Ethereum’s Total Value Locked Sees Significant Drop in February

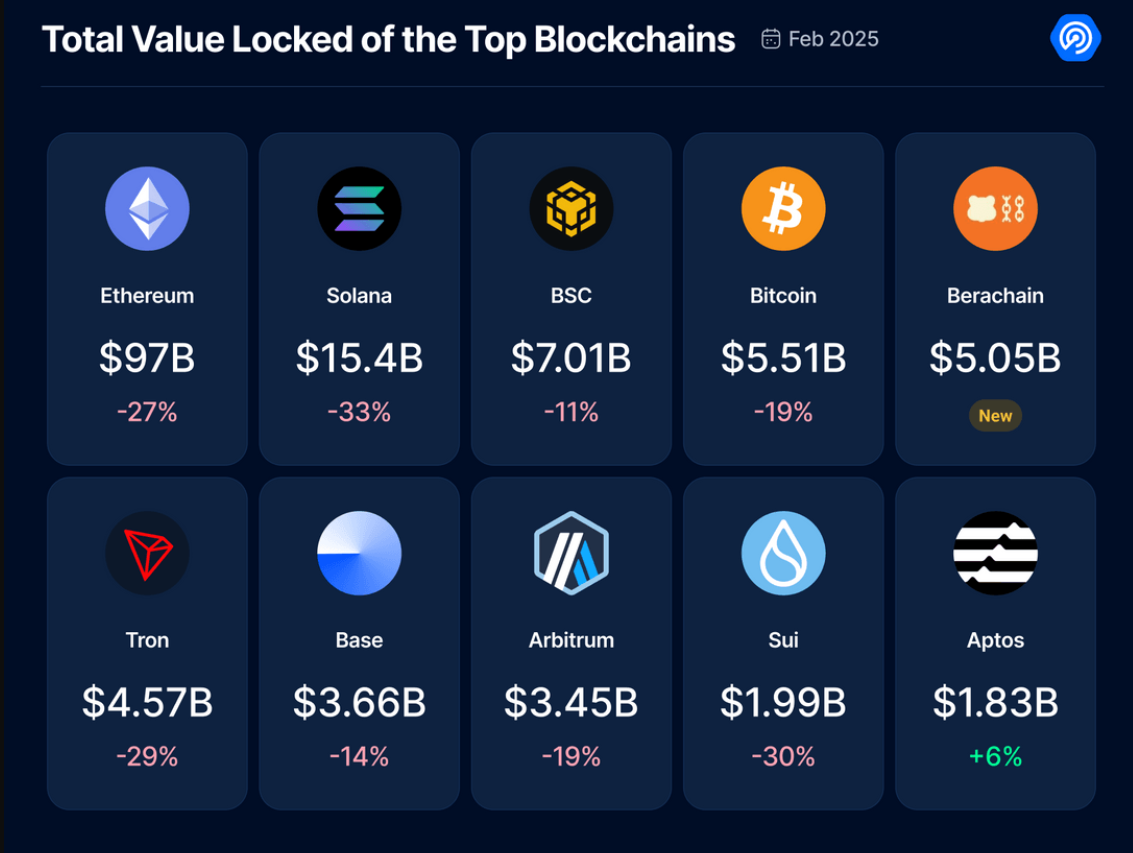

In February, Ethereum’s total value locked (TVL) experienced a notable decrease of 27%, reaching $97 billion. This decline was part of a broader trend in the decentralized finance sector, which saw a 23% drop from $217 billion to $168 billion, attributed to market volatility, liquidity shifts, and capital outflows.

Key Insights from DappRadar Analyst Sara Gherghelas

According to a recent research report by DappRadar analyst Sara Gherghelas, Ethereum, holding nearly 60% of DeFi’s liquidity, witnessed a 27% decline in TVL to $97 billion. The decrease was primarily driven by lower liquidity in liquid staking protocols. Despite this downturn, Ethereum maintains its dominance in the DeFi space.

Performance of Other Chains

Solana (SOL) experienced a substantial decline of over 30% in TVL to $15.4 billion, following a strong January. The drop was attributed to profit-taking and liquidity migration to more stable DeFi platforms. On the other hand, Berachain (BERA) emerged as a winner, reaching a TVL of $5.05 billion due to its attractive proof-of-liquidity model.

“The chain’s rise is fueled by its proof-of-liquidity model, which has attracted users through lucrative liquid staking and yield farming incentives. As users seek high returns despite broader market declines, Berachain is positioning itself as a key player in the evolving DeFi landscape.” – Sara Gherghelas

BNB Chain (BNB) and TRON (TRX) experienced declines in TVL, while Aptos (APT) saw a 6% increase to $1.83 billion. Ethereum’s drop in TVL coincided with a decrease in futures open interest in major cryptocurrencies, signaling cautious trading behavior among investors.

Outlook for Ethereum and DeFi

While the upcoming Pectra upgrade could provide a temporary boost for Ethereum, uncertainties remain regarding the overall trajectory of DeFi activity. Traders are closely monitoring market developments and waiting for clearer signals before re-entering the market.