Ethereum (ETH) Price Surge After Tariff Pause

The recent 90-day tariff pause announced by the U.S. President has had a significant impact on the cryptocurrency market, particularly boosting the price of Ethereum (ETH) by over 13%. This positive momentum comes after a prolonged period of downward movement in the crypto space.

Ethereum (ETH) Current Price Analysis

As of now, Ethereum is trading near $1,670, marking a 13% surge in the past 24 hours. The trading volume has also seen an 85% increase, indicating a higher level of participation from traders and investors compared to the previous day.

Ethereum (ETH) Technical Analysis

The recent price surge has halted Ethereum’s downtrend, with expert analysis pointing towards a bullish engulfing candlestick pattern at the key support level of $1,440. If the current market sentiment persists, there is a strong possibility of ETH reaching the $1,850 level, representing an 11% increase in the near future.

Despite the positive outlook, Ethereum is still trading below the 200-day Exponential Moving Average (EMA) on the daily timeframe, indicating a continued downtrend.

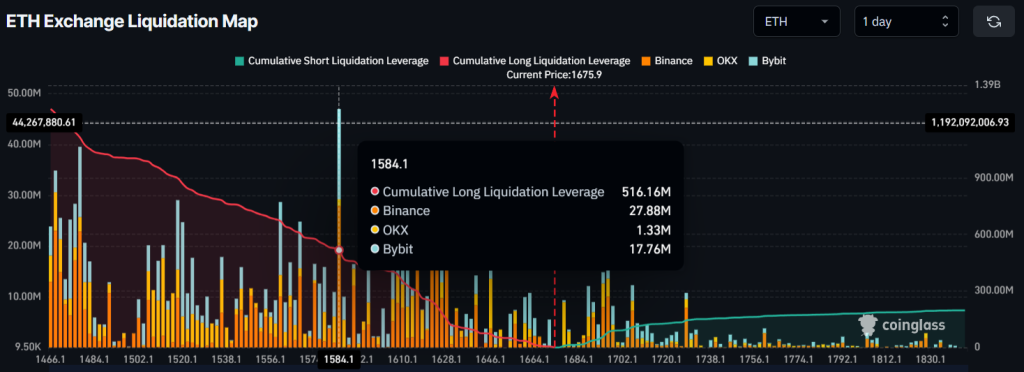

According to on-chain analytics firm Coinglass, traders are heavily leaning towards the bullish side, further supporting Ethereum’s upward momentum.

Ethereum (ETH) Traders’ Sentiment

The current ETH long/short ratio stands at 1.03, showcasing a strong bullish sentiment among traders. Long positions outweigh short positions, indicating a positive outlook for the cryptocurrency.

Furthermore, traders have accumulated $516 million worth of long positions and $80 million worth of short positions at the $1,585 and $1,696 levels respectively over the past 24 hours. This suggests a high level of confidence and interest in Ethereum among market participants.

With traders dominating the market and showing strong support for Ethereum, the cryptocurrency is poised for further upward movement in the coming days.