Prominent crypto analytics firm Swissblock warns Bitcoin may not have hit market bottom yet

Despite the US enacting a 90-day tariff pause, Swissblock, a leading crypto analytics firm, has expressed concerns that Bitcoin (BTC) may not have found its market bottom just yet.

In a recent post on the social media platform X, Swissblock highlighted that the current momentum of Bitcoin towards the upside is not necessarily indicative of a convincing breakout.

“Don’t let your guard down yet! The 90-day trade war extension eases tensions, but we’re not out of the woods. Bitcoin breaks $78,000-$79,000, now holding above $80,000. Are we in the clear?”

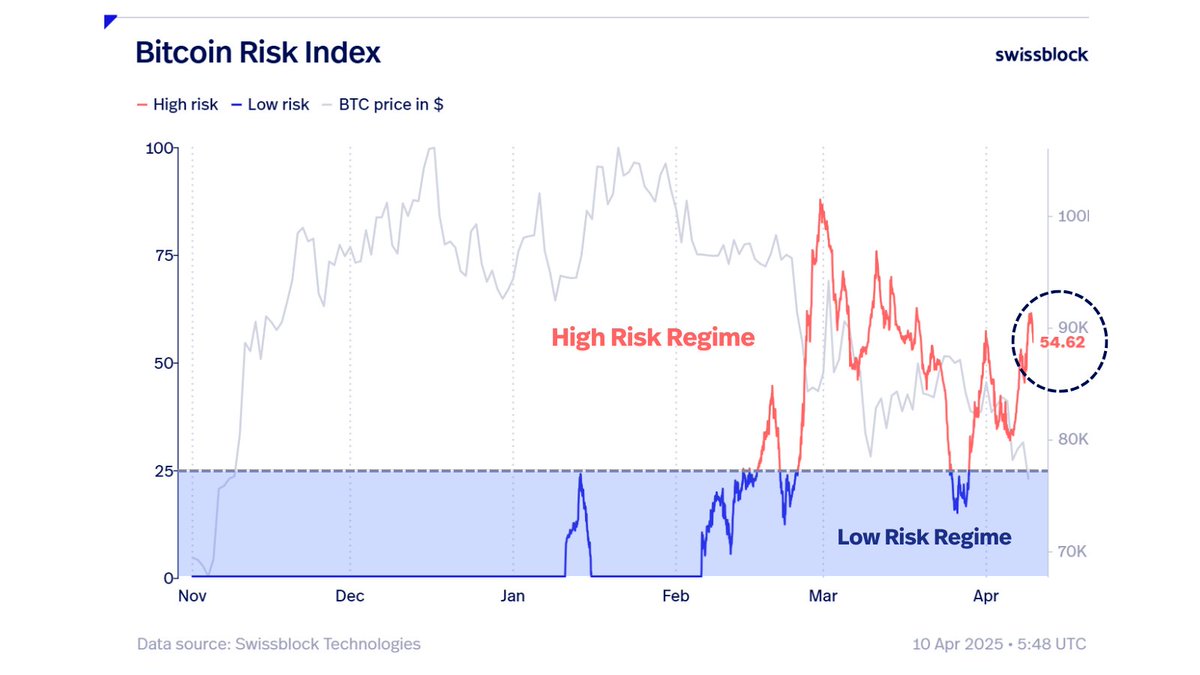

Swissblock also shared insights from their Bitcoin Risk Signal, a tool that assesses various indicators such as price data and on-chain metrics to determine if BTC is at risk of a major drawdown. The firm emphasized that the risk signal does not currently suggest that a market bottom has been reached.

“Market risk must ease for a true bottom. It’s under control but still elevated, not in a low-risk regime yet. We need to see a clear decline in risk.”

According to Swissblock, Bitcoin is currently in a downtrend phase.

“For the bottom to progress, market trend must signal formation. We’re in a downtrend phase, normal in bottoming cycles: bottom-downtrend-uncharted. The bottom is close, but not confirmed.”

Swissblock has emphasized that for Bitcoin to confirm a bullish reversal, it needs to hold $80,000 as a key support level.

“Bitcoin must hold $80,000 and consolidate to break the downward compression. Strength and volume are key for a bullish shift.”

At the time of writing, Bitcoin is trading at $83,221, marking a 4.7% increase in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney