Ethereum is currently at a crucial juncture as it hovers within a narrow trading range, with the $1,850 resistance and the $1,750 support levels acting as key battlegrounds. Despite a strong rebound from the $1,400 level earlier in the month, Ethereum is now facing a significant challenge. The bulls have managed to stabilize the price action, but the ultimate test lies in reclaiming the $2,000 level in the near future to confirm a sustainable bullish trend.

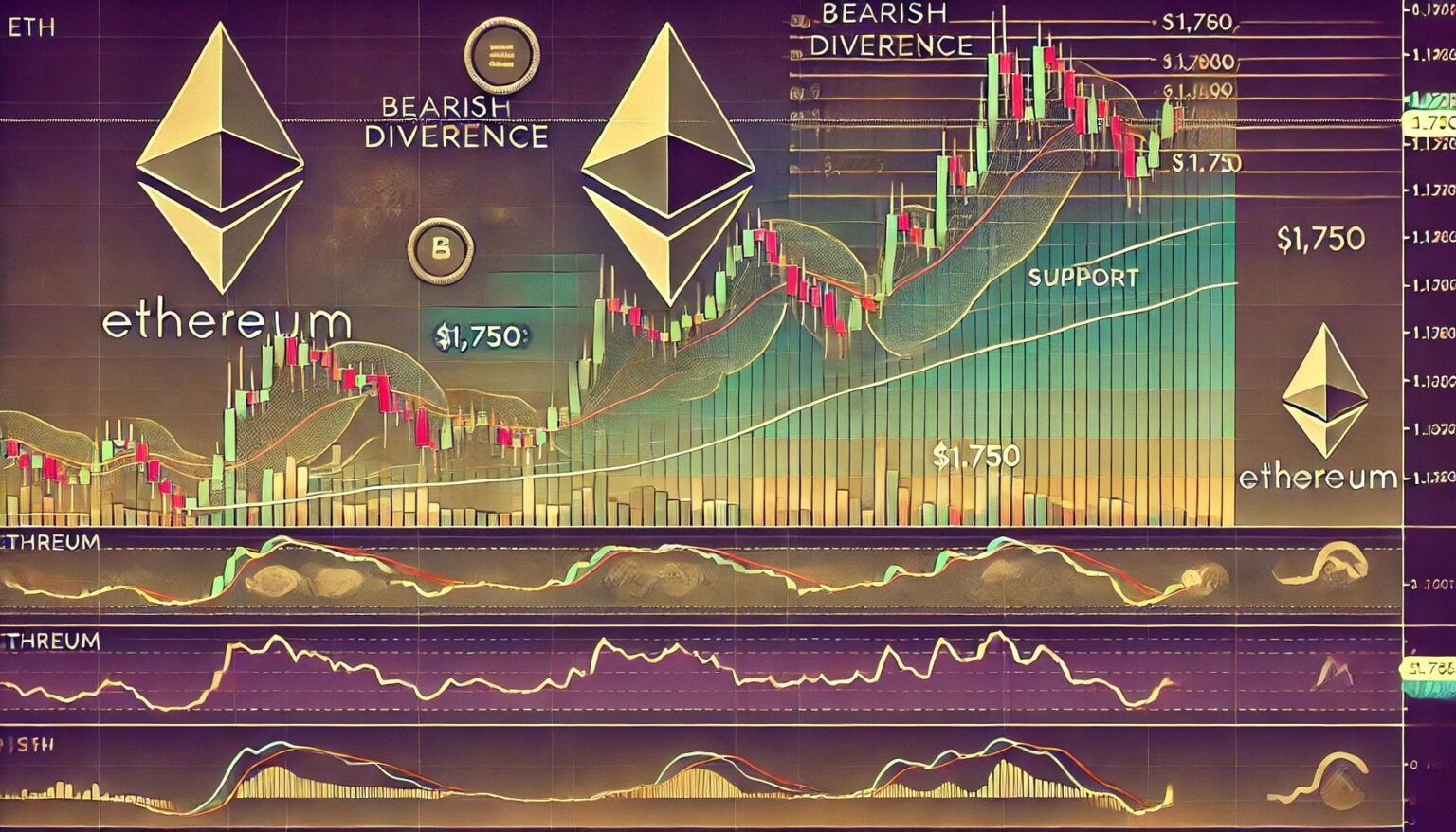

Market sentiment surrounding Ethereum remains cautious as it consolidates below resistance, amidst ongoing macroeconomic uncertainties that are weighing on risk assets. Noted crypto analyst Big Cheds has raised a technical concern, pointing out a 4-hour bearish divergence on the On-Balance Volume (OBV) indicator for Ethereum, along with the emergence of an upper shadow structure.

With increased volatility anticipated and traders on high alert for a potential breakout or breakdown, the upcoming trading sessions are poised to define Ethereum’s trajectory for the weeks ahead. It is imperative for the bulls to act swiftly to maintain their momentum and prevent the bears from seizing control of the market.

Ethereum is displaying early signs of a bullish setup on lower time frames, offering optimism for a broader recovery. Following its recovery from the $1,400 low, ETH has managed to stay above crucial moving averages and consolidate within a tight range. While momentum has shifted in favor of the bulls recently, there are diverging views on the potential price action. Some analysts are predicting a significant breakout if Ethereum breaches the $1,850 resistance, potentially leading to a swift rally towards the $2,000 level. However, there are also concerns that failure to reclaim higher levels could result in a retest of the $1,300 zone.

Cheds’ analysis highlights the importance of the $1,750 support level, with a potential breakdown from the consolidation pattern signaling a bearish trend. The 4-hour bearish divergence on the OBV indicator further underscores the weakening buying pressure for Ethereum. A breach of the $1,750 support could trigger a short position and confirm a breakdown from the current consolidation phase.

In terms of technical levels, Ethereum is currently trading at $1,815, with the $1,750-$1,800 support range being closely monitored. To shift the prevailing bearish structure into a confirmed bullish trend, Ethereum must surpass the $2,100 level. Without this breakout, any rallies are likely to be perceived as temporary relief in the broader downtrend.

Maintaining support above $1,800 is crucial for Ethereum in the coming days, as it would help build strong demand and pave the way for a sustained recovery rally. While bulls are gaining some short-term momentum, the overall market sentiment remains cautious due to macroeconomic uncertainties. A failure to hold above $1,750 could expose Ethereum to downside risks, potentially leading to a sharp sell-off towards the $1,500 mark.

As Ethereum navigates through this critical phase, its next move will be pivotal in determining whether it can join a larger recovery trend or continue to struggle in a volatile and uncertain market environment. Traders and investors are closely monitoring key levels and technical indicators for clues on Ethereum’s future price action.

In conclusion, Ethereum’s current price action and market sentiment underscore the importance of key levels and technical indicators in determining its near-term trajectory. The battle between bulls and bears intensifies as Ethereum faces a critical test, with the outcome likely to shape its price movement in the coming weeks. Stay tuned for further developments as Ethereum navigates through this crucial phase.