In a recent article by Jurrien Timmer, Director of Global Macro at Fidelity Investments, he delves into the ever-changing economic landscape and its potential impact on various markets, central bank policies, and the trajectories of both Bitcoin and gold. Timmer’s insights shed light on the current state of the market, with the S&P 500 reaching new highs and the previous “Trump Trade” narrative taking a different direction. Here are some key takeaways from Timmer’s analysis:

The Trump Effect:

Timmer notes the unexpected market movements in the first six weeks of 2025, leading to a high “noise-to-signal ratio.” The anticipated consensus trade of higher yields, a stronger dollar, and outperforming US equities has shifted, reflecting the volatile nature of the market. Despite the S&P 500’s record levels, Timmer describes this as a “digestion period” post-election optimism, with only 55% of stocks trading above their 50-day moving averages.

Federal Reserve Policy:

Timmer emphasizes the significance of Federal Reserve policy, particularly in light of the recent CPI report showing a year-over-year core inflation figure of 3.5%. He believes that the Fed is likely to remain on hold for the foreseeable future, given the current economic conditions. Timmer warns against a “premature pivot” in policy, drawing parallels to past mistakes that led to inflation.

Bitcoin and Gold:

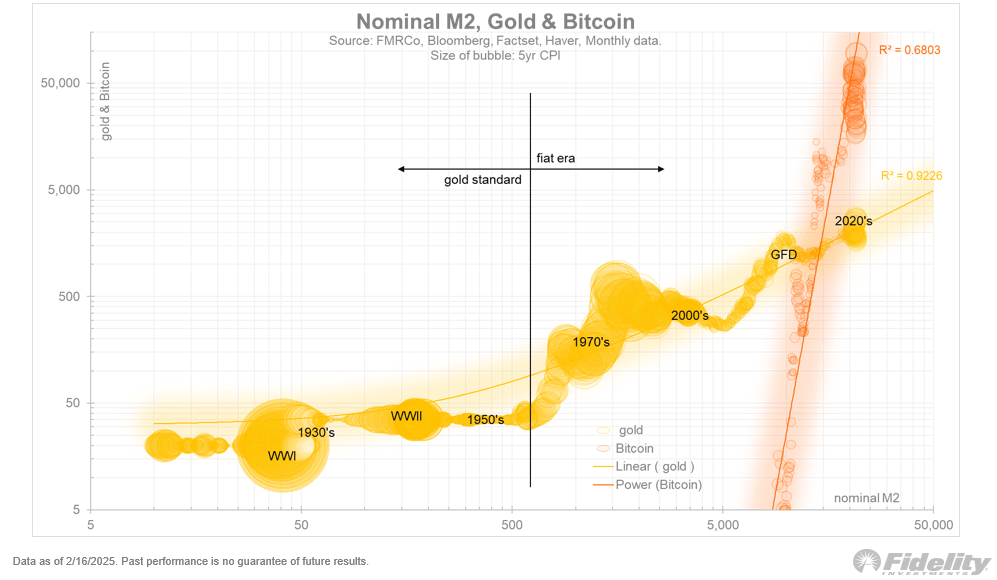

Timmer highlights the outperformance of both Bitcoin and gold in recent times, sparking conversations about monetary inflation. He distinguishes between the growth in the money supply and price inflation, emphasizing that asset prices cannot solely be attributed to monetary debasement. Timmer’s analysis reveals strong correlations between M2, gold, and Bitcoin, with both assets playing complementary roles in the current market environment.

Implications for Investors:

As Bitcoin continues to surge and gold maintains its solid performance, Timmer suggests that investors may need to reconsider traditional portfolio models. With uncertainties surrounding fiscal deficits and rising long-term rates, the 60/40 portfolio strategy may no longer suffice. Timmer underscores the importance of evaluating the broader macroeconomic landscape and the impact of fiscal policies on asset prices.

In conclusion, Timmer’s analysis offers valuable insights into the market dynamics, central bank policies, and the roles of Bitcoin and gold in today’s economy. As investors navigate through a complex and ever-changing landscape, Timmer’s perspectives serve as a guide for making informed decisions in an unpredictable market environment.