President Donald Trump has once again taken aim at Federal Reserve Chair Jerome Powell, this time calling him a “numbskull” and expressing his frustration over the central bank’s reluctance to lower interest rates. Despite the mounting tension, Trump has pledged not to fire Powell, at least for now.

During a White House event, Trump made his strongest criticism yet of Powell’s monetary policy approach, arguing that even a small reduction in interest rates could save the United States billions of dollars annually. Trump pointed out that a one-percentage point cut could result in $300 billion in savings, while a two-point reduction could generate $600 billion in savings.

This latest attack on Powell is part of a larger pattern of public criticism from the Trump administration. Commerce Secretary Howard Lutnick and Vice President JD Vance have also joined in, with Vance labeling the Fed’s approach as “monetary malpractice.” The coordinated pressure campaign reflects the administration’s growing impatience with the central bank’s independence, especially as Trump faces re-election pressures and seeks to demonstrate economic leadership.

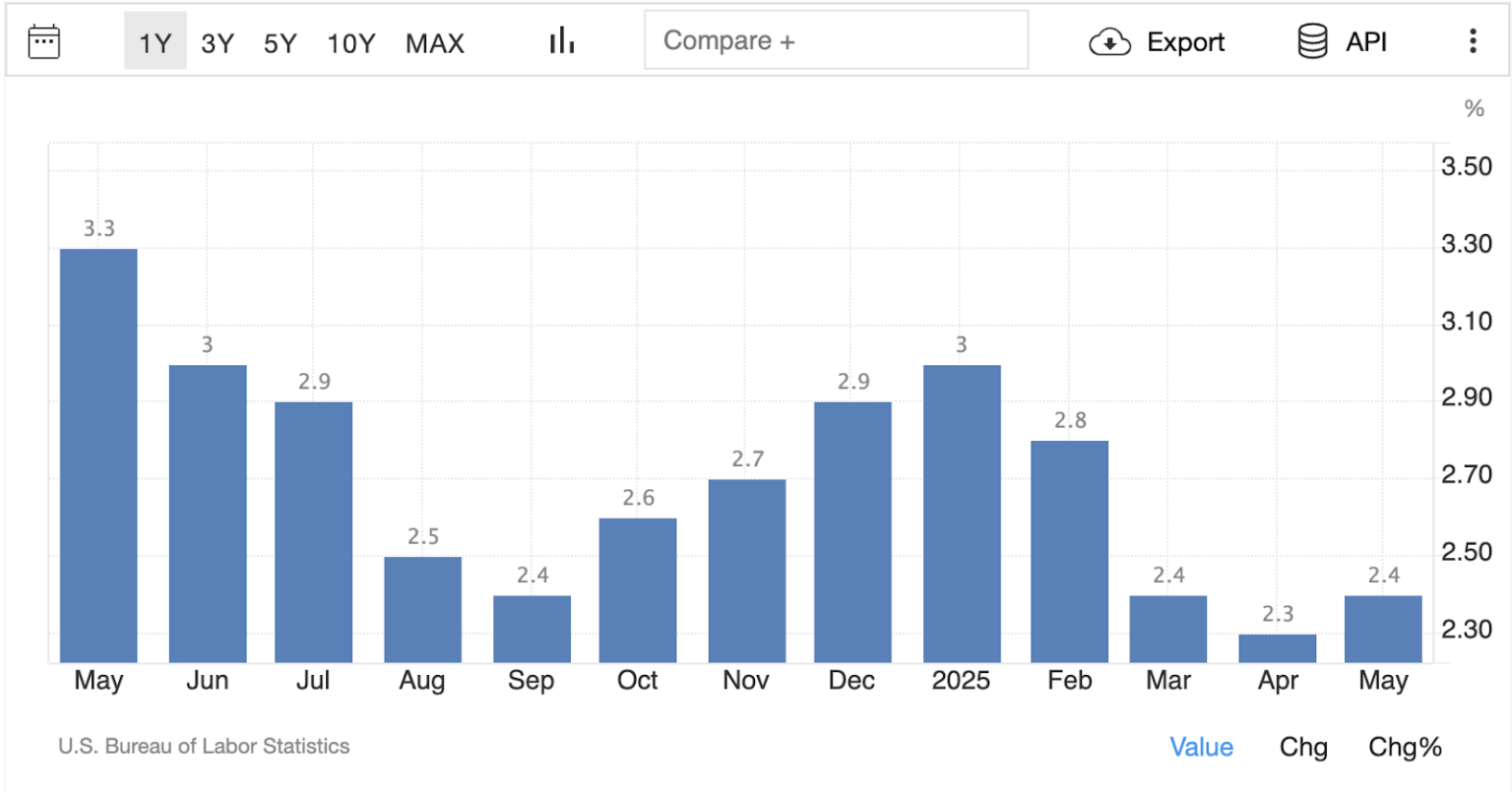

Despite his harsh words for Powell, Trump stopped short of threatening to fire the Fed chair. Instead, he ominously suggested that he “may have to force something” if the rate cuts he desires do not materialize soon. This veiled threat comes at a strategic time, as recent economic indicators show signs of cooling inflation and declining energy prices thanks to increased domestic drilling under Trump’s energy policy.

Powell’s current term as Fed chair expires in May 2026, and Trump has hinted that he may announce his nominee for the next Fed chair soon. Legal experts warn that while Trump technically has the authority to remove Powell, such a move could trigger market volatility and damage the Fed’s credibility as an inflation fighter.

The escalating feud between Trump and Powell highlights a broader debate about Federal Reserve independence and its implications for the economy. Trump’s frustration with the Fed’s interest rate policy stems from his belief that it unnecessarily burdens federal borrowing costs, especially as the government faces mounting short-term debt obligations.

The president has pointed to Europe’s ten rate cuts as evidence that the Fed should follow suit, given similar economic conditions and falling inflation metrics. While the Federal Reserve Act of 1913 allows governors to be removed “for cause,” recent Supreme Court decisions have eroded some of the traditional protections that independent agencies have enjoyed.

Harvard Law School’s Daniel Tarullo suggests that conservative justices may treat the Federal Reserve differently from other agencies, given its historical precedent. However, market dynamics may ultimately protect Powell, as any attempt to remove him could trigger market reactions that are counterproductive to Trump’s economic goals.

Recent economic indicators support Trump’s argument for immediate monetary easing, with inflation remaining stable and energy costs decreasing. The administration is increasingly pressuring the Fed to cut rates, as markets price in potential rate cuts later this year. Despite the tension between Trump and Powell, for now, the Fed chair’s job remains safe.