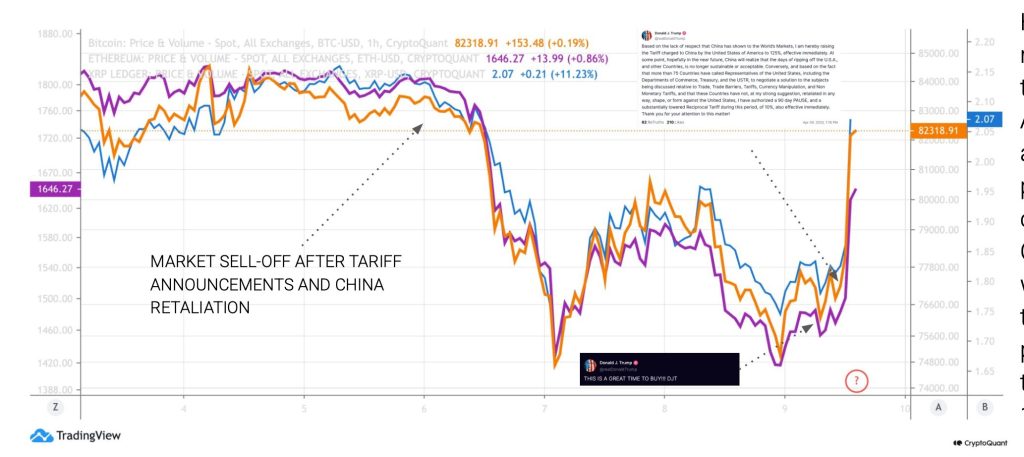

The recent announcement of a 90-day tariff pause by President Trump has brought some relief to the crypto markets, which had been rattled by escalating trade tensions. The initial sell-off, triggered by retaliatory tariffs imposed by China and the EU, saw Bitcoin plummet from $84K to a five-month low of $74K. However, the market quickly bounced back following President Trump’s announcement, restoring investor confidence and pushing prices back up.

Technical analysis indicates that Bitcoin’s recovery was supported by its 365-day moving average, currently hovering around $76.1K. This moving average has historically been a key indicator of market trends, with sustained drops below it often signaling the onset of a bear market. While the recent bounce above this average is encouraging, market sentiment remains pessimistic, with the Bull Score Index hitting a low of 10, the lowest since November 2022. This suggests that the recent recovery may be more of a short-term correction rather than the start of a sustained bullish trend.

Looking ahead, Bitcoin may face resistance at key price levels of $84K and $96K. These levels have historically acted as barriers within the current trading cycle, indicating that the market is still vulnerable to reversals if bullish conditions do not improve. Overall, while the tariff pause has provided a temporary reprieve, investors are still cautious and waiting for stronger bullish signals to emerge.

In conclusion, the recent market volatility highlights the sensitivity of digital assets to international policy shifts. While the tariff pause has helped stabilize prices, the market remains on edge, with the potential for further fluctuations if bullish conditions do not materialize. Investors should stay vigilant and closely monitor market developments in the coming weeks.