Bitcoin Approaching Critical Juncture, Glassnode Warns

Analytics firm Glassnode is sounding the alarm on Bitcoin (BTC), indicating that the leading cryptocurrency is nearing a crucial point that has historically signaled the end of bull markets.

One of the key metrics being closely monitored by Glassnode is Bitcoin’s short-term holder (STH) cost basis. This metric tracks the average price at which investors who have held their BTC for less than 155 days acquired their coins.

According to Glassnode, historical data suggests that when Bitcoin’s price falls below the value of this metric, it typically marks a transition into bear territory.

“Bitcoin’s Short-Term Holder (STH) cost-basis model is crucial for gauging sentiment among new investors. Historically, this model has tracked market lows during bull cycles and also distinguished bull from bear markets. BTC price is now around 7% above the STH cost-basis of $88,135. If the price stabilizes below this level, it can signal waning sentiment among new investors – which is often a turning point in market trends.”

As of the latest data, Bitcoin is currently trading at $94,425.

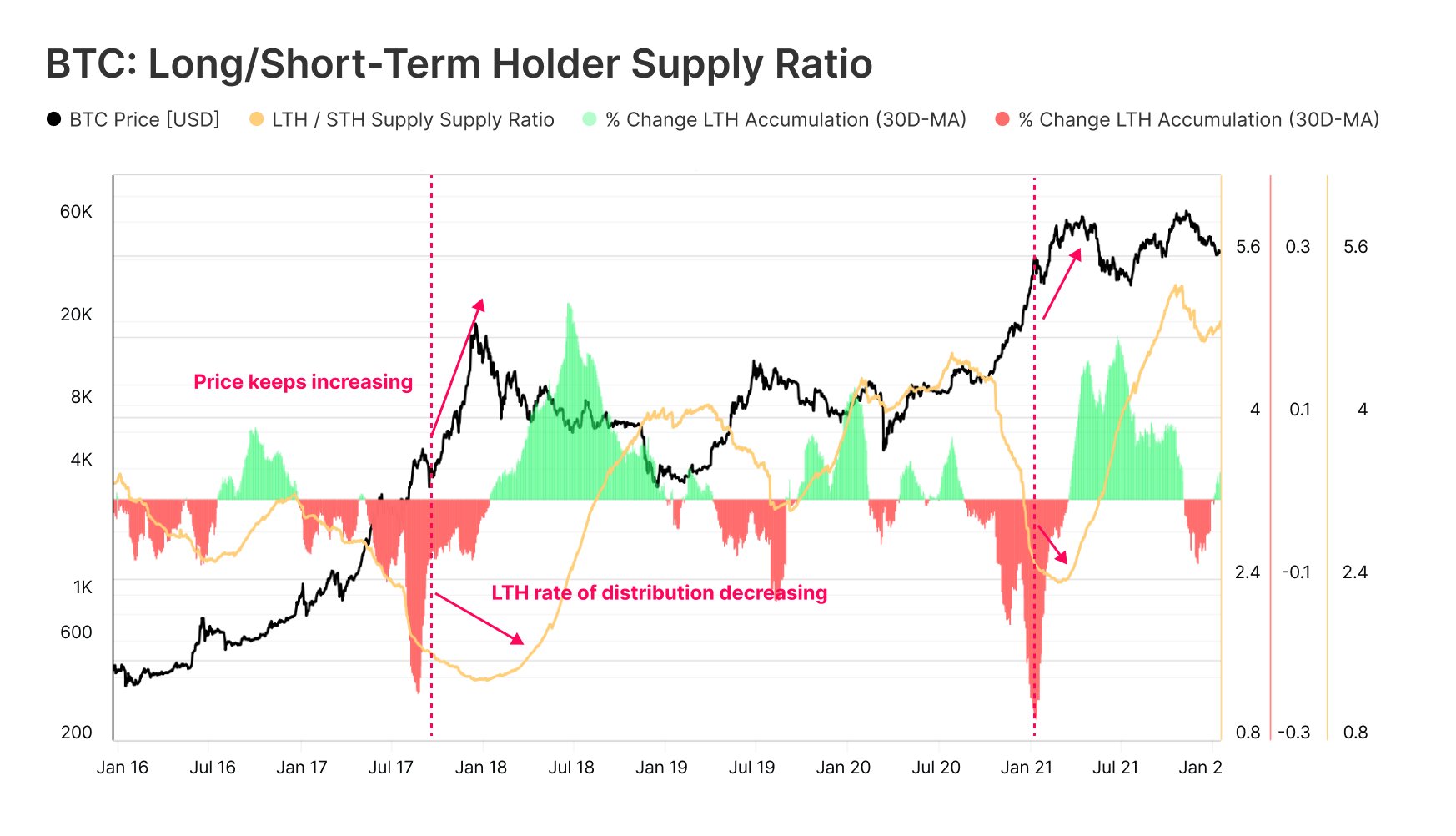

On the flip side, Glassnode also highlights the behavior of long-term holders, who are investors that have held their BTC for 155 days or more. The analytics firm notes that this cohort is rapidly offloading their Bitcoin holdings, although this doesn’t necessarily indicate the end of the current bull market.

“Even at prices about 12% below all-time highs, Bitcoin Long-Term Holders (LTHs) are still distributing, but at a slower rate. Yet, the 30-day percent change in LTH supply suggests that the rate of distribution has likely peaked, reaching extremes seen in previous cycles. In past cycles, prices continued to climb even after LTH distribution peaked. This infers that a peak in distribution doesn’t always align with an immediate macro top.”

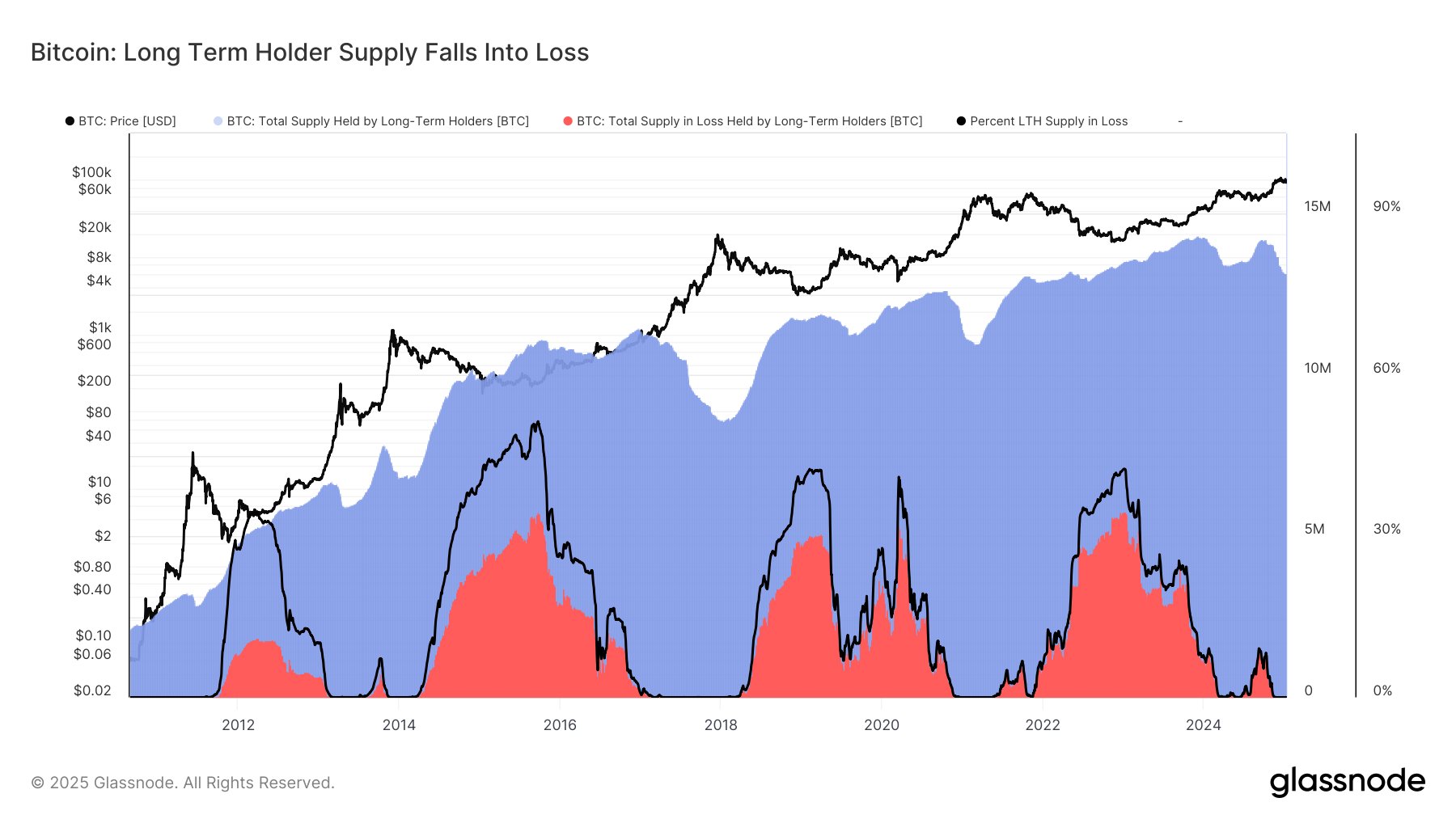

Glassnode concludes by pointing out that almost all long-term holders are currently in a profitable position.

“Another factor to consider: Bitcoin LTH supply in loss remains at 0%. Nearly all Long-Term Holders are still in profit. Historically, when LTHs experience persistent losses that grow in severity, it has often marked the true end of a cycle. For now, that’s not the case.”

Stay Informed – Subscribe to Receive Email Alerts

Stay Updated on Price Action

Follow us on Twitter, Facebook, and Telegram

Explore The Daily Hodl Mix

Generated Image: Midjourney