S. Treasuries as backing assets. BVNK’s profitability outlook remains positive, with Harmse highlighting the strategic investments made by U.S. banks like Citigroup to stay ahead in the evolving payments landscape.

In conclusion, Citigroup’s investment in BVNK signifies a broader shift towards embracing stablecoin technology within the banking industry, driven by regulatory clarity and the potential for innovation in digital payments. As Wall Street accelerates its integration of digital assets, the landscape for cross-border transactions is poised for significant transformation, with stablecoins playing a pivotal role in shaping the future of finance.