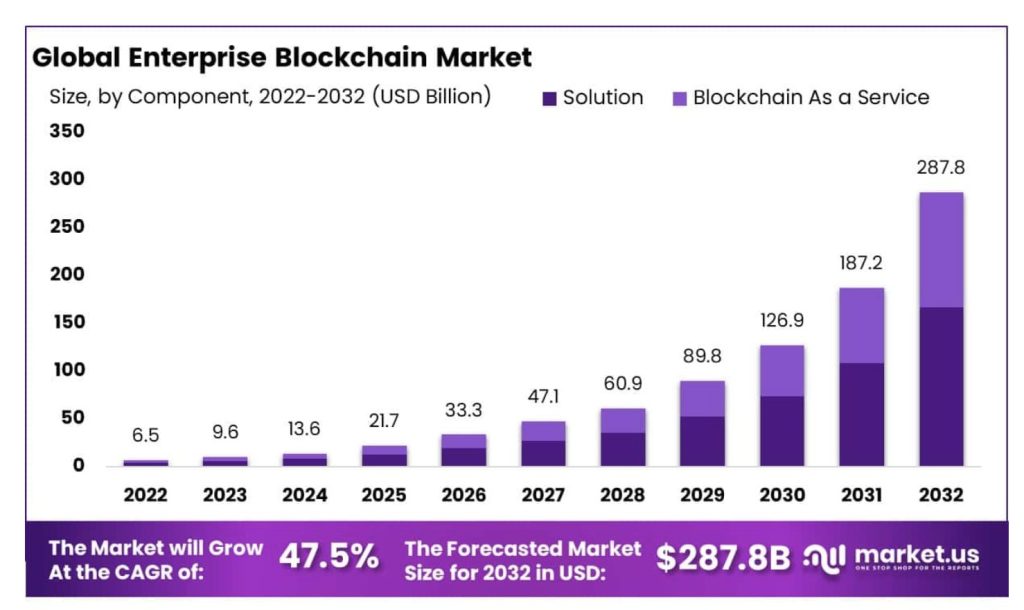

Enterprise blockchain technology has seen a resurgence in interest as institutions explore new applications such as tokenization, product traceability, and data-sharing. According to research from market.us, the global enterprise blockchain market is projected to grow at a compound annual rate of 47.5%, reaching $287.8 billion by 2032.

A New Era for Enterprise Blockchain

The landscape of enterprise blockchain has evolved significantly since its inception in 2017. Initially focused on permissioned networks for private data sharing, many early networks faced scalability and governance challenges leading to shutdowns. However, advancements in technology and the demand for tokenized assets have shifted the focus of enterprise blockchain strategies.

Andrew Stakiwicz, head of solutions at Hashgraph, believes that the growth in the enterprise blockchain sector is driven by technological maturity, regulatory clarity, and evolving business needs. Blockchain technology has transitioned from experimental to practical deployments, offering improved scalability, security, and interoperability.

A Hybrid Solution for Enterprise Blockchain

Stakiwicz highlights the appeal of hybrid models that combine public and private elements, allowing organizations to maintain control over sensitive data while leveraging the benefits of distributed ledger technology. Hashgraph’s HashSphere, a private permissioned network running on Hedera’s public ledger, offers institutions the speed and scalability of Hedera while ensuring data control and privacy.

Enterprise Blockchain Model Nightfall Gets Upgraded

Ernst & Young (EY) recently updated Nightfall, its enterprise blockchain solution, to simplify private transactions on the Ethereum public network. Nightfall_4 eliminates the need for liquidity services and block challenge periods by shifting to a cryptographic architecture. This update enhances privacy and efficiency for use cases like product traceability and financial asset transfers.

How Enterprise Blockchain Will Advance

As hybrid models mature, the use of blockchain in enterprise settings is expected to increase. Bakhrom Saydulloev of Mercuryo predicts that financial institutions will view blockchain as core infrastructure, particularly with the growing importance of real-time settlement. Automating contracts and integrating financial middleware tools will streamline B2B settlements and enhance usability.

Challenges Hampering Adoption

Despite progress, challenges like privacy, security, and education continue to hinder broader adoption of blockchain technology. Privacy models can complicate use cases like traceability, while security concerns require decentralized contract upgrades for error correction. Education efforts are needed to shift the perception of blockchain from speculation to infrastructure.

In conclusion, the evolution of enterprise blockchain towards hybrid solutions, upgraded models, and advancing functionality indicates a promising future for the technology. As institutions embrace blockchain as core infrastructure and overcome adoption challenges, the utility of blockchain is set to drive real business value and innovation in the coming years.