Goldman Sachs Bullish on Ten China-Based Companies

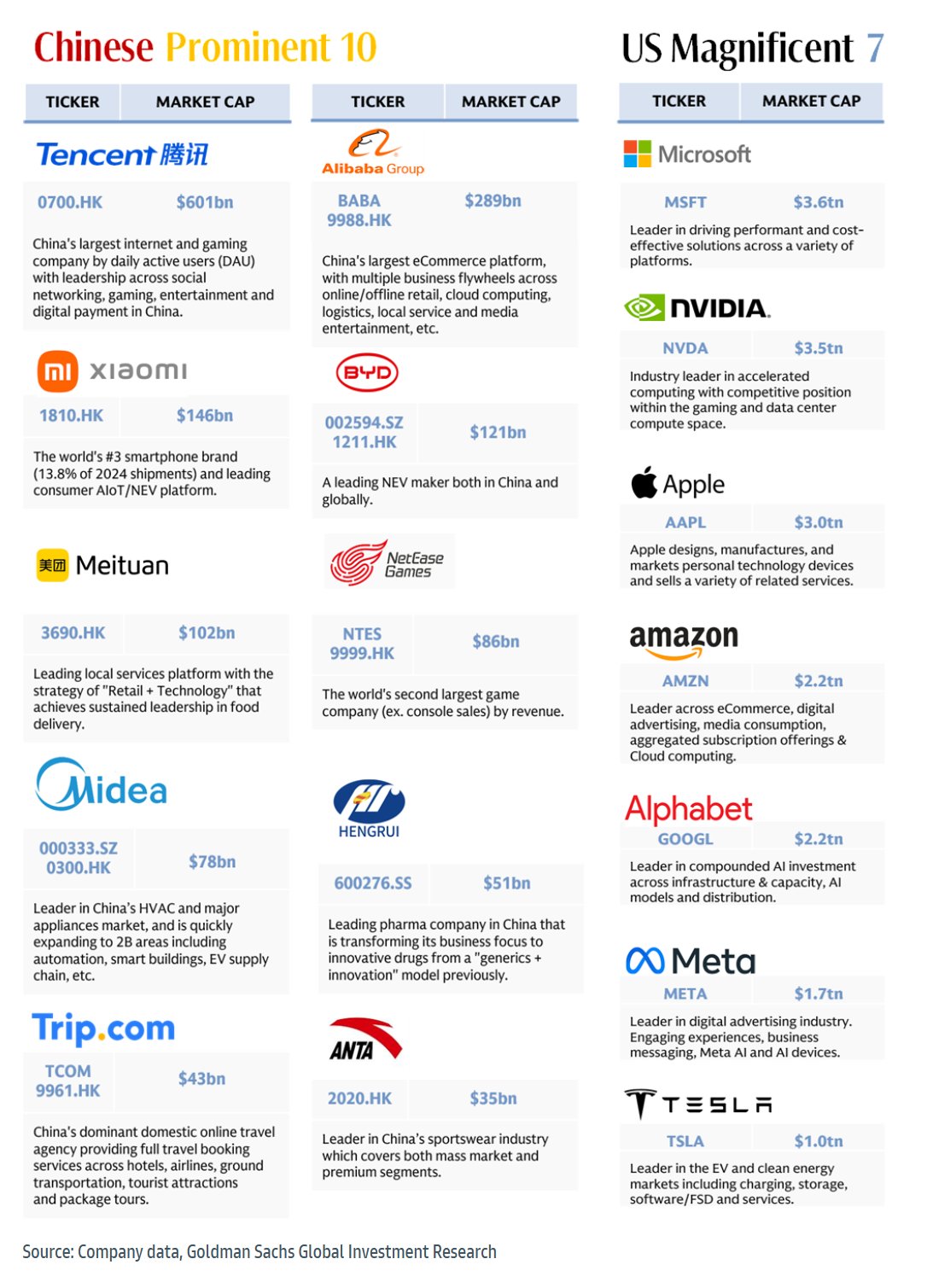

Banking giant Goldman Sachs is reportedly turning bullish on ten China-based companies, dubbing them the “Prominent 10” in a note to investors. The bank’s analysts suggest that these companies could be China’s equivalent of the “Magnificent 7” companies in the US.

Key Points:

- The ten companies represent themes like AI/Tech development, self-sufficiency, ‘Going Global,’ services, new forms of consumption, and China’s improving shareholder returns.

- Favorable regulatory environment and AI investments may boost earnings of these public-owned enterprises (POEs) by 13% in each of the next two years.

- Companies in the list include Tencent, Alibaba, Xiaomi, BYD, Meituan, NetEase, Midea, Hengrui, Trip.com, and ANTA.

- Goldman Sachs compares them to the Magnificent Seven companies which include Tesla, Meta, Alphabet, Amazon, Apple, Microsoft, and Nvidia.

- The bank’s bullish outlook considers the Chinese equity market’s segmentation and modest valuations.

- The Chinese government’s support for the private economy and updated regulations for mergers and acquisitions are also taken into account.

Goldman Sachs’ analysts believe that recent government support and regulatory changes will revitalize POEs’ investment appetite, supporting their organic and acquisitive growth in the future.

Follow us on X, Facebook, and Telegram for more updates.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox.

Check Price Action and Surf The Daily Hodl Mix for more news and insights.

Generated Image: Midjourney