Cryptocurrency treasury companies that have raised capital through private investment in public equity (PIPE) deals are facing a significant risk of their stock prices plummeting by up to 50%, according to a recent market report from CryptoQuant. The analytics platform highlighted that companies backed by PIPE deals have already experienced substantial declines, often seeing their share prices gravitate towards their PIPE issuance levels.

When lock-up periods expire, investors are inclined to sell off their positions to lock in profits, leading to significant selling pressure in the market. PIPE deals enable private investors to purchase new shares below the market price, providing companies with quick access to liquidity in a competitive sector. While these arrangements are effective for raising cash, CryptoQuant cautioned that they dilute existing shareholders and create an overhang of shares that can weigh down stock performance.

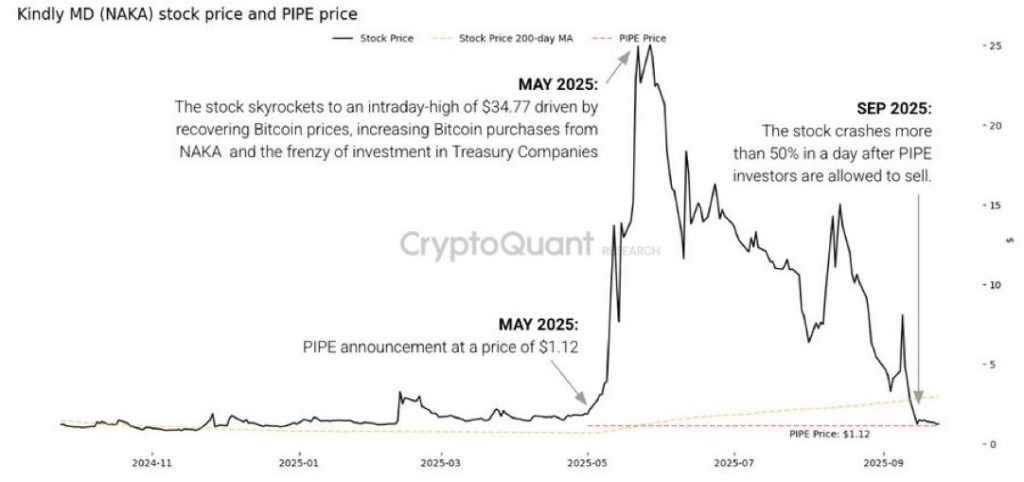

An illustrative example is Kindly MD (NAKA), a medical company that transitioned into Bitcoin treasury holdings earlier this year. Following a PIPE raise, its stock surged from $1.80 in late April to nearly $35 by late May. However, once the PIPE shares were unlocked, the stock plummeted by 97%, dropping to $1.16, almost mirroring its PIPE offering price of $1.12. This retracement was termed as “PIPE price gravity” by CryptoQuant.

Other crypto treasury firms are also witnessing similar patterns. Strive Inc. (ASST) reached a peak of $13 in May but has since declined by 78% to $2.75. CryptoQuant highlighted that the company’s PIPE was priced at $1.35, indicating a potential further 55% decline as investors prepare to sell off when the lock-up period ends next month.

Additionally, Cantor Equity Partners (CEP), a special purpose acquisition company merging with Twenty One Capital, conducted a PIPE priced at $10. CEP’s shares have already dropped by nearly 70% from their highs to below $20. CryptoQuant suggested that the stock could experience another 50% decline from its current levels once PIPE investors start selling off.

As the value of digital asset holdings approaches parity with overall company valuations, even well-established crypto treasuries are facing pressure. This dynamic could accelerate sell-offs if investors perceive limited upside in stock performance compared to direct exposure to cryptocurrencies. CryptoQuant concluded that only a significant and sustained Bitcoin rally could counteract the downward pressure facing treasury stocks linked to PIPE deals. Without such a rebound, many companies are likely to continue trending towards or below their PIPE issuance levels.

The trend has left PIPE-funded crypto treasury stocks vulnerable to substantial losses, with investors closely monitoring how upcoming unlocks will impact market sentiment in the coming weeks. On the other hand, small-cap firms that adopted the crypto treasury strategy in 2024 are now resorting to debt-funded share buybacks to support declining valuations. This shift reflects investor skepticism and challenges the notion that digital assets alone can bolster stock performance.

Several companies, including gaming, biotech, and electric vehicle firms, have initiated repurchase programs despite trading below the value of their crypto holdings. This trend has raised concerns among analysts, indicating that the once-celebrated crypto treasury playbook may be reaching its limits. Overall, the cryptocurrency market remains dynamic and subject to rapid changes, with companies navigating various challenges to maintain their financial stability and market performance.