Cryptocurrency investors and traders have been facing a new challenge in recent years with the introduction of Form 1099-DA by the IRS. This form was designed to track digital asset sales and improve tax compliance in the crypto space. However, the implementation of this form has been met with confusion and pushback from the industry.

The journey of Form 1099-DA began in November 2021 when the IIJA law expanded the IRS definition of “broker” to include crypto platforms. This move was intended to make it easier for the IRS to track and report on cryptocurrency transactions. By mid-2023, the IRS had introduced Form 1099-DA with proposed broker rules, which were finalized in January 2024. Centralized platforms were required to issue these forms starting in 2025.

However, things took a turn when the IRS tried to include DeFi platforms in its broker rule in late 2024. This move was met with resistance from the crypto community, as many argued that DeFi platforms should not be classified as brokers. Despite the pushback, the IRS finalized the rule in January 2025, applying it to both centralized brokers and some DeFi interfaces.

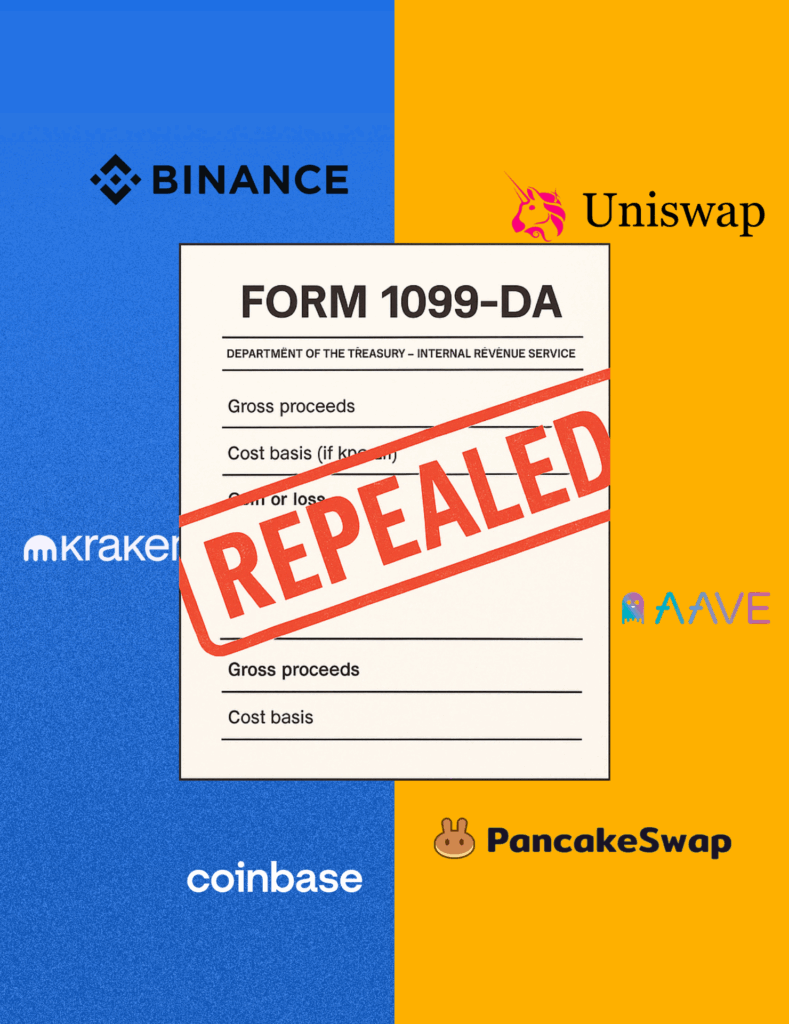

The controversy surrounding the inclusion of DeFi platforms in the broker rule ultimately led to Congress repealing the rule in April 2025. This meant that decentralized platforms were no longer classified as brokers and were no longer required to issue Form 1099-DA. However, individual crypto investors and traders are still responsible for reporting their gains and losses, whether they use centralized exchanges or DeFi platforms.

For centralized exchanges like Coinbase, Kraken, and Gemini, not much changes with the repeal of the DeFi reporting rule. These platforms are still required to issue Form 1099-DA for eligible transactions. On the other hand, DeFi platforms are now off the hook and users are expected to report their own transactions manually.

While the repeal of the DeFi reporting rule was a victory for the industry, the IRS still sees DeFi as a potential blind spot in tax reporting. Future administrations could introduce new regulations targeting DeFi platforms, so developers and users should remain vigilant.

In conclusion, the burden of reporting cryptocurrency transactions still falls on individual investors and traders, regardless of the platform they use. While the repeal of the DeFi reporting rule provides some relief, it’s important to stay compliant and report all transactions accurately to avoid any potential issues with the IRS.