Dogecoin (DOGE), a cryptocurrency that started as a meme, has now become a prominent player in the crypto market. On the other hand, LF Labs (LF) represents a new breed of speculative micro-cap tokens. This article will delve into both cryptocurrencies using the daily timeframe, providing an updated technical analysis and insight for traders.

Market Overview At the latest daily close, Dogecoin is trading at $0.1688 with a market cap of $25.11 billion and a 24-hour volume of $1.17 billion. Its circulating supply is 148.68 billion DOGE, with an all-time high of $0.7376. On the other hand, LF Labs is priced at $0.0006150, with a market cap of $2.13 million. The 24-hour trading volume is $1.31 million, and the circulating supply is 2.99 billion LF. LF Labs hit its all-time high in March 2025 at $0.001316.

Daily Technical Analysis

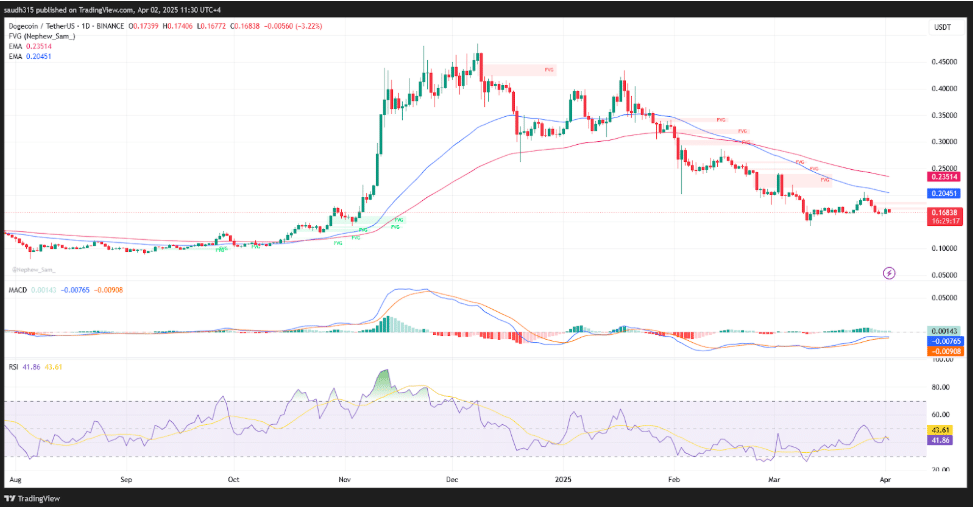

Dogecoin has been consolidating on the daily chart. The MACD is above the signal line with expanding histogram bars, indicating bullish momentum. The RSI stands at 42, showing consistent demand. The price is currently below the 50-day and 200-day moving averages, signaling consolidation. Volume has been strong on breakout candles, particularly around the $0.16 level, which has become a strong support zone. Short-term resistance is at $0.178, with a psychological barrier at $0.20.

Source: TradingView

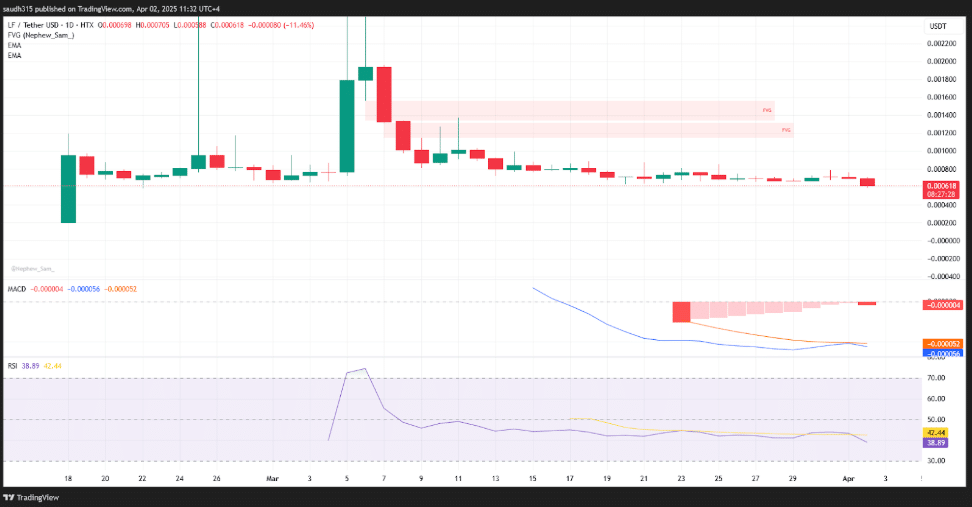

On the other hand, LF Labs is in a consolidation phase after a sharp rally in mid-March. The price is testing a descending wedge pattern on the daily chart. The MACD recently crossed into bullish territory, although with muted momentum. The RSI is at 38, suggesting potential upward movement if buyers enter the market. Price action is holding above the $0.00060 support level, which has been tested multiple times. A breakout above $0.00075 could confirm a pattern breakout. Volume remains concentrated during resistance tests, indicating accumulation.

Source: TradingView

Trading Strategy Insights (Daily Timeframe)

For Dogecoin, a potential swing trade setup could involve an entry between $0.158 and $0.162, with a stop loss at $0.149 and take profit targets at $0.176 and $0.188. A breakout confirmation entry at $0.178 with a stop at $0.165 might aim for levels between $0.195 and $0.205. Traders considering a mean reversion setup could short between $0.184 and $0.188 if volume decreases, with stops at $0.195 and a target retracement to $0.165.

For LF Labs, there is a high-risk swing opportunity. A long position could be initiated between $0.00060 and $0.00063, with a stop at $0.00057 and targets at $0.00074 and $0.00088. Breakout traders could enter on a daily close above $0.00076, with stops at $0.00070 and profit targets at $0.00085 and $0.00095. Traders using short-term scalping strategies should monitor price action around $0.00067, especially if the RSI shows signs of turning upwards.

Comparative Analysis Summary Dogecoin remains a strong contender for trend-following and momentum strategies due to its liquidity and technical strength. LF Labs, while riskier, shows potential for short-term swing trades with its technical patterns. However, its limited trading history and lower liquidity make it a more speculative asset.

Conclusion Dogecoin is well-suited for swing and breakout trades, supported by its bullish momentum and liquidity. LF Labs, although speculative, presents opportunities for explosive moves if key resistance levels are breached. Traders should assess their risk tolerance and investment horizon when considering these assets. It is crucial to implement disciplined risk management, especially when dealing with micro-cap cryptocurrencies like LF Labs.

Disclaimer: This is a paid post and should not be considered as news or financial advice.